Deluge of foreign capital marks strong start to 2021

Deluge of foreign capital marks strong start to 2021

The wave of high-tech companies investing billions of US dollars in Vietnam is already materialising, raising the question for the country on exactly how to absorb all the incoming capital.

Deluge of foreign capital marks strong start to 2021

|

Intel Corporation, the US-based manufacturer of semiconductor computer circuits, last week announced injecting an additional $475 million into its plant in Vietnam, taking its total involvement in the country to $1.5 billion.

The new investment will develop complex technologies like manufacturing 5G products and the next generation of Intel Core processors.

Kim Huat Ooi, general manager of Intel Products Vietnam (IPV) said, “As of the end of 2020, IPV has shipped more than two billion units to customers worldwide. We are very proud of this milestone, which shows both how important IPV is to helping Intel meet the needs of its customers all around the world and why we continue to invest in our facilities and team here in Vietnam.”

The plant is IPV’s single largest assembly and test plant globally, with more than 2,700 employees as well as cutting-edge technologies and machinery.

Nguyen Anh Thi, head of the management board at Saigon Hi-Tech Park where the plant is located, highlighted that Intel’s decision to increase investment “indicates its confidence in the workforce and Vietnam’s reliable investment environment”.

Rise of high-tech giants

A number of electronics giants in Vietnam are expanding operations as they seek to diversify their supply chains. In the middle of January, Foxconn received an investment certificate to build a $270-million Fukang Technology plant in the northern province of Bac Giang’s Quang Chau Industrial Zone (IZ) to manufacture eight million laptops and tablets annually.

Foxconn Vietnam general director Harry Zhuo said as of December, the company had invested $1.5 billion in Vietnam, including $900 million in Bac Giang, creating 35,000 jobs. “The company is planning to inject an additional $700 million in 2021 and create a further 10,000 jobs,” added Zhuo.

In addition to Bac Giang, Foxconn is setting sights on the central provine of Thanh Hoa, and along with other tech giants such as Heesung Electronics, Goertek Technology, Mitac Computer, and Luxshare ICT Vietnam, Foxconn has met with Hanoi authorities to find investment opportunities related to high technologies thanks to favourable conditions like high-quality human resources and proximity to international airports.

Luxshare is also developing its second project in Bac Giang’s Van Trung IZ with a total investment sum of $190 million, and is expanding a project in the central province of Nghe An.

In another case, Chinese acoustic components company Goertek has just visited the northern province of Thai Nguyen to look for new prospects, with a factory manufacturing headsets, microphones, speakers, AirPods, and phone components for Samsung and Apple.

Meanwhile, Capital United, an investment advisor and real estate financial services firm from the United States, met Thai Nguyen provincial leaders and proposed to develop an industrial and technology centre on 900 hectares and the total investment of $390 million to set up a location for companies in IT, high-tech, light and clean industries, and logistics.

“US investors are always good at catching up on trends and seizing opportunities. They have surely seen something attractive and profitable here, along with the wave of technology companies arriving at Vietnam,” said Van Duc Phu, representative of the Foreign Investment Agency’s (FIA) Investment Promotion Centre for North Vietnam.

Retaining the wave

A recent report by the Economist Intelligence Unit has indicated that Vietnam has emerged as an attractive foreign direct investment (FDI) destination in Asia, beating China and India to become a new hub for low-cost manufacturing in Asian supply chains.

Indeed, over the last two years, the trend of technology companies entering Vietnam has been strong. Huge investors arriving in the country in the first wave such as Samsung and LG are now expanding their investment and facilities, not only for manufacturing lines and factories but also research and development centres.

Panasonic of Japan has also decided to end the production of washing machines and refrigerators in Thailand and move it to a consolidated appliance assembly facility in Vietnam.

In addition to Foxconn and Luxshare, Pegatron has invested $500 million in Haiphong city in the north to produce electronics components (motherboards, graphic cards, laptops, netbooks, cable modems, and smartphones); while Wistron has forked out $273 million in the northern province of Ha Nam to manufacture electronics devices as well as networking and communication products.

Besides these, numerous well-known high-tech investors were already present in Vietnam like Universal Global Technology (Taiwan) which has a facility in Haiphong. In Bac Giang, three projects have just received investment certificates – Ja Solar PV Vietnam (of Hong Kong’s Ja Solar Investment Ltd.), Risesun New Material Vietnam, and Vietnam Kodi New Material (by Singapore’s Risesun Investment Pte., Ltd.) with the combined investment of $300 million.

Such moves are always followed by billions of US dollars in projects by suppliers and supporting firms tagging along.

However, economist Tran Dinh Thien remains concerned. “Although Vietnam has prepared carefully, including policies, incentives, infrastructure, energy, land, and human resources, to welcome these investments, administrative procedures still need to be simplified, human resources improved, and infrastructure modernised,” said Thien.

The report from the Economist Intelligence Unit suggested that factors that place Vietnam above its peers are the available incentives for international investors to set up units to manufacture high-tech products, the pool of low-cost workers, and the proliferation of free trade agreements.

Vietnam has scored higher than both India and China in FDI-related policies, as well as higher than India in terms of their respective labour markets. The report also raises a bright outlook for Vietnam to offer generous arrangements for international corporations with incentives for investment.

Additionally, the FIA has been having discussions with Japan about a potential cooperation in training employees. This will significantly contribute to enhancing the quality of human resources, meeting more requirements of foreign investors, and improving the competitiveness of the country.

“The new investment from Intel is expected to encourage more Japanese investors and suppliers to Vietnam, and Vietnam is ready in all aspects to welcome both Japanese and all other investors, as well as absorb the investment as best as possible,” said Phu from the FIA.

|

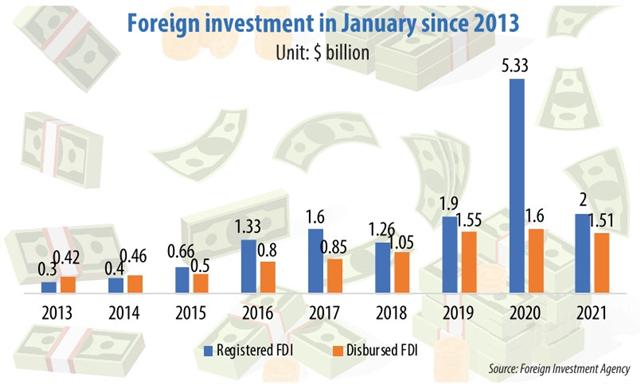

As of January 20, total newly-registered capital, added capital, and capital contribution/share purchasing was $2.02 billion, equalling 37.8 per cent on-year. If excluding the $4-billion liquefied natural gas project in the Mekong Delta province of Bac Lieu registered in January 2020, the total investment this month will be 51.7 per cent higher than in the same month last year. This included 47 newly-registered projects (down 81.8 per cent on-year), with the total investment of over $1.3 billion (decreasing by 70.3 per cent on-year). Besides these, 46 projects (reducing by 40.3 per cent on-year) adjusted registered capital with the total value of $472.2 million (up 41.4 per cent). Additionally, there were 194 capital contribution and share purchasing (down 78.1 per cent on-year) with a total of $220.8 million (decreasing by 58.7 per cent). Disbursement of foreign-invested projects in January 2021 was $1.51 billion, a rise of 4.1 per cent on-year. Some major new moves in January involve China’s Radian tyre manufacturing project in the south-western province of Tay Ninh adding $312 million into registered investment; Singapore’s Kodi New Material Vietnam registering $270 million in Bac Giang province; China’s JA Solar PV Vietnam investing $210 million in Bac Giang; and Hong Kong’s Everwin Precision Vietnam pouring $200 million into Nghe An province. (Source: Foreign Investment Agency) |