Mitigating crisis crucial for intra-ASEAN trade activities

Mitigating crisis crucial for intra-ASEAN trade activities

Along with the signing of the Regional Comprehensive Economic Partnership, ASEAN as chaired by Vietnam is calling for more intra-investment and foreign direct investment into the region, in an aim to make the bloc more affluent, with Vietnam surging to become a bright spot for funding.

|

In April 2019, the Trade in Services Agreement (ATISA) and the fourth protocol amending the ASEAN Comprehensive Investment Agreement (ACIA) were inked at the 25th ASEAN Economic Ministers Meeting in Thailand. Entering into force that October, the ATISA aims to improve regulatory standards for the services sector in the region, as well as a reduction of unnecessary barriers to services trade within ASEAN, and at increasing the respective regulatory transparency in each member state.

Meanwhile, the fourth amendment to the ACIA is an agreement in the ASEAN region consisting of four aspects – protection, promotion, facilitation, and liberalisation of investment. The ACIA contains a prohibition on performance requirements as well as elements of the trade related investment measures regime set by the World Trade Organization.

At the recent 37th ASEAN Summit and Related Summits held online and hosted by Vietnam as ASEAN chair over a fortnight ago, leaders determined that the agreements will lay foundations for ASEAN’s next phase in the integration of trade in services and investment, through transitioning into the negative list approach under the ATISA and additional reservations on prohibition of performance requirement under the ACIA, and looked forward to the timely entry into force of these agreements.

“We underscored the importance of keeping the region as an attractive investment destination, especially when the region recovers from the COVID-19 pandemic, and therefore underscored the importance of enhancing facilitation of investment into ASEAN in the new normal,” read the ASEAN chairman’s statement of the latest ASEAN Summit.

A more favourable environment

ASEAN member states have been working closely together to contain and mitigate the impacts of the health crisis and assuring a stable environment for investment.

Signing the ATISA and updating the ACIA are just among many solutions for ASEAN to turn itself a more attractive destination for trade and investment, especially in the context that the region’s network of partners is increasing, with a number of nations seeking to forge new partnership with it, and that the bloc is boosting its economic recovery, with trade and investment considered a major drivers of the whole region’s economic growth.

Two weeks ago, ASEAN launched for the first time its e-brochure titled “Investment Opportunities in ASEAN 2021 – Invest in ASEAN: Towards Resilient Growth in the New Normal” which was designed by Vietnam’s Ministry of Planning and Investment (MPI).

The e-brochure is ASEAN’s initiative and a part of its recovery efforts by inviting the international community to continue investing in the region. It features the major imports, exports, industries, and investment opportunities in ASEAN member states for 2021, and comes at an unprecedented time as the challenges posed by the COVID-19 pandemic are still looming and the global economy remains at risk.

“ASEAN’s strength comes from its diversity and this creates vast and varied business opportunities. Strategically located in Asia, ASEAN is well positioned to serve as the hub for regional and global multinational companies,” states the brochure. “As a community, ASEAN member states work together to contain and mitigate the impact of any crisis affecting the region, assuring a stable environment for investment. We welcome investors to take advantage of and tap into the competitive environment and the diverse resources in this region, making it an attractive, free, and open investment destination.”

ASEAN’s economic growth slowed down to 4.6 per cent in 2019 from 5.2 per cent in 2018, amounting to a combined GDP of $3.2 trillion. The rate is expected by the International Monetary Fund to be only -3.3 per cent for this year.

Updated statistics from the ASEAN Secretariat revealed that in 2019, total merchandise trade reached $2.8 trillion, of which 22.5 per cent was intra-ASEAN; and the bloc’s total services trade hit $844.6 billion, of which 14.8 per cent was intra-ASEAN. Meanwhile, foreign direct investment (FDI) inflows to ASEAN stood at $160.6 billion, of which 13.9 per cent was intra-ASEAN.

However, both trade and investment flows in ASEAN this year are expected to decline massively due to COVID-19.

“We noted with concern that an unprecedented recession is projected in 2020 due to the pandemic, with pressures expected on trade and investment as shown by preliminary data,” read the statement. “Despite these challenges, we are confident that our macroeconomic fundamentals remain strong, and we are committed to work together to mitigate the economic impact of COVID-19, keep markets open, and continue building our region’s collective resilience and competitiveness towards a swift recovery by 2021.”

Vietnamese bright spot

According to the United Nations Conference on Trade and Development’s (UNCTAD) World Investment Report 2020, Southeast Asia, with FDI rising by 5 per cent on-year to a record level of $156 billion last year, continued to be the region’s growth engine in 2019. The growth was driven by strong investment mainly in Singapore, Indonesia, and Vietnam. The three countries received more than 80 per cent of inflows in Southeast Asia in 2019.

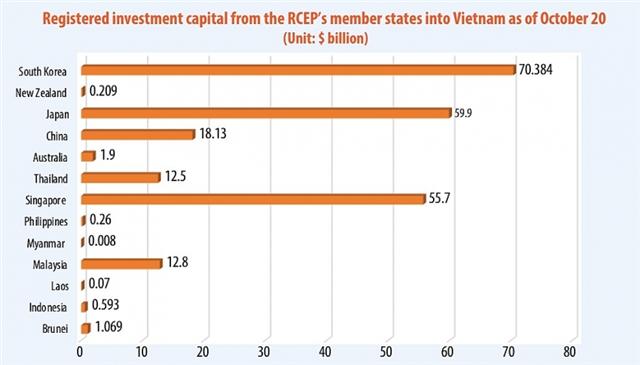

Statistics from the MPI also showed that as of October 20, total registered investment capital from ASEAN nations was $83.58 billion.

Notably, Singapore’s Delta Offshore Energy Pte., Ltd. is now boosting implementation in the Mekong Delta province of Bac Lieu of a $4 billion project to develop a 3.200MW power plant run by liquefied natural gas. The plant, licensed in February, will have four turbines of 750MW each and one with capacity of 200MW. The former to go on stream in 2023 and the latter in 2027

It is expected that investment from ASEAN and even its partners into Vietnam will further escalate once the Regional Comprehensive Economic Partnership (RCEP) inked over two weeks ago enters into force in 2021.

As of October 30, businesses from RCEP member states, including the 10 ASEAN nations and the bloc’s five partners (Australia, China, Japan, New Zealand, and South Korea), registered $234.12 billion for ventures.

According to the UNCTAD, Vietnam is poised to benefit significantly from the RCEP. Intra-regional investment, at about 30 per cent of total FDI in the agreement, has significant room for further growth. It is relatively low compared to other major economic partnerships. ASEAN, at the heart of RCEP, will play an important role. Already about 40 per cent of investment in the bloc comes from RCEP members.

The MPI said that Vietnam may stay among the world’s top destinations for FDI in 2021 thanks to its successful effort to contain and fight off COVID-19. The skilled workforce and political and economic stability are among the country’s most important advantages in attracting foreign investors, especially with the global economy struggling to recover from the pandemic.

Despite the pandemic, Vietnam licensed in the first 10 months of this year about 2,100 new foreign invested projects registered at $11.7 billion. The total newly-licensed, newly-added, and stake acquisition-based capital hit $23.48 billion.

At a recent meeting with 15 Japanese firms eligible to receive subsidies from Japan’s government to expand business and investment activities in Vietnam, Prime Minister Nguyen Xuan Phuc stated that Vietnam is committed to creating “the best conditions and improving its business environment” so that not only these 15 enterprises but also all other foreign-invested enterprises could perform well in the country,

Talks between the MPI and investors have produced promising results with businesses from Japan, Singapore, and the EU showing great interest in carving a firm niche in the country. International corporations including Apple, Foxconn, and Luxshare have committed billions of US dollars in investment to Vietnam in recent years.

During a meeting last month in Hanoi between PM Phuc and Samsung Electronics vice chairman Lee Jae Yong, they were reported to have discussed a rise in investment related to battery and smartphone manufacturing, and Samsung SDI reportedly may announce a plan to build an electric vehicle battery manufacturing plant in Vietnam.

Up to now, Samsung has invested about $17 billion into the country.