Capital inflows to Southeast Asian startups up 91 per cent despite outbreak

Capital inflows to Southeast Asian startups up 91 per cent despite outbreak

Southeast Asian startups, especially e-commerce and fintech companies, have witnessed a significant increase in their investment attraction between April and June with the global public health challenge continuing to exert pressure on the whole economy.

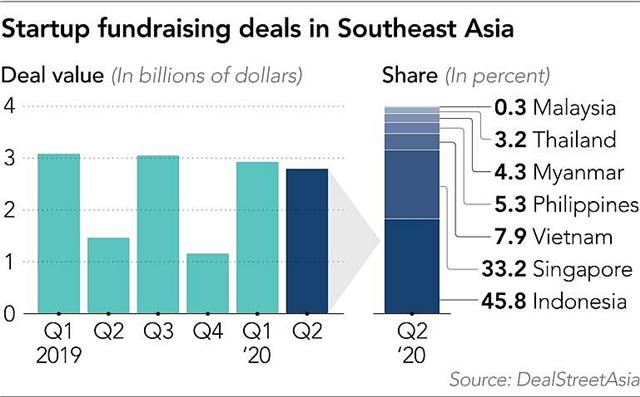

Particularly, the total value of investment deals in Southeast Asia jumped 91 per cent to $2.7 billion while the number of transactions rose by 59 per cent to 184, which is higher than the 116 transactions in the same period last year.

Data from newswire DealStreetAsia also revealed that since the mid-2010s, Southeast Asia's startup funding boom has been led by Singapore's Grab and Indonesia's Gojek – the two prominent “unicorns” focusing on ride-hailing and food-ordering services.

|

In this year’s first quarter, these two big guns alone successfully raised more than $2 billion, making up around 70 per cent of the regional inflows into startups.

E-commerce startups are considered to be the most appealing, attracting $691 million, followed by the sectors of logistics ($360 million) and fintech ($496 million).

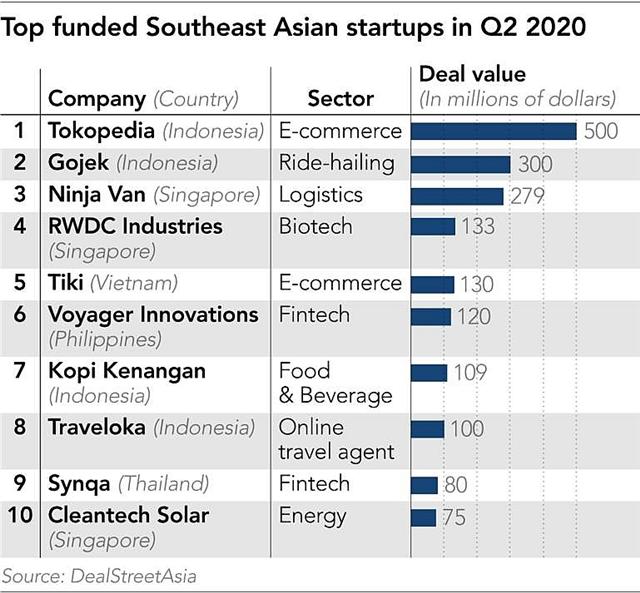

Indonesian e-commerce unicorn Tokopedia was named as the largest capital raiser of funds in the second quarter in the region with $500 million from Temasek Holdings.

Vietnamese e-commerce platform Tiki also secured $130 million from private equity fund Northstar Group.

Previously, the local market was looking at two high-calibre developments with the potential mergers and acquisitions (M&A) deal between Tiki and Sendo – another e-commerce player based in Vietnam. Unfortunately, the two sides have blown the retreat on the deal after allegedly failing to convince shareholders.

This decision came just after the two sides in early June submitted a request for authorisation for the deal to the Vietnam e-Commerce and Digital Economy Agency under the Ministry of Industry and Trade, as reported by VIR.

Tran Ngoc Thai Son, CEO and founder of Tiki, had proposed a few relief measures to support e-commerce and tech companies tide over the COVID-19 crisis, including Vietnamese authorities loosening the IPO rules to help firms like Tiki access more public capital.

Investment inflows to Southeast Asian startups increased 91 per cent despite the outbreak. Photo: Tiki in the music video Sang mat chua of Vietnamese artist Truc Nhan

|

Since demand for online shopping has picked up, logistics and delivery companies also received much attention from deep-pocketed investors, as seen in the case of Singapore’s Ninja Van and Indonesia’s Kargo Technologies pulling in $279 million and $31 million, respectively.

On the other hand, hefty sums also found their way to fintech, as investors still believe in the immense opportunities in this lucrative segment. According to Nikkei Asia Review, Voyager Innovations, the company behind Filipino mobile payment app Paymaya, raised $120 million in April from existing shareholders, including US private equity fund KKR and Chinese tech giant Tencent Holdings. The funding round, its first since 2018, gave the company additional financial muscle to compete with domestic rival Mynt, which is backed by Alibaba Group Holding.

In May, Singapore-backed Validus, the leading SMEs financing platform, secured more than $14 million in its ongoing Series B+ funding round which was led by Vertex Growth Fund and Kuok Group’s Orion Fund.

Validus is now expanding its footprint in Singapore, Indonesia, Vietnam, and potentially Thailand in the latter half of this year.

In the six months through June, Paymaya reported a 150 per cent on-year increase in transaction volume, helped by mobile payments and remittances.

In Myanmar, Digital Money Myanmar, known for its Wave Money brand, announced in May that China's Ant Financial Group, operator of Alipay, will invest $73.5 million in the company.

|

Meanwhile, Thailand-based fintech firm SYNQA, formerly known as Omise Holdings, has gained $80 million in Series C funding led by some high-profile names such as Toyota Financial Services, Sumitomo Mitsui Banking Corporation, and SPARX Group.

Just a few days ago, Traveloka – Southeast Asia’s largest online travel app that also operates in Vietnam – has bagged $250 million to bolster its operations in these challenging times.

“Our business in Vietnam has returned to 100 per cent pre-COVID-19 level and in Thailand has surpassed 50 per cent pre-COVID-level,” Traveloka co-founder & CEO Ferry Unardi said in a statement.

He noted that both Indonesia and Malaysia were also seeing “strong week-to-week improvement”, cited by Reuters.