Delays certain but developers push ventures ahead

Delays certain but developers push ventures ahead

Pandemic containment measures have hit most sector business activities, while developers have been challenged to meet construction timelines hit by related supply shortages, locked-down workers, and tightened financing availability.

|

According to a survey from Savills Hotels, Vietnam has one of the largest pipelines in Southeast Asia with an astonishing 20 per cent compound annual growth rate of supply over the past three years.

There are 49 projects under construction with nearly 17,000 rooms expected to be available in 2020. Of those, 53 per cent reported struggles with delays but are still on track to be open by the end of the year.

The remaining 23 have been postponed until 2021, more than 60 per cent of which are delayed to the first and second quarter, and the rest unable to confirm. Of those reporting longer delays, 90 per cent are in coastal destinations.

|

For the rest of this year, some remarkable hotel brands are expected to be opened such as JW Marriott Danang, Regent Phu Quoc, and Zannier Bai San Ho, which confirms Vietnam’s potential as an emerging luxury destination.

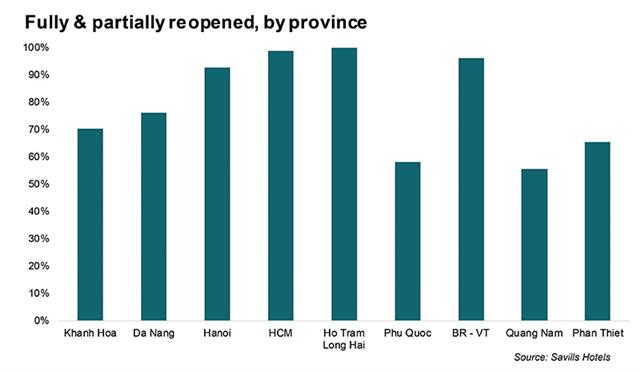

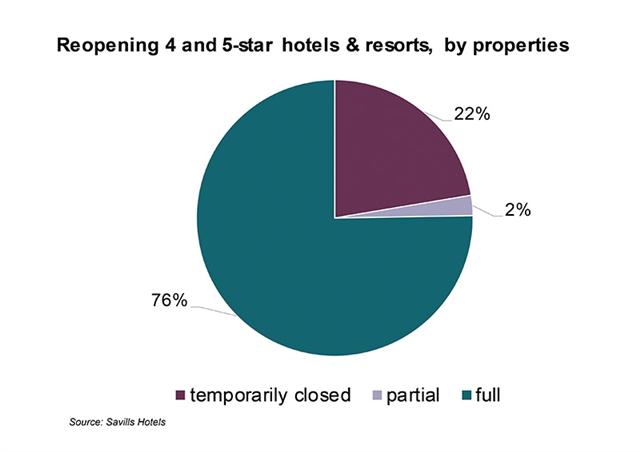

Most resorts resumed operations with attractive promotions in May, with almost half offering deals and lowering rates. Upscale or luxury segments targeted local demand with value deals, combined with free food and beverages and transportation.

Adjusting pricing and using clever and ideally integrated promotions is a smart way for resorts to increase competitiveness until recovery drives room rates back up, according to Savills Hotels.

A consequence of the steep demand drops in April saw room rates drop in properties that previously relied on international visitors. Average room rates were reported to have fallen by 29 per cent. Nevertheless, most upscale properties are reluctant to lower rates, anticipating recovery once international routes start to re-open and corporate business resumes.

Coastal destinations like Danang, Phu Quoc, Quang Nam, and Phan Thiet have the most aggressive promotions. These have been heavily impacted by the precipitous drop in foreign tourists and are relying on promotions aimed at local guests to stay afloat.