Why should Vietnam pursue offshore wind?

Why should Vietnam pursue offshore wind?

Vietnam is fortunate to have some of the best natural conditions for wind energy in Asia. This is particularly the case for offshore wind energy, where Vietnam has some of the best conditions in the world. According to a recent World Bank sponsored report ‘Offshore Wind Roadmap for Vietnam’, Vietnam has the potential to realize between 11GW and 25GW of offshore wind capacity by 2035, which could create up to 700,000 man year jobs and avoid up to 217 million tonnes of CO2 emissions.

|

As seen in the map below, the highest wind speeds and best offshore wind sites are concentrated off the coast of Binh Thuan and Ninh Thuan. Good wind speeds are found further up and down the coast. Vietnam has a major advantage of having large population centers along the coast and high wind speed areas where water depths are relatively shallow. Vietnam also has skilled offshore workers, a strong manufacturing capability and existing reinforced harbours.

Offshore wind is a proven technology and has seen major cost reductions in Europe, where it has been implemented on a mass scale. As an energy source it is now cheaper to build than other forms of energy such as coal, nuclear and gas.

Offshore wind is already being implemented in markets closer to Vietnam such as Taiwan, Japan, China and Korea. This will result in a maturing supply chain and costs reductions within the Asian region, which Vietnam can reap the benefits from.

Vietnam’s combination of strong wind, shallow water, cities close to the coast, existing harbours and skilled workers are ideal for offshore wind. Vietnam is in a unique position to pursue offshore wind as a secure energy source and a major part of its transition to clean energy.

Currently, there are no true offshore wind farms in Vietnam. Vietnam’s wind power development is focused on onshore and intertidal / nearshore areas. This is typical for a new market that is in the early stages of adopting renewable wind energy as a power source, as onshore and intertidal/nearshore wind farms are on a small scale, easier to finance and have shorter development periods. For example, Denmark and China first initiated intertidal and nearshore developments before moving to true offshore wind.

In other countries, the main driver for moving windfarms further from shore has been the quality of the wind, availability of space, concern for the environment, and avoidance of conflict with coastal communities and marine users.

In Vietnam, offshore wind offers similar benefits. True offshore wind projects will be in areas where wind speeds are higher and more stable, resulting in more consistent and efficient energy production. Offshore ‘land’ is more available than intertidal/nearshore ‘land’, which is limited by tides and water depth. Offshore wind farms are likely to have less environmental impact, as there is less biodiversity in deeper waters. Offshore wind farms also have less visual and noise impact, and will have less overlap with existing ocean users, such as from military, shipping, fishing and tourism sectors.

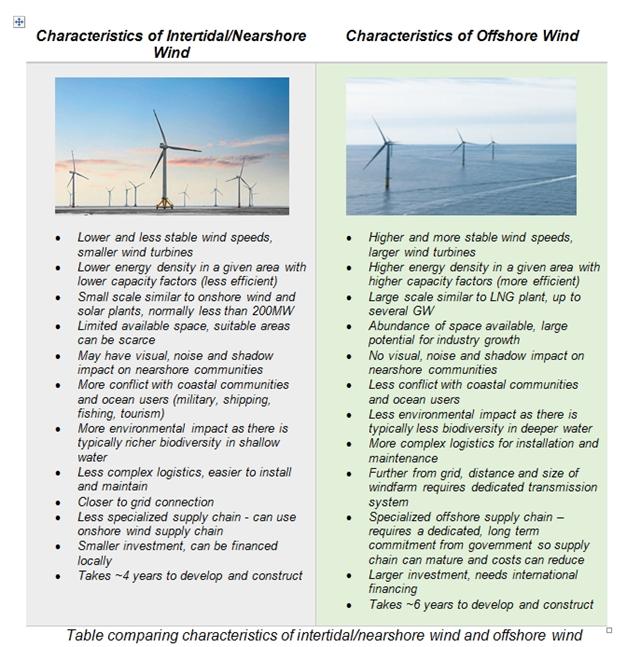

The development of intertidal / nearshore wind in Vietnam has so far been driven by government policies which award specific Feed-In-Tariffs (FITs) for ‘on-sea’ (intertidal / nearshore) projects. At this point in time there is no official definition or specific policy for true offshore wind projects in Vietnam. For offshore wind to succeed in Vietnam, a similar dedicated policy is required. This is because the characteristics of offshore wind are quite different to intertidal/nearshore wind and the supply chain needs a kick start. The key differences are summarized below:

|

To untap the huge potential of offshore wind in Vietnam, developers are urging government to provide certainty to the industry, which will allow them to invest in development. The government can do this by establishing meaningful offshore wind targets, as well as a dedicated offshore wind policy.

The world is embracing offshore wind – global offshore wind capacity will surge from 29GW in 2020 to over 234 GW by 2030, led by exponential growth in Asia-Pacific and continued strong growth in Europe, according to Global Wind Energy Council (GWEC). Other countries that started with intertidal/nearshore policies such as Denmark and China have fully embraced offshore wind. Like these markets, Vietnam is well placed to take advantage of its unique coastal conditions, achieve security of energy supply, create jobs and deliver clean offshore wind energy for years to come.

|

Intertidal/Nearshore Wind Farms – Key Facts Intertidal/nearshore wind farms are located in the tidal area or within a few km to the coast where the water is very shallow. They tend to use smaller turbines (each turbines is typically less than 4MW in capacity), are smaller in scale (typically less than 200 MW), and are often located close to the grid. They may have custom foundations but are generally similar in design to onshore wind farms. Due to their smaller scale, they have lower investment costs, and can be locally financed. Offshore Wind Farms – Key Facts Offshore wind farms are located more than 5 km from the coastline in water that is usually more than 10m deep. They use very large turbines (the latest technology turbines are up to 14MW in capacity) and are larger in scale (up to several GW). Their large capacity and distance to shore often requires dedicated substations and cables to transport power to the grid. The wind turbines, foundation design, installation methods and supply chain are customized for offshore conditions. Offshore wind does not share the same supply chain as intertidal/nearshore wind. Due to their large scale, which is more comparable to an LNG plant, offshore wind farm investment costs are higher, and require international financing. |