Vietnam infrastructure market among most diverse competitive landscapes in SE Asia

Vietnam infrastructure market among most diverse competitive landscapes in SE Asia

Foreign contractors will play an increasingly important role over the next decade, as the new PPP Law signals the government’s intention to attract more private sector investments.

Vietnam’s infrastructure and construction market is among Southeast Asia’s most diverse competitive landscapes, given the mix of nationalities of companies operating in the country, according to Fitch Solutions, a subsidiary of Fitch Group.

High level of openness of construction market

The market was historically dominated by homegrown state-owned enterprises but with the gradual opening up of the Vietnamese economy to foreign investors, as well as the government’s emphasis on infrastructure development, Fitch Solutions expects more foreign participation in Vietnam’s construction market over the coming years.

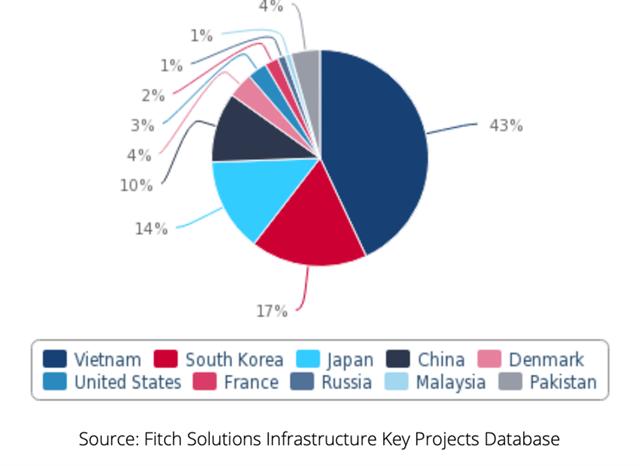

Foreign Players Hold Higher Market Share Than Domestic ContractorsVietnam - Share Of Construction Roles By Company Nationality

|

Opportunities exist mainly in areas where private or foreign companies have competitive advantages, including designing, consulting, building and managing projects (especially projects that are more technically challenging) and supplying high-value industrial goods such as rolling stock and wind turbines.

Based on its data, Fitch Solutions suggested foreign players hold a larger market share than domestic contractors, with the latter holding 43% of construction roles awarded. This, nevertheless, reflects the openness of Vietnam’s construction market.

The proportion of local dominance is lower as compared to its regional peers – in Indonesia, local companies hold 65% of market share, Thai companies hold 56% in Thailand, and Malaysian companies hold 62% in Malaysia. Only the Philippines has a lower share of domestic dominance than Vietnam at 34%.

Major Vietnamese players include joint-stock company Civil Engineering Construction Corporation (CECC), represented through its various divisions (e.g. CECC No.1, CECC No. 4 etc.), Truong Son Construction Corp, LILAMA Vietnam Machine Installation Corporation and Vinaconex.

South Korean firms leading among foreign players

Meanwhile, foreign companies, accounting for 57% of the market share, reflect the openness of Vietnam’s construction market. Moreover, they are essential to the development of Vietnam’s infrastructure sector with modern technology, expertise in project management and construction methods, stated Fitch Solutions.

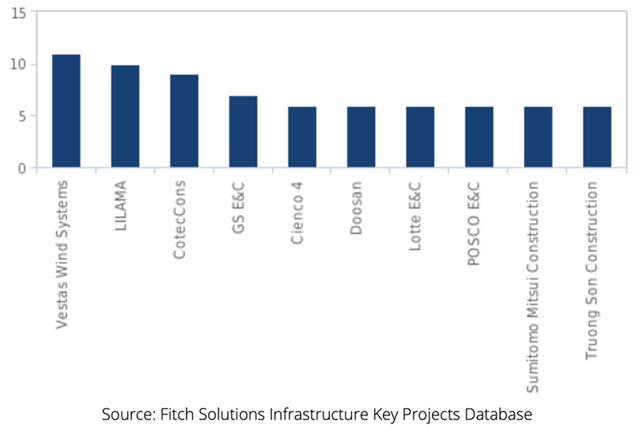

South Korea, Japanese, Chinese Companies DominateVietnam - Share Of Construction Roles Held By Foreign Companies, Top 10

|

The enactment of the Public-Private Partnership (PPP) Law in 2020 signals the government’s intention to attract more private sector investments in the infrastructure sector, and Fitch Solutions is of the belief that foreign players will play an increasingly important role over the next decade.

Leading the foreign nationalities in construction roles are South Korean companies with 17% of market share, represented by established brands such as GS E&C, Doosan Heavy Industries & Construction and POSCO E&C. In particular, three South Korean engineering companies, GS E&C, POSCO E&C and Hamon Group, were involved in the construction of the US$9 billion Nghi Son Oil Refinery and Petrochemical Complex, which was completed in 2018.

South Korean dominance in the petrochemical sector is also demonstrated by Hyundai E&C and POSCO’s role in the construction of the US$5.4 billion Long Son Island Petrochemical Complex, which is slated for completion by 2023. South Korean companies are also involved in the construction of power and transportation infrastructure, with Doosan appointed as contractors to the 1,330MW Nghi Son 2 Coal-Fired Power Plant and POSCO appointed as contractors to the 12.5km Hanoi (City) Urban Metro Line 3 along with Daelim Industrial.

Japanese companies hold 14% of market share and are mainly involved in infrastructure projects in the transportation and water sectors. Examples include the construction of the Ho Chi Minh (City) Metro - Line 1 project, which is handled the trio of Shimizu Corp, Sumitomo Corp and Maeda Corp, and the Binh Hung Sewage Treatment Plant Expansion Project, which is primarily tasked to Hitachi Corp.

More notably, despite being geopolitical rivals, Chinese companies currently hold approximately 10% of the market share. Besides being involved in the construction of segments of the North-South Expressway and the Hanoi Urban Metro Line 2A, most Chinese contractors are involved in the construction of power projects. That said, Fitch Solutions expects that Chinese investments and their involvement in Vietnam’s infrastructure market face a higher level of political risks, given the volatile state of bilateral relations between the two countries.

Japan dominating Vietnam infrastructure financing landscape

The extent of Japan’s involvement in the Vietnamese infrastructure market is further illustrated by the amount of financial support provided by Japanese-linked organizations.

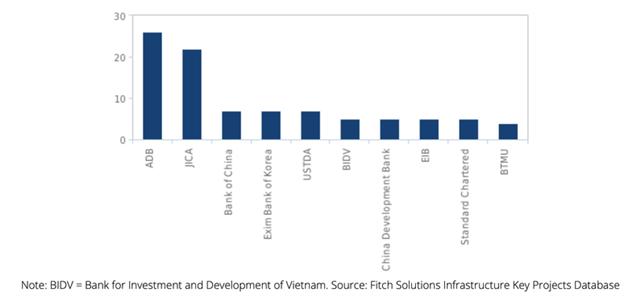

Japanese Financiers Play Big Role In Vietnam Infrastructure MarketVietnam - Share Of Financing Roles By Financier, Top 10

|

According to Fitch Solutions, Japan is dominating the Vietnamese infrastructure financing landscape, with Japanese financers accounting for slightly more than 20% of all roles (41 out of 198).

The most active Japanese financier in the market is the Japan International Cooperation Agency (JICA), with 22 out of 41 roles, representing a total market share of 11%. JICA has been active in the Vietnamese market for many years and had assisted on numerous projects such as the construction of the Cai Mep-Thi Vai International Port and the Hai Phong (City) 2 Thermal Power Plant, completed in 2013 and 2014 respectively. More recent projects with JICA involvement include the financing of segments of the North-South Expressway, and the planning of the proposed Hanoi-Ho Chi Minh City High Speed Rail, which is estimated to cost around US$58 billion.

Besides JICA, the big three Japanese commercial banks Bank of Tokyo-Mitsubishi UFJ, Sumitomo Mitsui Banking Corporation and Mizuho are also involved in lending activities related to various power and petrochemical projects.

Fitch Solutions also notes export credit agencies (ECAs) and multilateral development banks (MLDBs) play a large role in financing more than one-third of projects. ECAs include the Exim Bank of Korea and the Exim Bank of China, and MLDBs include the Asian Development Bank and the World Bank.