Critical energy sector in region’s crosshairs

Critical energy sector in region’s crosshairs

Projections show ASEAN could experience an increase in energy demand of about 50 per cent by 2025, photo Le Toan

|

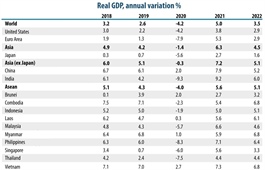

The economic growth of ASEAN has been one of the most dynamic and the fastest in the world. ASEAN is one of the most preferred investment destinations in the world, and the region’s economy is expected to grow at over 5 per cent, per year to become the fourth-largest economy in the world by 2030. Yet, such economic growth prospects could be affected by the COVID-19 pandemic which has caused unprecedented shocks to industries and sectors across the global economy.

The energy sector, which is vital to economic growth, has not been spared. However, energy has the potential to play a critical role in global reconstruction and recovery efforts. ASEAN remains cautiously optimistic that economic growth would rebound or achieve an even higher growth if ASEAN addresses, at regional and national levels, the challenges of greater integration and innovation in the areas of trade, investment, human capital, and regulatory coherence, while capitalising on global megatrends and other emerging trade related issues

The ASEAN Plan of Action for Energy Cooperation 2016-2025 (APAEC) has identified opportunities to shape the energy development of the region. As phase one of APAEC concludes in 2020, Smart Energy International considers the roadblocks to achieving all of the goals set out in the plan.

Much of the framework upon which this is based has been developed in the context of the UN’s 2030 Agenda for Sustainable Development and the Paris Agreement on Climate Change, and aims to address energy challenges and climate action measures which need to be taken.

Phase one of the plan included increasing multilateral power trading between members with the aim of making the ASEAN Power Grid a reality. There is also an intention to implement higher aspirational targets against energy efficiency improvements and the uptake of renewable energy sources.

The aim is to enhance energy security cooperation and take further steps towards connectivity and integration in this part of Asia. It is anticipated that ASEAN will experience an increase in energy demand of about 50 per cent by 2025. There is also an aim to increase the share of renewable energy sources to 23 per cent.

The proposed increase in renewable energy use will require a significant amount of investment into infrastructure development. Yet, in addition to the significant investment required, there are other challenges which may hamper the goals set out in the APAEC.

Mixed power system role

Despite numerous renewable energy resources, the region is still heavily dependent on hydrocarbons. This does mean that in many cases, energy from hydrocarbons is considered more affordable.

The specific energy contexts for each country in Southeast Asia is partly responsible for the challenge of integrating energy policy across the region. The diversity of development within the region ranges from fully developed energy systems and industrial sectors, to those without nationwide access to energy services.

Fuel demand has outpaced production within the region, and Southeast Asia is now set to become a net importer of fossil fuels, mostly oil. In addition to the increased cost, this is a concern for energy security as the region becomes increasingly impacted by the unpredictability of both the global energy markets and geopolitics.

Southeast Asia’s overall energy demand has increased 80 per cent since 2000. The demand has largely been met by doubling the amount of fossil fuels used. Oil has been the fastest growing and the resulting impact has been an increase in development and growth, but also an increase in air pollution and CO2 emissions.

According to the International Energy Agency, this trajectory could have troubling consequences. “The number of annual premature deaths associated with outdoor and household air pollution is projected to rise to more than 650,000 by 2040, up from an estimated 450,000 in 2018,” according to an agency statement. “The projected growth in fossil fuel consumption would drive a two-thirds rise in CO2 emissions, reaching almost 2.4 billion tonnes in 2040.” There are, however, promising signs.

Southeast Asia’s largest economy, Indonesia, is also one of the largest producers and exporters of coal globally. However, in February, the Indonesian government prioritised passing new legislation on renewable energy and legislators are working on a draft of the renewable energy bill. Indonesia has pledged to cut emissions by 29 per cent independently by 2030, or by at least 41 per cent with international help.

As efforts to align national renewable energy goals and regulations on emissions proceed, the reality of addressing energy poverty and affordability is another consideration among some of the ASEAN countries. The goal is to enable a cleaner energy transition that takes into account the various contexts of each country. The ultimate aim is to spread the goal of 23 per cent renewable energy across the region, instead of making it the responsibility of a few individual countries.

Pandemic caveats

Despite the above, and in light of the COVID-19 pandemic, ASEAN member states may need to reconsider both national and regional plans as delays impact the construction of solar plants and wind turbines.

In fact Dr. Yongping Zhai, energy sector group leader of the Asian Development Bank, has recommended that developing economies turn to domestic suppliers instead of relying on international suppliers, contractors, and materials.

Southeast Asian countries including Malaysia, Singapore, Vietnam, and Thailand manufacture photovoltaic components and assemble solar modules with imported cells and system integration – and mostly for export markets outside of Southeast Asia. Zhai urged these countries to target more regional markets as they develop.

The message often repeated is one of coordination between government stimulus and the ongoing energy transition – a message recently repeated by the United Nations Environment and Social Commission for Asia and the Pacific.

Thus far, many of the guiding objectives behind the APAEC are on target to be achieved. These include the development of guidelines to integrate energy efficiency standards across the region through the ASEAN Electrical and Electronic Equipment Mutual Recognition Agreement.

The APAEC Phase II: 2021-2025 explores more ambitious targets to enhance energy security and sustainability in line with the objectives of the global energy transition, Sustainable Development Goals, and the Paris Agreement.

Already plans are underway for the next phase of the agreement. In September 2019, two new energy efficiency and conservation deliverables, part of Phase II, were endorsed and adopted. Implementation will start with air conditioners and be expanded to other appliances.

With these and the development of a larger strategy for Phase II, collaboration at an ASEAN level will contribute to a better energy future for those within the region as they cooperate to tackle the challenges of energy transition together.

|

Osamu Ono - CEO, Mitsubishi Power

ASEAN’s economies have grown significantly over the past decade, but it is important we accept that this development has come at a price. Countries in the region register some of the highest rates of greenhouse gas emissions globally, which are directly linked to the severe weather phenomena and public health problems that we experience here. No energy transition journey is straightforward, and highly polarised global discourse has made it seem that we must choose between protecting the environment and driving economic progress. But it does not have to be this way. With a clear vision and attainable milestones set to build accountability, we can strike a balance between these two ambitions. I urged for a process that utilises existing power generation infrastructure even as cleaner energy solutions are still being developed. The idea is to reduce carbon at every stage of the power generation process – from the selection of fuels to management of exhaust gas – while maintaining stability of power supply. This begins by increasing the flexibility of existing power generation systems to operate optimally and to accommodate current intermittencies in power generation from renewables. Secondly, countries must look for ways to decrease the environmental impact of existing systems through equipment upgrades, as well as the installation of carbon capture technologies across power generation systems. In tandem with these two approaches, countries must progressively raise adoption of fuels with inherently lower carbon intensity, starting with natural gas and biomass which are abundant in some parts of the region. A case in point is Mitsubishi Power’s work with the Intermountain Power Plant in the United States. The two M501JAC power trains we will supply will replace existing coal-fired generation and transition from a blend of 30 per cent hydrogen and 70 per cent natural gas, to 100 per cent renewable hydrogen fuel in the future. Advanced-class gas turbines like the JAC model are the core of the systems that we have put in place not just in the US but all around the world, including Southeast Asia. These power systems can reduce CO2 emissions by 65 per cent compared to traditional coal plants. This proportion increases to 75 per cent with 30 per cent hydrogen co-firing, making them a gamechanger for the energy transition in the region. |