The challenges ahead in attracting high-quality FDI

The challenges ahead in attracting high-quality FDI

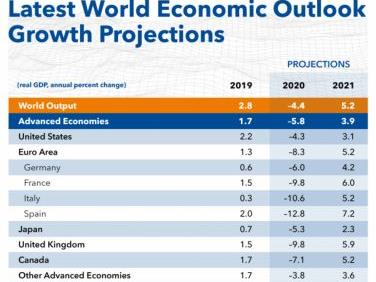

The world has been heavily affected during the COVID-19 pandemic since the beginning of the year, which has caused a serious decline in economies globally. However, due to the pandemic being under good control in many ASEAN member states, these economies are on the way to recovery and is one of the key points why capital inflows are being attracted away from China.

By Pham Duy Khuong - Managing director, ASL LAW

|

With the desire to bring the economy through difficult times, the ASEAN region has made innovations and new policies to attract more foreign direct investment (FDI) into their countries. Indeed, together with the aim of becoming the third-largest area in FDI attraction, member countries have signed internal agreements which generate convenience for investors in the flow of goods within the bloc.

With the efforts to generate a good competitive environment in order to attract FDI into ASEAN countries, economic ministers have officially discussed and enhanced legal documents in the framework of the ASEAN Comprehensive Investment Agreement in order to eliminate obstacles for investors.

While the coronavirus pandemic remains complicated for many major economic powers, ASEAN countries have become an attractive place for foreign investors. Here, each country has its own laws, policies, and conditions to create their own competitive advantages to attract FDI flows.

Singapore is one such leading country in attracting FDI. Although the city-state does not have a specific investment law, through the provisions of general law, Singapore has created a fair treatment environment between domestic and foreign enterprises.

Meanwhile, Thailand – one of the biggest competitors with Vietnam – has adopted investment and tax incentive policies to actively encourage the movement of foreign investors into Thailand with outstanding policies such as a 50 per cent reduction in corporate income tax (CIT) up to five years, as well as encourage the development of human resources in the field of advanced technology with tax incentives.

Another rival of Vietnam for attracting FDI is Indonesia, which has built a plan to construct many industrial zones until 2024 with many incentives, such as the reduction of CIT from 22-25 per cent this year and a continuous reduction to 20 per cent in 2022.

Between 2011 and 2016, Malaysia continuously conquered new heights in FDI attraction, but this capital tended to flow more slowly in the following years. In the context of declining domestic FDI attraction and regional peers constantly having new policies to attract foreign investors, Malaysia has made a strong effort to improve its attractiveness.

Meanwhile, Vietnam has many competitive advantages as compared to other ASEAN countries because it has controlled the pandemic very well with a small number of COVID-19 cases as compared to the likes of Thailand and Indonesia.

Moreover, Vietnam has a great geographical advantage with bordering many countries in Asia, especially China. In addition, with its long and large coastline, Vietnam becomes an important place adjacent to essential sea routes to generate convenient conditions for import and export.

However, apart from competitive advantages, Vietnam must face challenges in FDI attraction.

The first is that although 2019 has been one of the bright years for FDI attraction, based on analysis of the FDI source, it mainly focuses on processing and manufacturing industries (accounting for 45.8 per cent), but these industries do not require high-skilled labour so it does not create a basis for further training of high skilled labour for Vietnam.

Therefore, in the coming years, Vietnam should focus on directing FDI to diversify investment sectors such as high-tech industries, industries for the development of labour skill, and research industries.

Secondly, based on the World Bank’s statistics on capital flow trends, investors are gradually choosing mergers and acquisitions as a mode of investment, instead of investing in new production facilities. Therefore, Vietnam needs to improve the laws and regulations on this field so that it is simple and flexible to avoid the cumbersome system.

Thirdly, domestic enterprises have to face competition with foreign investors. That means leaders are often forced to reform their companies and improve management and legal skills to cope with the increasingly competitive market.

Finally, although increasing in quantity, Vietnam also needs to assess and refine the quality of FDI sources, as well as avoid FDI sources with poor quality such as outdated technology or harming the environment.

Although other ASEAN countries are competitive with Vietnam, they are still partners. This has been shown through registered FDI of foreign investors from ASEAN countries into Vietnam, which is $81.9 billion accounting for 21.7 per cent of the total amount of investment capital into Vietnam with $54.8 billion, $12.7 billion, and $12.3 billion for Singapore, Malaysia and Thailand respectively.

Besides that, Vietnam also invests directly into Laos and Cambodia with $4.8 billion and $2.8 billion respectively. Therefore, this can help ASEAN countries develop more equally and aim for a more developed community.