Speedier recovery up ahead for some

Speedier recovery up ahead for some

Industrial and residential properties could be the sectors grasping the most upcoming attention in the real estate market of Vietnam, Indonesia, and the Philippines – three of the ASEAN’s fastest-growing economies.

|

In a webinar titled “Investing in Asia: Obstacles & Opportunities in Vietnam, Indonesia, and the Philippines” held last week, Savills experts explained that the trend of investing into Southeast Asia is pointing towards new foreign direct investment (FDI) prospects for the three nations in particular.

According to Neil MacGregor, managing director of Savills Vietnam, COVID-19 is accelerating relocation wave from other destinations to Vietnam and this has been increasing the demand of industrial property in the country. “Multinationals that produce these will be under pressure to cut costs, prompting a shift in production to Vietnam,” MacGregor said.

He explained that previously companies were reluctant to set up operations in Vietnam due to supply chains lacking depth. “Today foreign-invested companies are not only establishing new factories in Vietnam, but have a greater incentive to foster development of local supply chains. All of these factors are pushing up the demand for industrial and housing property,” he said.

According to Savills, Vietnam has an average occupancy rate of 75 per cent in operational industrial zones nationwide. In some key zones in the south such as Binh Duong and Dong Nai provinces, this occupancy has reached more than 90 per cent already with the appearance of Vietnam Singapore Induastrial Parks and Thailand AMATA. In the north, Haiphong and Bac Ninh are hot spots with the presence of VinFast and DEEP C Industrial Zones.

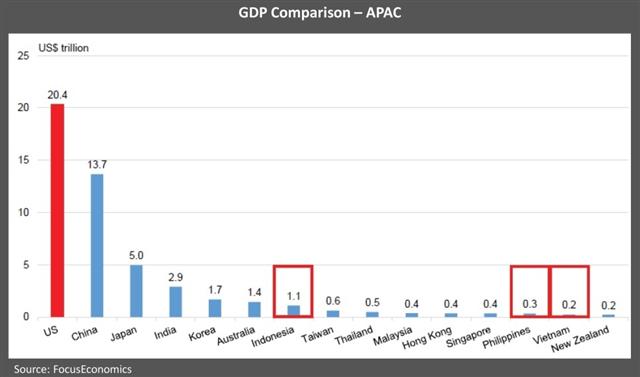

Despite Indonesia boasting many advantages as the biggest economy in the region, and with a rising middle class and resilient and stable economy, it has received less interest from international financiers for many years. However, that situation has been changing. “Interest is also increasing from foreign investors for modem logistics development and efficient distribution centres,” said Savills Indonesia general manager Anton Sitorus. The Indonesian government in the last five years has focused much on infrastructure projects to meet the growing demand for transit-oriented development in the country’s major cities. In Jakarta, a capital city with more than 30 million in population, there remains room for growth of foreign investment, based on the number of around 270,000 units of Grade A being in stock in the market. The figure remains small if compared to other major cities in the region such as Kuala Lumpur and Bangkok, and even in Vietnam.

Meanwhile KMC Savills managing director Michael McCullough said that in the Philippines, industrial, logistics, and business process outsourcing (BPO) projects would be faster in recovery compared to other sectors. “Industrial and BPO will bounce back within 2-3 months and will become stronger than before, while residential ranks at a mixed outlook,” said McCullough.

“Manufacturing companies will look for alternative sources and invest in automation. Many manufacturing facilities have had to shut down over recent months but there will be newcomers on the way,” added McCullough. In the Philippines, high uncertainly is spreading to parts of retail and offices, which will be impacted for 6-12 months at least.

In the residential segment, Vietnam meanwhile retains room for increasing mid-range and affordable apartments because the slow approval from competent bodies has brought limited supply while demand is increasing. The high-end segment, meanwhile, has seen challenges in the short term given foreigners cannot visit Vietnam due to the pandemic; but the segment still yields potential for FDI in the long term based on the policy from the government to permit foreigners to grab home ownership in Vietnam since 2015, along with the quota of 30 per cent in every project being allowed to be sold to foreigners. Apart from that, the percentage of higher-income earners is also increasing in the country. There is pessimism in hospitality sector across the board, which will be greatly affected and will endure long-lasting impacts which may lead to recession. The pandemic has inevitably put the sector under financial distress which will compel some owners to liquidate assets.