Land rental rise in industrial property

Land rental rise in industrial property

The increasing demand and the drying up of land banks in industrial zones has bumped up rental prices in first-tier property markets in Vietnam.

Figures from CBRE Vietnam reported strong escalations in industrial land and warehouse rent. Industrial land rates went up 20-30 per cent on-year and warehouses have increased as well across industrial zones (IZs) in Ho Chi Minh City, Dong Nai, and Long An.

Specifically, in some IZs in Ho Chi Minh City, rental rates have increased from $150 to $300 per square metre for the remaining lease terms. In Dong Nai, rental rates have increased from $110 to $155 per sq.m. Meanwhile, Long An saw rates go from $110 to $200 sq.m.

Some northern localities also witnessed an increase in rental rates, but the trend was not as pronounced as in the south. In Hanoi, rental rates increased from $155 to $260 per sq.m while in Bac Giang they moved from $55 to $110.

|

The market of IZs, ready-built factories, and warehouses have been developing at a breakneck pace in the past few years.

The segment has moved light years away from the first traditional IZ opened in 1986, to now encompass three key types of industrial developments: IZs, ready-built factories, and warehouses with the participation of a wide range of large-scale developers.

The segment is strongly polarised towards the two ends of the country. In the northern provinces, the total supply is around three million sq.m, mostly in Haiphong, Bac Ninh, Hanoi, Hai Duong, and Hung Yen. This region has reported an occupancy rate of 74 per cent.

The southern provinces meanwhile have total supply of five million sq.m in the key provinces of Binh Duong, Dong Nai, Ba Ria-Vung Tau, Ho Chi Minh City, and Long An. In this region the average occupancy is at around 76 per cent. However, counting only Ho Chi Minh City, Binh Duong, Dong Nai, and Long An, the rate is at 86 per cent.

Reacting to the strong demand, a significant new supply of ready-built factories and warehouses has been reported in major industrial regions. The total supply of ready-built factories and warehouses in the north reached 2.1 million sq.m, up 25.3 per cent on-year. For the south, the figure is 2.7 million sq.m, up 28.2 per cent on-year.

Supply has been coming along steadily, in parallel with improvements and expansions in the infrastructure system of roads, airports, ports, and related facilities.

|

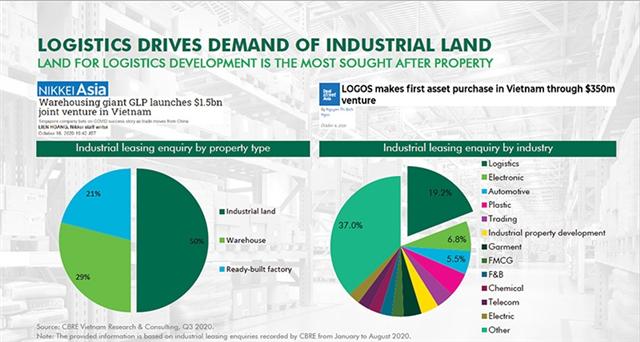

Tenants’ demand has mainly centred on Vietnam’s key industries such as electronics, e-commerce, food, livestock, and fast-moving consumer goods. These industries are developing at pace in Vietnam and investors are looking to use the country as a hub to access new markets.

There is also a clear trend of relocation among investors in automobile assembly, with the northern and central regions benefiting. In addition, many investors are looking to get their hands on ready-built warehouses via conducting mergers and acquisitions or buying and leasing land.

|

Additionally, with the land funds in first-tier cities becoming limited, rates increasing, and workforce growing scarce, investors are turning towards second-tier locations.

In the north, Tier 1 includes Hanoi, Bac Ninh, Hai Duong, Hung Yen, and Haiphong while Vinh Phuc, Thai Nguyen, Bac Giang, Ha Nam, Thai Binh, and Quang Ninh make up Tier 2.

In the south, Ho Chi Minh City, Binh Duong, Dong Nai, and Long An are in Tier 1 while Tier 2 consists of Tay Ninh, Binh Phuoc, Ba Ria-Vung Tau, Binh Thuan, and Tien Giang.

The rental gap between the two tiers is about 20-30 per cent. The savings resulting from this gap, according to Le Trong Hieu, director of advisory and transaction services at CBRE, are appealing to tenants, especially for those looking to minimise costs.