Vietnam’s energy industry: Transparent regulatory framework needed

Vietnam’s energy industry: Transparent regulatory framework needed

A transparent legal framework will ensure a proper risk-sharing mechanism among all parties.

Vietnam’s energy sector is destined for stronger foreign capital inflows due to high demand of the local economy, one of the fastest-growing in the world.

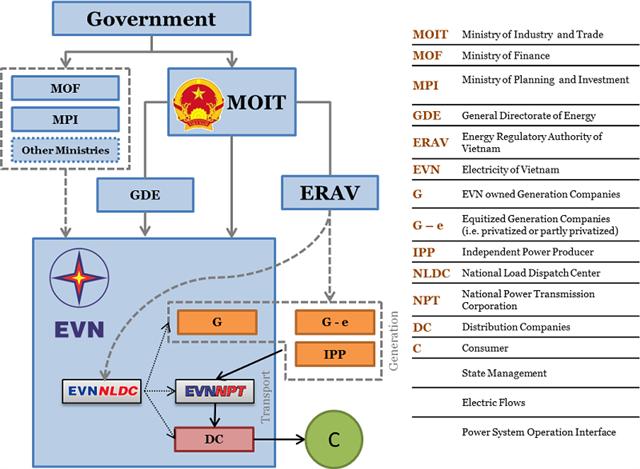

Management system in Vietnam's energy sector

|

To make the investment come to the right place, changes must be made, especially in terms of policy making, an economist from the World Bank has said.

Investors need a transparent and stable regulatory environment which incorporates a proper risk-sharing mechanism among all parties, said the World Bank’s Lead Energy Economist Franz Gerner.

He said a large interest is observed from private investors to participate in the vast growing energy market in Vietnam, especially in renewables and LNG development. But they are willing to invest as long as the projects are well-structured and bankable.

In reality, the changing macroeconomic and sectoral context in Vietnam requires a new approach to financing electricity and gas investments.

An enabling environment is needed for private players to drive the next wave of electricity and gas investments, according to World Bank officials.

For a better approach to Vietnam’s energy sector, the World Bank has conducted a study that highlights the unviability of the traditional financing model which relies mostly on public investment by state-owned enterprises.

Importantly, it presents an action plan on how to unlock new sources of finance, especially from the private sector, based on a comprehensive analysis of investment needs as well as constraints in the regulatory environment including the capital and forex markets.

The World Bank officials urged the Vietnamese government to address comprehensively the constraints currently impeding the flows of domestic and cross border private capital into two of the most strategic segments of the Vietnamese economy.

Energy mix in Vietnam. Source: Law firm DFDL

|

To remove constraints and maximize financing available for electricity and gas investments in Vietnam, the report proposes a well-coordinated policy effort around three pillars, namely (1) Develop a major PPP/IPP program for new power generation as part of the development of Power System Development Plan 8 to build investor confidence; (2) Enhance the financial standing and credit worthiness of Vietnam Electricity (EVN) and Vietnam Oil and Gas Group (PVN) to enable them to access commercial finance without government support; and (3) Increase the availability of local currency financing which is critical for both project finance and corporate project finance.

While EVN and PVN will continue to play an important role in developing new infrastructure, the vast majority of new gas and electricity investments will need to come from private players, the report argues.

To ensure the power development strategy, Vietnam will seek foreign and domestic private investment to help develop new power plants and speed the privatization of state-owned power companies.

Efforts

The Communist Party of Vietnam’s powerful decision-making Politburo has issued a resolution on the energy strategy by 2030 and vision to 2045 with a focus on three pillars namely oil, coal, and renewable energy.

The strategy is aimed at ensuring national energy security and sufficiently supplying power for fast and sustainable socio-economic development.

Vietnam plans to more than double its power generation capacity to 125-130 gigawatts (GW) from about 58 GW to feed its fast-growing economy.

Accordingly, it will invest more in oil exploration and exploitation domestically and internationally to raise the ratio of oil energy in the power mix.

The strategy calls for oil refineries to meet at least 70% of domestic demand for refined petroleum products. Vietnam will also develop infrastructure to be able to import 8 billion cubic meters of liquefied natural gas annually by 2030.

It will raise the proportion of renewable energy to 15%-20% by 2030 while trying to lower reliance on coal which now accounts for about 38% of the total capacity.

The resolution also requires more attention to power generation projects and the wholesale and retail power markets.