Vietnam could resume pre-COVID-19 growth levels by next year: McKinsey & Company

Vietnam could resume pre-COVID-19 growth levels by next year: McKinsey & Company

Vietnam could resume pre-COVID-19 growth levels by next year although the pandemic threw a spanner in the works for the country’s thriving economic growth story, McKinsey & Company said in report published on Consultancy.asia.

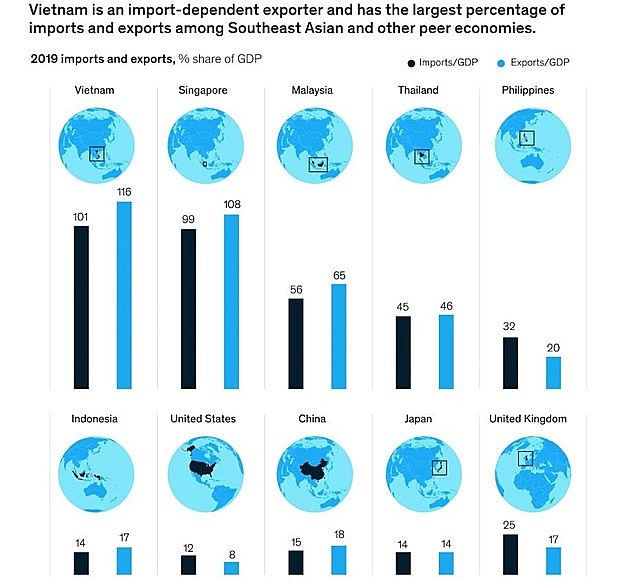

Photo: consultancy.asia

|

Hanoi – Vietnam could resume pre-COVID-19 growth levels by next year although the pandemic threw a spanner in the works for the country’s thriving economic growth story, McKinsey & Company said in report published on Consultancy.asia.

According to the firm, two factors have combined to cushion the blow of COVID-19 on Vietnam’s economy. For one, the country was successful in containing the virus. In fact, reports highlight that the last report of community transmission of Covid-19 in Vietnam was two months ago.

Lockdown in Vietnam lasted only three weeks, and the country has been among the first to open for business, it said.

The second conducive factor is the state of Vietnam’s consumer market, the firm said, adding that a growing middle class with money to spend has led to a boom in the country’s consumer market, to the extent that domestic spending accounts for nearly 70 percent of Vietnam’s GDP.

Back in April, more than half of Vietnamese consumers had reported a dip in spending, according to a McKinsey & Company report. GDP growth dipped to a decade-low in this quarter. However, the biggest cuts came in the discretionary spending segment, which fortunately accounts for just over a quarter of the GDP.

More than 40 percent of Vietnam’s GDP, meanwhile, is driven by spending on necessities, which has remained robust throughout the crisis and is expected to remain steady in its wake.

Both these factors mean that steadying the ship is relatively less of a challenge for Vietnam in the context when supply chains across the globe were thrown off balance by the lockdown, and Vietnam’s export numbers were affected by closures in China and other key markets, leading to a 21 percent dip in FDI for Vietnam in the first three months this year.

Forecasts suggest that most economies should be up and running by the end of this year, while a degree of momentum should accumulate by the middle of 2021. Provided that there is no second wave of infections, Vietnam could be up and running by this period. In fact, the Asian Development Bank, the World Bank and the International Monetary Fund all predict that Vietnam could reach a GDP growth rate of up to 7 percent by next year, the firm said.