Japanese companies enticed by local investment climate

Japanese companies enticed by local investment climate

Driven by new encouraging policies and motivations, more fresh opportunities will be coming for Japanese investors in Vietnam, expecting a new investment wave ahead.

Japanese companies have shown wide interest in relocating some operations to Vietnam. Photo Le Toan

|

Having been present in the country over the past 25 years, Watanabe Yutaka, director of TOWA Industrial Vietnam, is impressed with the improvements in the business climate. Now the successful control of COVID-19 is giving his company more confidence in making its next steps.

“Vietnam has more advantages than other regional countries in investment attraction. The cost of the manufacturing sector in China and Thailand remains high. Economic activities globally are on a downtrend, while investments are gearing up,” he said at the Ministry of Planning and Investment’s (MPI)webinar on Japanese investment promotion last week, which attracted over 1,000 Japanese companies.

TOWA Industrial Vietnam specialises in manufacturing precise mechanical spare parts. It built the first factory in the country in 1996, a second 10 years later, the third in 2012, and has been operating a fourth since last year.

“We are restructuring our supply chain. Some of our facilities suspended operations in China, Indonesia, and India, and we are considering moving operations to other countries. Vietnam is a safe destination for us,” Yutaka elaborated.

New wave

According to the Japan External Trade Organization (JETRO) Hanoi Office, there has been a trend of reshuffling supply chains among Japanese businesses amid COVID-19 and global trade tensions.

As shown in a quick survey on nearly 2,000 Japanese companies in Vietnam by the JETRO carried out last month, 1 per cent had already moved their activities to Vietnam from China, while 5 per cent are considering. Meanwhile 4 per cent are mulling over an investment shift to Vietnam from other countries.

Nakajima Takeo, chief representative of the JETRO Hanoi Office said, “Vietnam has advantages to attract Japanese investors because of successful control of the pandemic, low labour costs, abundant labour force, the signing of free trade agreements, and increasing position in the region.”

In this trend, TOWA Industrial Vietnam is among the Japanese companies that have had plans to make investment shifts. Olympus, Nintendo, JUKI, and Sharp also have made similar moves.

Sharp, one of the leading conglomerates in Japan, is going to open its new factory in the outlying district of Ho Chi Minh City this year. It will focus on manufacturing car displays for the US market, as well as air cleaners for domestic use. Sharp has achieved great success in Vietnam over past years on the back of local annual electronics and household appliance growth of 10-15 per cent.

The company is one of the typical examples for successful Japanese investment in the Southeast Asian country.

Similarly, Japanese electronics manufacturer Olympus ceased activities in China in 2018 and is focusing on the production of digital cameras in Vietnam’s southern province of Dong Nai, while Nintendo relocated a part of its Switch console production to Vietnam from China.

Japan’s investment shifts have evolved over several decades now. At the turn of the century, supply chain restructuring was aimed at reassessing the excessive focus on China amid rising labour costs, mounting competition, tightened rules, and technology leaks. In 2018, moves were made to ease possible negative impacts from trade tensions. And this year, groups want to develop and diversify supply chains to adapt to the COVID-19 outbreak, global economic slowdown, and digital transformation.

In addition to the processing and manufacturing sector, which is of most interest among Japanese investors in Vietnam, infrastructure and equitisation of state-owned enterprises (SOEs) are already attracting strong attention for their future plans, making it an attractive channel for financiers.

More fresh opportunities for Japanese investors will come in the coming months because a number of powerful SOEs will have their stake holding divested, including Vietnam Posts and Telecommunications Group, as well as at many commercial lenders such as Agribank.

In infrastructure, the eastern cluster of the North-South Expressway will have five sections developed under the public-private partnership (PPP) model. The country is also calling for investment in renewable energy projects, especially in solar and wind power, thus hoping to bring new opportunities for Japanese enterprises. Looking ahead, the Vietnamese government is encouraging innovations and digital transformation with a number of supporting policies.

And the landmark EU-Vietnam Free Trade Agreement (EVFTA) will take effect imminently, bringing about important legal changes and special incentives for international ventures which have exports to the bloc.

Okabe Daisuke, from the Japanese Embassy in Vietnam, proposed to soon resume flights between the two countries, improve disbursement quality of public investment, develop transport infrastructure, add investment incentives, and offer more transparency in policies.

|

New motivations

In anticipation of investment shifts globally, Vietnam is preparing to welcome a new wave of high-quality foreign direct investment (FDI), including that from Japan by continuing administrative reform, focusing on advanced technologies with high-added value and connecting with global supply chains.

“We are making careful preparations to welcome multinational corporations that are planning to make investment shifts. We encourage them to open research and development centres, and establish operation regional centres in Vietnam,” said Vu Dai Thang, Deputy Minister of Planning and Investment.

The Southeast Asian country is expected to have a more competitive and favourable legal environment, thus increasing transparency and facilitation for investors in the months to come with the recent issuance of a number of laws, including new laws on investment, enterprises, PPP, and others.

In addition, the country is also to focus on infrastructure development, improvement of human resources, development of supporting industries and financial tools, and enhancement of administrative reform to welcome new investment flows.

“We are working with localities on preparation of land funds at industrial zones in the localities which attract more Japanese investors. We also propose an increase in land funds to facilitate their business and investment activities,” said Do Nhat Hoang, director general of the MPI’s Foreign Investment Agency.

Also importantly, Vietnam aims to have developed supporting industries under Resolution No.23-NQ/TW dated 2018 on the orientation of industrial development by 2030, with a vision for 2045. The government has already issued Resolution No.58/NQ-CP on the action plan to implement Resolution No.50-NQ/TW dated August 2019, governing the directions on completing the policies on FDI attraction by 2030.

“We have set up a working group to consult the prime minister with the new policies on FDI attraction, with members who are leaders of ministries and agencies. Many more Japan desks have been also established to support their investment inflows in Vietnam,” Hoang noted.

According to the MPI, amid global fall in FDI attraction, Vietnam saw some positives in June’s FDI picture with $1.8 billion in newly-registered, newly-added, and stake acquisition capital, up 3.1 per cent on-year, and 14.9 per cent on-month. As of June 20, Japan was Vietnam’s second largest foreign investor, with 4,548 valid investment projects, registered at over $60 billion.

|

Vu Dai Thang - Deputy Minister of Planning and Investment

Vietnam and other countries across the globe are facing a lot of difficulties caused by COVID-19 and major economies are suffering from the worst recession ever. Most global supply chains are impacted seriously, and numerous multinational corporations are looking for new destinations to relocate facilities. The success in controlling the pandemic enables Vietnam – one of the very few countries reaching positive growth – to be recognised as a safe and attractive destination for every investor. While global investment flow is anticipated to decrease by 40 per cent this year, Vietnam’s foreign direct investment (FDI) mobilisation in the first half of the year is not too bad with $15.67 billion in the total registered capital, and an increase of 13.8 and 26.8 per cent on-year in newly registered capital and additionally registered capital, respectively. This confirms the trust of foreign investors towards Vietnam’s investment climate. Vietnam will continue perfecting policies to improve the quality and performance of FDI while focusing on high-tech and environmental protection projects that can generate much added value. In this regard, we see a huge advantage with Japanese investors, and the investment and co-operation with them will support and benefit both sides. Okabe Daisuke - Economic Minister, Japanese Embassy to Vietnam

We are impressed by Vietnam’s fight against the pandemic, which is an amazing success of the government and the people. It confirms the country’s ability of risk management. Its economy has been recovering and is one of the first countries that can enjoy the opportunities of diversifying supply chains to become a developed and prosperous country soon. We are glad that Vietnam’s government facilitated 500 Japanese experts to arrive in the country, and opened the transport between both nations. We will consider to do more in the coming time. Japan spent $2.3 billion for local businesses to diversify their supply chains and cope with the pandemic, which could offer good chances for them to enhance investment into Vietnam. So, I recommend that Vietnam should apply suitable investment policies, which are implemented fairly and transparently. Accelerating the implementation of public investment projects will significantly contribute to the economic recovery. As such, launching Metro line 1 in Ho Chi Minh City and re-developing Ben Luc-Long Thanh Highway, both projects that will be assisted by the Japanese government, are effective measures for Vietnam’s economy. Takeo Nakajima - Chief representative, JETRO Office in Hanoi

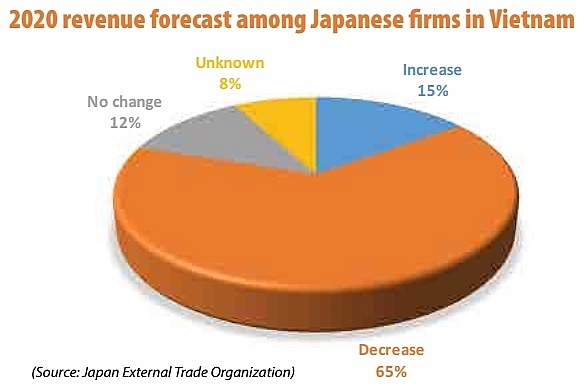

According to a survey carried out by the JETRO and other associations last month, 96 per cent of 631 responding Japanese enterprises in Vietnam confirmed that they felt the impacts of COVID-19, and 58 per cent of these are suffering serious impacts. A total of 65 per cent of respondents reported some decrease of their revenue, while 13 per cent reported an increase in the first half of the year. Another 65 per cent of respondents are facing difficulties from social distancing and the stagnation of the local market, while 56 per cent are influenced by the decrease of overseas markets. Most of our respondents would like to see an ease of entry restrictions and the reopening of flights between Vietnam and Japan. These companies believe that all investment and business activities in Vietnam will be recovered totally in the first quarter of 2021 or even earlier. Japanese investors have been relocating and restructuring supply chains for a couple of years already to avoid the US-China trade war and diversify suppliers. Vietnam has done a very good job in reining in COVID-19, and the country has relatively low labour cost and abundant workforce. Notably, Vietnam has inked a series of free trade agreements, with its prestige increasingly enhanced in the region. Tooru Aguin - Chief representative, Japan Bank for International Co-operation

Vietnam is one of the most important partners of ours and provides policies and financial packages to Japanese companies to invest and do their business in Vietnam, focusing on such industries as power, energy, and manufacturing. Most assistance from us is spent on power projects, equivalent to 13 per cent of the total power supply, including electrification, thermal power, and some projects related to altering renewable energy. We also help Vietnam to develop infrastructure by mobilising private capital as well as strengthening the evolution of supply chains and the local industry. Therefore, Vietnam ranks second globally in terms of the number of projects we support, and fifth in terms of the number of projects in the 2017-2019 fiscal period. In order to promote supply chains between Vietnam and Japan, we provide an emergency assistance programme to support Japanese investors doing their businesses overseas; supports high-quality, environmental, and infrastructural projects; and helps those troubled by COVID-19. Our assistance will contribute to the long-term working capital of businesses and help them to build up or expand their facilities, purchase more equipment, and acquire or contribute capital to other corporations. During May and June, our programme has provided loans to two companies to start their business in Vietnam, namely $475,000 to household textile producer Sunrose Co., Ltd. from Aichi, and $3.5 million to seal and gasket maker Uchiyama Manufacturing Corporation from Okayama. |