Real estate inventories increase significantly in Q4

Real estate inventories increase significantly in Q4

The real estate inventories of listed companies increased significantly in the fourth quarter of 2020 over a year ago because many projects were stagnant due to the impact of the COVID-19 pandemic, legal bottlenecks and limited financial capacity of the developers.

The financial report of Dat Xanh Group (DXG) showed that the company earned revenue of VND2.89 trillion in 2020, equivalent to just half of 2019 and reported a loss of VND126 billion – the first loss since the company was listed in 2009.

Inventories increased by 51 per cent to VND10.2 trillion as of December 31, making up for 55 per cent of the company’s total assets. The inventories of completed projects were mainly at An Vien and Luxgarden projects while the inventories of unfinished projects were estimated around VND9.6 trillion. Many unfinished projects did not see any progress in construction in 2020, such as Tuyen Son, Hiep Binh Phuoc – Thu Duc, C1, Gemriverside and Mo Street projects.

The inventories of Phat Dat Real Estate Development Joint Stock Company also increased by 16 per cent to VND9.3 trillion, or nearly 60 per cent of the company’s total assets.

The financial report of An Gia Real Estate Development and Investment Joint Stock Company showed that as of the end of December, the company’s inventories increased 120 per cent against the end of 2019 to around VND5.7 trillion, or 59 per cent of the total assets.

An Gia’s projects with high inventories included The Song, The Westage, River Panorama 1, Panorama 2, Sky 89 and Signial projects.

For Nam Long, inventories rose 40 per cent to more than VND6 trillion, mainly at unfinished projects like Akari City in HCM City, Waterpoint in Long An, Paragon Dai Phuoc, Vam Co Dong and Novia projects.

In the market, the inventories of finished projects were mainly those with prices of more than VND35 million per sq.m.

According to Nguyen Van Dinh, deputy general secretary of the Viet Nam Real Estate Association, in major cities like HCM City and Ha Noi, many projects had prices of around VND25 million per sq.m but now were pushed up to VND30-40 million per sq.m, the sales were not very good.

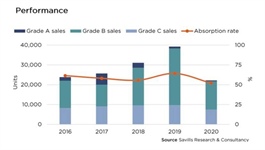

He cited statistics that only around 26.6 per cent of offerings in the capital city were sold in 2020, compared to 65.4 per cent in 2019, 70.6 per cent in 2018 and 60.7 per cent in 2017.

Many projects remained unfinished and did not see any progress in construction in 2020 due to the impact of the COVID-19 pandemic, legal bottlenecks and limited financial capacity of the developers, according to Dinh.

Le Hoang Chau, President of HCM City Real Estate Association, said that the inventories of listed enterprises alone did not fully reflect the real inventories of the property market.

Increasing inventories would weigh on enterprises in particular and the whole economy in general, Chau said.

However, Dinh said that the progress of many projects would be sped up in 2021, creating more supply for the market when the legal frameworks were tackled and improved financial capacity of developers.