Vietnam’s pathway to accessing new overseas investment flows

Vietnam’s pathway to accessing new overseas investment flows

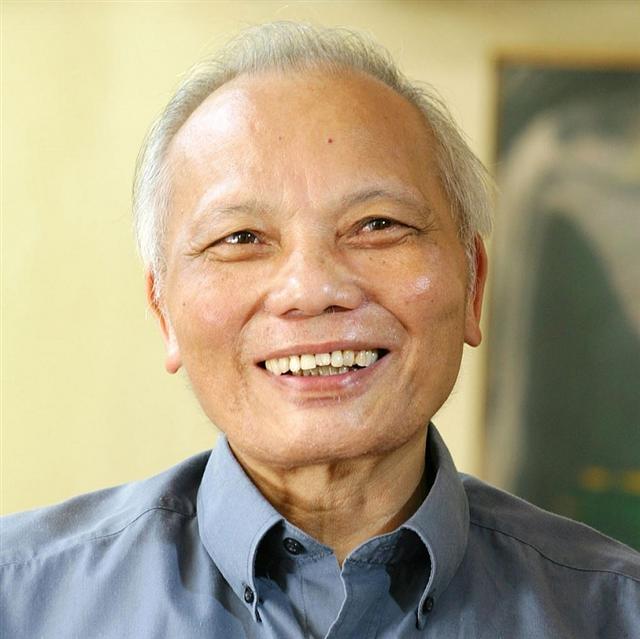

Vietnam is generally regarded as having great prospects to seize overseas investment flows moving away from China. Nguyen Mai, senior economist and chairman of the Vietnam Association of Foreign Invested Enterprises, scrutinises the opportunities for Vietnam in the current circumstances.

Nguyen Mai, senior economist and chairman of the Vietnam Association of Foreign Invested Enterprises

|

The government has been considering forming a special taskforce to greet new investment flow for post-pandemic times. How can this be successfully carried out?

Two opinion channels exist about the movement. The first insists that the China+1 story has in fact existed for a century now, but that people appear to be more energised today. The advocates of this stance assumed that the United States or Japan have the policy, even forking out billions of US dollars, to secure their businesses back into home countries and not moving to third countries, so we should not be too optimistic.

There are now up to 40 million unemployed people in the US. If the situation worsens, the Trump administration will want to coax US investors into heading back home.

Japan is likely to incur an economic recession, so this country will willingly splash $2.2 billion to draw their businesses back home. But even with this, I believe not many Japanese or US companies will return. That is because China has been the market with the fullest potential by virtue of its population size, high technology development level, good workforce, and sizeable groups such as Alibaba and Huawei.

The possibility for a shift in capital flows from China to Japan or the US therefore would not be significant, perhaps just hovering around 10-15 per cent of their respective total investment value into China, or even lower.

Just a tiny portion at around 3-5 per cent find doing business in China increasingly tougher due to high costs and the country’s current policy giving more support to local businesses considering moving out of China to other lucrative destinations.

Given the fact that the total foreign direct investment (FDI) sum in China currently stands at around $2 trillion, 5 per cent of this equals $100 billion which is quite remarkable. Last year disbursed FDI volumes into Vietnam came to just more than $20 billion, compared to $140 billion in volume to China.

This signifies that objectively investment flow massively moving out from China would be unlikely as it still proves a major market, but the shift at a level of 3-5 per cent is also quite significant for us. I, therefore, uphold the second opinion channel that Vietnam has a real chance to hail the investment flow moving out of China, and that capital flow is different from the usual capital growth as seen before the pandemic.

Competition in FDI attraction is unpredictable, particularly now when funding flows are down on a global scale. Experts assume it may not be easy for our country to secure this capital flow. Is that truly the case?

Not only Vietnam but many countries, particularly the two economies of India and Indonesia, want to seize the upper hand in FDI attraction.

India has proclaimed being ready to host 1,000 large factories, and prepared well in terms of land and others to accommodate them. This country has many advantages over Vietnam – for instance, its IT capacity is better than Vietnam, having the highest number of annually trained engineers and workforce. Besides having fruitful human resources, India also reports a cheaper workforce than Vietnam.

Meanwhile, Indonesia houses nearly 300 million people. The Indonesian president pays special regard to FDI attraction as he directly signs such projects. The country has also announced the creation of a ready-to-serve 4,000-hectare tech park to accommodate high-tech projects moving out of China.

Irrespective of other countries, just these two heavyweight rivals prove the heat of competition. It is therefore important to make adequate and objective assessments about our advantages to take suitable action.

What are Vietnam’s advantages, and what must be done for us to grasp this valued opportunity?

We have both inherent and fresh advantages. Undeniably, Vietnam prevails over others in terms of political stability, stable economy and monetary system, low inflation, high growth level, abundant workforce, and more.

More recently, via the COVID-19 pandemic, Vietnam has emerged as a successful model in containing the issue, attesting that our country has the capacity and innovative mindset to prevent global threats.

Also, local businesses are resilient. The country has posted growth despite having millions of labourers losing jobs, and tens of thousands of businesses either going bust or temporarily ceasing operations.

In the first quarter this year, the economy expanded 3.82 per cent and is expected to grow at least 2.7 per cent based on a recent forecast from the International Monetary Fund for the whole year, or 4.5-5 per cent under government projections. This factor shows that Vietnamese firms are quite flexible and resilient, helping the economy to bounce back quickly post-pandemic.

In the past, we might have missed out on a number of opportunities, but the current ones are worthy so we must try our best to avail of the chances.