SK Group expands pharma foothold

SK Group expands pharma foothold

With SK Group recently joining the mergers and acquisitions race, Vietnam’s pharma and healthcare market is becoming more robust. However, newcomers are expected to face challenges amid increasingly mounting competition in the lucrative pharmaceutical market in the months to come, driven by the enforcement of the EU-Vietnam Free Trade Agreement.

|

On May 29, SK Investment III, a subsidiary of South Korea’s third-largest conglomerate SK Group, got more than 12 million shares, nearly 25 per cent of Imexpharm Corporation’s stocks, at an undisclosed value.

Imexpharm is one of Vietnam’s five largest pharmaceutical companies. In the first quarter, its pre-tax profit hit VND51.4 billion ($2.23 million, up 13.2 per cent on-year and its revenue was VND304 billion ($13.2 million), up 10 per cent on-year.

Michael Han, head of SK Group’s representative office in Vietnam, told VIR, “We feel that there will be good opportunities in the healthcare sector by working closely with our partners at Imexpharm. Despite the unexpected logistical challenges presented by the pandemic, the said investment could be moved forward and closed. This deal is further testimony to SK Group’s commitment in Vietnam.”

Han also added that, “Imexpharm has become a market leading player in Vietnam with strong production prowess evidenced by the company’s excellent production capabilities.”

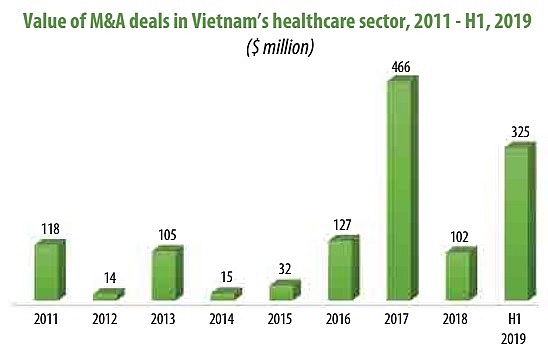

According to Que Vu, partner of law firm Rajah & Tann LCT Lawyers, the healthcare sector ended the first half of 2019 as the second most active sector with eight mergers and acquisitions (M&A) deals signed, valued at $325 million, and foreign investors’ interest in local pharma and healthcare companies is expected to continue increasing.

This has been proven by a number of M&A deals with a combined value of trillions of VND from large foreign investors, including the published deals of Abbott’s investment into Domesco Medical Import Export JSC, Taisho Pharmaceutical Holdings’ investment into Hau Giang Pharmaceutical JSC, and Adamed Group’s investment into Dat Vi Phu Pharmaceutical JSC.

Vu noted that pharmaceutical companies from India, Thailand, Japan, Malaysia, South Korea, and some European countries are now seeking opportunities for their step into the Vietnamese market.

“Pharma and healthcare M&A deals are still on an increasing trend in the second half of 2020. Given the opening policies and the divestment of the state from pharma companies, more overseas investors could join the market. Hospital and clinic M&A could also be a new trend,” she added.

Commenting on the attractiveness of Vietnam’s pharma and healthcare market, Han said that, historically, this sector’s growth has been backed by its people’s growing concerns about the well-being of their family members, environmental factors, rising household income, and the high urbanisation rate – which leads to changes in lifestyle and higher demand in personal healthcare.

“We believe that this robust growth will continue into the foreseeab le future. We have seen a similar trend in South Korea over the last 20 years or so. In terms of market size, Vietnam is still at the emerging stage, with an estimated total value of $7 billion in 2019, growing at a robust pace of 8 per cent from 2019 to 2024,” Han said.

He further added that “The South Korean pharma market in terms of sales in 2019 stood at about $17.3 billion, and is now expected to grow at half the pace of Vietnam’s expected growth. As such, when comparing the two nations’ population and demographics, we like what we see in Vietnam’s pharmaceutical space.”

However, SK Group and potential newcomers might face hurdles on their way to crack the Vietnamese market due to stiff competition. According to the statistics of the Drug Administration of Vietnam, there were about 180 pharmaceutical manufacturing enterprises in Vietnam as of May 2019. Therefore, despite Imexpharm’s position as one of the top five pharma manufacturers, it would still have to compete with a large number of other players in the market, according to Vu.

She further said that Vietnamese consumers mostly prefer to use imported drugs rather than local manufactured drugs. This would also place a yet another challenge on local manufacturers as they are battling for the trust of Vietnamese consumers.

A large part of imported drugs in Vietnam is from the EU market. It is estimated that the Southeast Asian country imports over 50 per cent of its total demand from the bloc.

Competition will even be more heated when the EU-Vietnam Free Trade Agreement, which is expected to come into effect in August after last week’s ratification of Vietnam’s National Assembly. The landmark deal will make pharmaceutical imports from the EU into Vietnam will be more favourable and accessible.

Vu also stressed that drugs supplied for hospitals take about 70 per cent of the market while only 30 per cent are for over-the-counter (OTC) retail pharmacies. “SK Group may focus on increasing its products distribution via the OTC channel and online to increase its market share,” she suggested. “The great demand of the young and middle-aged populace in non-prescription drugs and dietary supplements may also bring SK Group good opportunities.”

|

The four key factors driving M&A growth in healthcare First, the large population and the booming urban middle-class stimulate the demand for high-quality healthcare products and services. The Drug Administration of Vietnam has predicted the domestic pharmaceutical to grow by 10-15 per cent annually, with market value expected to reach $7.7 billion by 2021. Second, pharmaceutical and healthcare products would be considered unique products in which the business growth is subject to an enterprise’s reputation. Existing pharmaceutical groups with a stable development history would also have advantages in joining the supply bids for state-owned hospitals. Therefore, M&As of major local pharmaceutical enterprises may be a faster option for investors to gain market shares. Third, recent regulatory changes have brought out positive effects, encouraging the participation of foreign players. The government’s Decree No.60/2015/ND-CP on amending the Law on Securities empowers self-determination for publicly-listed enterprises to remove the 49 per cent cap on foreign capital, adding more room for overseas investors and a better chance for M&As in this sector. Fourth, another key factor which may also strengthen the upward trend of M&A in the pharmaceutical sector is the government’s equitisation policy with its divestment from many pharmaceutical companies. Accordingly, the government has outlined plans to pull out its investment from many pharmaceutical companies, opening opportunities for private investors. Source: Rajah & Tann LCT Lawyers |