Export turnover lends country further surplus in spite of snags

Export turnover lends country further surplus in spite of snags

Despite a decline in state budget revenue, remittances, and foreign direct investment, Vietnam is expected to see a surplus in current account this year thanks to a possible rise in export turnover.

|

According to the Asian Development Bank (ADB), Vietnam’s current account is expected to see a surplus equivalent 1 per cent of GDP in 2020 before rising to 1.5 per cent in 2021.

If the economy grows about 2 per cent on-year in this year as expected by the government, the GDP will be $267.2 billion, and the current account surplus will be $2.67 billion.

Vietnam has continuously earned a current account surplus since 2011, at 0.2 per cent of GDP in 2011, 6 per cent in 2012, 4.5 per cent in 2013, 5.1 per cent in 2014, 0.5 per cent in 2015, 3 per cent in 2016, 2.9 per cent in 2017, 3 per cent in 2018, and 2 per cent in 2019.

Meanwhile, in April the World Bank forecast under negative impacts of COVID-19, Vietnam’s current account surplus is expected to be 0.1 per cent of GDP this year, 1 per cent next year, and 1.2 per cent in 2022. It said that the current account balance “should deteriorate temporarily.”

The country’s current account surplus would be able to be higher without negative impacts from a dent in state revenue, remittances, and foreign direct investment (FDI).

According to the ADB, with tax collection reduced because of lower incomes and spending increased on health care and social security, and likely additional fiscal support in 2020, the fiscal deficit is forecast to widen to the equivalent of 6 per cent of GDP in 2020.

This 6 per cent is estimated to equal $16 billion, if GDP remains at $267.2 billion.

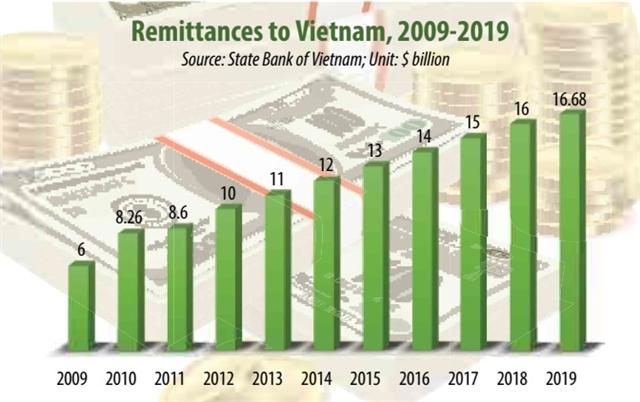

Besides that, based on its calculations the ADB projected that overseas remittances into Vietnam will drop about 18 per cent on-year in this year, causing pressure to the economy’s current account.

Last year, Vietnam’s total overseas remittances sat at $16.68 billion. If this 18 per cent decline became true, the figure might be about $13.7 billion this year.

“Difficulties caused by the pandemic globally have forced Vietnamese overseas to tighten their belt, making it more difficult for them to send money back to their homes in Vietnam,” said a senior ADB economist.

Venture slowdowns

Last year, the quantity of remittances sent to Vietnam mounted to $16.68 billion, accounting for 6.5 per cent of GDP, according to the State Bank of Vietnam. Of which, Ho Chi Minh City accounts for about $5.3 billion.

In addition, many investors are delaying the implementation of their projects in Vietnam, likely leading to a reduction in FDI disbursement this year. This will also affect the economy’s current account picture.

The Ministry of Planning and Investment (MPI) estimated that in 2020, total newly-registered, newly-added, and stake-acquisition foreign capital will be about $34-35 billion, down 10.1-12.8 per cent on-year, and total disbursed FDI will be $19-20 billion, down 1.9-6.8 per cent on-year.

The largest contributor so far this year is Thailand’s 464-hectare Long Son Petrochemicals Complex which increased capital from $3.7 billion to $5.1 billion in order to upgrade the refinery’s technology and improve its capacity. The investors include Vina SCG Chemicals Co., Ltd. and Thai Plastic and Chemicals Public Co., Ltd.

“The level of FDI inflows is projected to drop in 2020 given the uncertainties in the world economy, but should return to recent levels afterward, partly reflecting the growing interest of foreign investors in the domestic market and their willingness to diversify their activities away from China,” said a World Bank update on Vietnam’s economic outlook.

Figures from the MPI showed that in the first eight months of this year, total newly-registered, newly-added, and stake-acquisition foreign capital was $19.5 billion, down 13.7 per cent on-year, and total disbursed FDI stood at $11.4 billion, down 5.1 per cent as compared to the same period last year.

Export recovery

Currently, foreign-owned firms account for about 20 per cent of Vietnam’s GDP, contribute to a quarter of tax revenue, and have created millions of direct and indirect jobs. They also represent about 70 per cent of the country’s exports, with over half of them from electronics.

However, the economy’s current account picture this year is fuelled by a gradual recovery in exports. According to the MPI, this year is forecast to see Vietnam earn a trade surplus of about $7 billion, with total export turnover of $267 billion – up 1 per cent against last year, and total import turnover of $260 billion – up 2.6 per cent against 2019.

“Total export turnover for August is estimated to be 26.5 billion, up 6.5 per cent on-month, largely thanks to Samsung boosting the export of its new Note 20 mobile phone,” said an MPI report. “In the eight months, total export turnover of mobile phones and their spare parts was $31.5 billion, accounting for 18.1 per cent of total export turnover.”

Currently Samsung holds almost all the mobile phones and spare parts exports of Vietnam. It has invested over $17 billion in the country so far.

In the first nine months, Vietnam is roughly estimated to enjoy a trade surplus of $14 billion.

The World Bank said that Vietnam is now the global export champion. Since 2017, its export turnover has always been on top of the region. Vietnam has also signed and implemented more trade agreements, which numbers 13 now, than any other country in East Asia and the Pacific, and is currently negotiating three more.

With some of the lowest labour costs in the world, a strong openness to trade, and an advantageous geographic location, Vietnam has been a major destination of FDI over the past decade.

“Foreign enterprises have not only increased capital, but also generated millions of jobs and helped Vietnam expand important export markets,” said an economic expert from the World Bank.

|

The balance of payments remained positive in the first eight months of 2020, and the State Bank of Vietnam (SBV) has been able to accumulate about $12 billion more in international reserves. In August, Vietnam’s export performance remained resilient, growing 1.42 per cent on-month, but foreign direct investment (FDI) inflows moderated significantly as they reached about $720 million in August compared to $3.1 billion in July. Foreign reserves continued to accumulate, while the foreign exchange rate remained stable. At the end of August, the level of international reserves held by the SBV was equal to $92 billion, up from $80 billion at the end of December. While this increase is not as rapid as reported for the same period in 2019, it demonstrates the resilience of Vietnam’s economy, which reached a record-high merchandise trade surplus and attracted substantial FDI despite the pandemic. This performance helped mitigate the impact of lower remittances and foreign exchange earnings from foreign visitors. The resilience of Vietnam’s balance of payments was corroborated by the stability of the value of the local currency compared to the US dollar. Most economic and financial indicators continued to demonstrate Vietnam’s resilience, but the domestic rebound moderated in August, partly as the result of the COVID-19 outbreak in the central city of Danang. Exports continued to perform despite international headwinds, while FDI inflows slowed significantly. Going forward, attention should be given to domestic and foreign investors who may postpone their plans in the uncertain current environment as well as the government’s response, which needs to stimulate the recovery in the short term and preserve fiscal and debt sustainability in the longer term. Source: World Bank |