Hospitality property taking lead with domestic travel focus

Hospitality property taking lead with domestic travel focus

Despite 2021 being projected to remain a challenging time for global hospitality markets, Vietnam may have better chances than its neighbours to capitalise on domestic travel demand, which already made a large proportion of total travellers in the country before the pandemic.

|

The domestic market, especially involving millennials and Gen Z’s, have powered travel growth in recent years. Luxury properties, staycations, boutique hotels, wellness resorts, food experiences, and other getaway destinations have all enjoyed growing demand.

According to Mauro Gasparotti, director of Savills Hotels Asia Pacific, through suitable package pricing, Vietnamese hotels and resorts are well-placed to capture this local demand. “It’s also a good time for Vietnamese and expats alike to experience new properties and emerging local destinations. Drive-to destinations such as Ho Tram, Vung Tau, Phan Thiet, and Dalat are the perfect getaways for those wanting to avoid airports,” Gasparotti said at the Vietnamese hospitality experts’ event held by Savills Hotels Asia Pacific last week in Ho Chi Minh City.

Tourism has long been one of the key economic sectors for Vietnam. In 2019, the country welcomed more than 18 million international visitors and served 85 million domestic travellers, contributing about $32.8 billion to the economy, equivalent to 9.2 per cent of GDP. These growth rates and positive outcomes continued until February this year, when the coronavirus pandemic began to take hold. Since the end of March, when Vietnam’s international tourism activities were mostly suspended, the government has tried to provide solutions for the country to build on its previous growth successes.

Nguyen Trung Khanh, general director of the Vietnam National Administration of Tourism (VNAT) said, “The government has worked out various stimulus packages and reformed administrative procedures to create favourable conditions for experts and investors to enter Vietnam for working, investing, and seeking business cooperation opportunities.”

As for domestic tourism activities, Vietnam’s pandemic prevention response meant May, June, and July saw a travel resurgence under various promotional campaigns aimed at persuading Vietnamese people to explore their own country. The campaigns achieved remarkable results in which the number of domestic tourists increased by over 20 per cent compared with the same period last year.

Khanh added that the VNAT is planning to launch a new domestic stimulus campaign called “Vietnam - Travel to Experience”, to woo visitors in the time ahead.

Bumpy road ahead

Even as parts of the market gradually return with an increase of inbound travel; huge problems remain for the tourism sector, as well as developers and investors.

According to Kenneth Atkinson, founder and senior board adviser at Grant Thornton Vietnam cum chairman of the Vietnam Tourism Advisory Board (TAB), the current situation of hospitality in real estate means that many properties are either closed or for sale – particularly smaller and high-end properties.

“Sellers are still holding out for pre-pandemic prices. Prices need to be fairly valued even though at previous levels with discounts up to 30 per cent. Distressed sales are not apparent but it seems some transactions are being handled directly by bank lenders. There is certainly interest from overseas buyers but the problem is pricing and travel restrictions,” Atkinson said.

As with just about everywhere else around the world, hospitality has suffered in Vietnam, with many properties running at single digit occupancy. The return of COVID-19 in Danang in July further dropped national occupancy levels, with most destinations receiving cancellations as positive sentiment was returning.

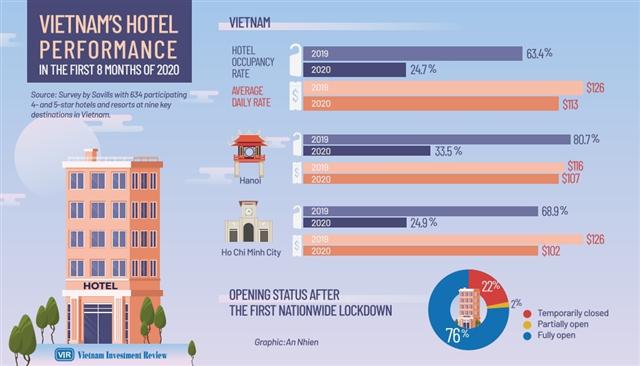

The August average national occupancy for upscale properties was under 20 per cent, down 75 per cent over the same period in 2019, with Ho Chi Minh City recording 14 per cent occupancy, and Hanoi 24 per cent. Average rates have also dropped by 10 per cent in the first eight months of the year compared to 2019, causing severe losses for many owners.

However, according to Gasparotti from Savills Hotels Asia Pacific, thanks to effective pandemic containment by the government, local sentiment for travel has been recovering again. “Hotels and resorts have received increased bookings over September and October, signalling that we are turning the corner. We are officially at the start of our road to recovery for the second time,” he said.

Expectations for 2021

Atkinson from TAB commented while foreign direct investment and mergers and acquisitions could increase, business travel to facilitate such activities remains limited.

In the global market, Vietnam has crafted an outstanding reputation in terms of managing COVID-19. Many keen travellers have been keeping tabs on the border situation on social media, itching for travel and making Vietnam top of their list.

But while some forecasts have predicted that the country could see anywhere from would 6-12 million foreign visitors next year, it is simply too early to tell depending on how the coronavirus is managed regionally and beyond over the next few months. Domestic travel in 2021, meanwhile, is predicted to remain at a high level of 50-60 million.

However, even when borders are reopened to selected countries, Gasparotti said that Vietnam should not expect international demand to immediately rebound. “There may be some initial demand from single travellers or small groups eager to spend a weekend overseas, but the larger overseas tourist base of groups or family travellers may take months to recover. The resonance of lodging industry slowdown and related sector shutdowns is likely to affect recovery potential even if demand rebounds,” Gasparotti said. “However, we firmly believe Vietnam will recover faster than other countries for its affordability, safety, and proximity to larger tourism sources.”

Sonu Shivdasani, founder and CEO of Soneva and Six Senses, highly appreciates that Vietnam has great potential for developing tourism. However, Shivdasani added, the country must know how to harmonise between tourism development and environmental protection in order to keep the tourism industry developing in a sustainable direction.

“In my experience, tourist destinations worldwide can be sustainably developed only when they know how to bring environmental protection solutions into their development strategy. If not, they are likely to fail,” Shivdasani warned.

|

Peter T. Meyer - CEO, Lodgis

Vietnam is no different from any market in the world. Properties especially rely on inbound business, international business, and tourism which have of course been significantly impacted. Until they are accessed again, and borders open in any kind of meaningful way, will there be a rebound. Now Vietnam fortunately has a very big domestic market, given the size of its population, so that can help, depending on what kind of property you have. International tourist destinations like in Vietnam have been significantly impacted while some of the more domestic locations are less so. And it gets true as well whether it is in Indonesia or Thailand – anywhere relying on unfettered access and opened borders. It is significant to drive businesses. That said there are certain countries where the size of the market does not have the depth, like Cambodia, where we own properties and those markets have been hit really hard. Roland Svensson - CEO, T&T Hospitality

We have seen the tremendous development of hospitality in Vietnam. There is a lot of focus from the government to develop Vietnam as a hot spot for tourism. With the support of the government, foreign investment is a great opportunity. It is a little bit like what happened in Thailand 15-20 years ago when they had a lot of foreign investment coming in, and we can see how that has gone. A lot of things still need to be carried out by the government, for example to expand the ownership for foreign investors. Another thing which is important is to improve both the quality and quantity of human resources, because that is the biggest challenge in the hospitality business today. Making the hospitality business attractive to work in is also tough. But there are a lot of opportunities to grow very quickly. The government should help to make it attractive for the younger generation of Vietnam. Douglas Louden - Principal, Perceptions Hospitality

The market remains challenging,. Vietnam is lucky as it has large population that has generally enough income to travel domestically. So, the demand for resorts, hotels, inns, and other services is still driven by Ho Chi Minh City and Hanoi. Obviously, where we are suffering is that the borders have not opened yet, and we have no inbound traffic. But the hospitality industry in Vietnam is doing better than some other countries such as Thailand, Cambodia, Laos, and the Philippines. I think Vietnam’s hospitality market will accelerate faster than other countries in the area. We have a very good track record through COVID-19. As soon as borders are opened, we can expect certain routes to come back very quickly. Most of the factors that are going to relate to the re-growth of hospitality are the airlines. Even if COVID-19 disappeared tomorrow, there is going to be two to three months before people get back to booking hotel rooms and so on, and then can airlines put on more capacity and start flying. Kai Marcus Schröter - General director, Hospitality Tourism Management

Vietnam’s coastal urban areas have been attractive to foreign investors and developers for quite some time. The government’s recognition of the tourism sector as a spearhead industry and generally favourable investment policies have led to a boom in the development of major tourism destinations. Improved connectivity and access, infrastructure and visa policies have contributed to a surge in domestic and international tourists. With more than 3,000km of coast line and extensive beaches, Vietnam is an attractive destination with plenty of untapped investment opportunities. Having worked with many foreign investors and developers in Vietnam, our Hospitality Tourism Management did not experience any major difficulties. If there are any particular issues, we would mention delays in land clearance and compensation, inadequate legal frameworks and inconsistent application, improper master planning, and overdevelopment. Vietnam is competing with other countries in the region and must continue to improve its competitiveness. |