Vietnam manufacturing activity drops for two consecutive months

Vietnam manufacturing activity drops for two consecutive months

Although marked, the latest decline in business conditions was much less severe than that seen during the worst of the Covid-19 related downturn in April.

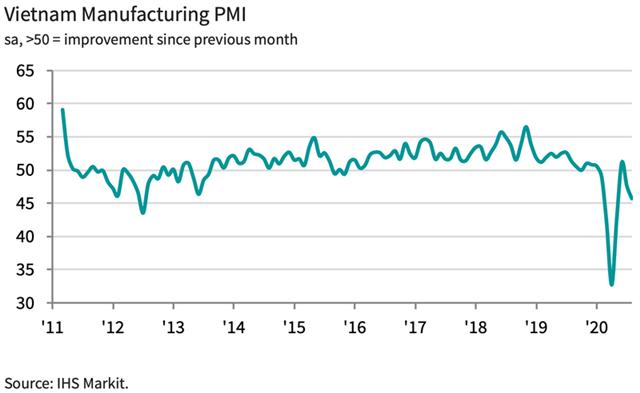

The headline Nikkei Vietnam Manufacturing Purchasing Managers’ Index (PMI) fell to 45.7 in August from 47.6 in July. This represented a second successive deterioration in the health of the manufacturing sector, after a return to growth had been signaled in June, according to Nikkei and IHS Markit.

|

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

Although marked, the latest decline in business conditions was much less severe than that seen during the worst of the Covid-19 related downturn in April.

Respondents indicated that the effects of the Covid-19 pandemic led to declines in both output and new orders. New business decreased at a solid pace amid reports of weak customer demand. Data also pointed to a sharp reduction in new export orders, and one that was faster than that seen for total new business.

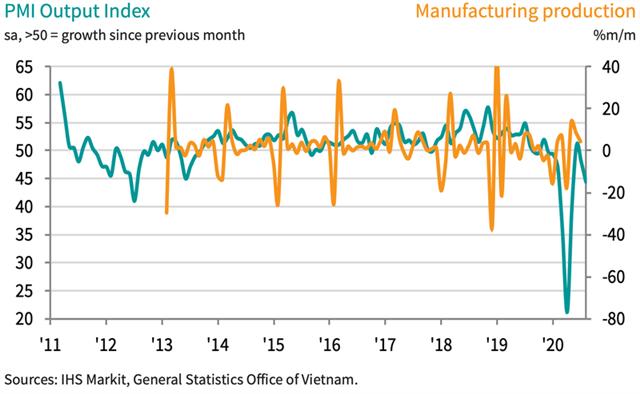

The latest reduction in manufacturing output was the eighth in the past nine months, and faster than that seen in July. All three broad sectors posted falling output, with the rate of contraction sharpest at intermediate goods producers.

|

Declining new orders led to further reductions in both backlogs of work and employment amid a lack of pressure on operating capacity. The rate of depletion in outstanding business was sharp, while firms scaled back their staffing levels to an extent only exceeded during the worst of the recent downturn in April.

A faster reduction in purchasing activity was also recorded amid lower new orders and production requirements. That said, the fall in input buying was still much weaker than April's record. The scaling back of inventories also continued, with stocks of both purchases and finished goods decreasing in August. Some respondents indicated that finished products had been dispatched to customers as soon as they were ready to avoid a build-up of inventories.

Input prices increased for the third month running in August, albeit at only a slight pace that was slower than the series average. A scarcity of materials due to the Covi-19 pandemic was the principal cause of the rise in input costs, according to respondents. Similarly, the impact of the pandemic was central to another lengthening of suppliers' delivery times.

Manufacturers responded to weak demand conditions by lowering their output prices again midway through the third quarter of the year. Selling prices have now decreased in each of the past seven months, with the latest fall the fastest since May.

Concerns around the ongoing effects of Covid-19 on demand led to a drop in confidence among manufacturers regarding the 12-month outlook for production. Firms still predicted, on balance, that output will rise over the coming year, linked to hopes that the pandemic will be brought under control. That said, optimism was among the weakest since the series began in April 2012.

“With the data moving in the wrong direction at present, the latest PMI data for Vietnam highlight the ongoing effects of Covid-19 on the manufacturing sector and the challenges faced in trying to overcome them. Customer demand remained weak, with firms scaling back production accordingly. The picture around employment was particularly worrying, with jobs lost at the second fastest pace in nine-and-a-half years of data collection,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

"Firms will be hoping that the virus can be brought back under control so that the recovery that got underway in June can get back on track."