VIR seminar: Restarting the economy to stimulate demand on consumer finance

VIR seminar: Restarting the economy to stimulate demand on consumer finance

Restarting the economy will improve the demand for consumer finance, however, both consumer finance companies and banks need to build diverse loans to meet customer demand.

The consumer finance seminar at the headquarters of VIR

|

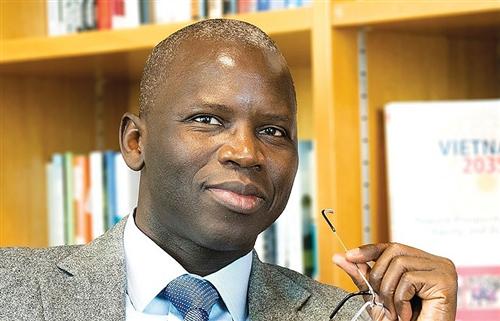

This was announced by Assoc. Prof. Dr. Dang Ngoc Duc, former dean of the School of Banking and Finance under National Economics University, at the seminar organised on May 21 at VIR's headquarters at 47 Quan Thanh Street in Hanoi’s Ba Dinh district.

Speaking at the seminar, VIR's editor-in-Chief Le Trong Minh said, “The credit market in general and the consumer finance sector in particular are expected to recover after the social distancing period. In addition, consumer finance, in collaboration with other financial solutions, are also expected to continue to play an important role in ensuring social security and supporting people who have short-term financial difficulties.”

Le Trong Minh, VIR's editor-in-chief talking about his expectations of a bounceback in the consumer finance sector after the COVID-19 pandemic

|

He recalled that at a recent talk with local media, leaders of diverse consumer finance firms agreed that Vietnam’s consumer finance market will continue its growth momentum, albeit at a slower pace due to the implications of the coronavirus outbreak (COVID-19) as well as new policy moves.

At today's seminar, Ngoc Duc discussed statistics depicting the positive growth of Vietnam, saying this will also serve as the basis for the growth of consumer finance in the future. Notably, Euromonitor International forecasts that Vietnam’s GDP will increase by 91.4 per cent in the 2019-2030 period. Besides, a 2019 study by Nielsen showed that the trust level of Vietnamese people reached 129 points in the third quarter of 2018.

“Consumer finance companies and banks have yet to meet customer demand. In reality, only a part of the people can approach consumer loans at commercial banks and other companies – and only a few of them actually get a loan. The opportunities for students and farmers are especially few and far between,” Duc said.

A report by Vietstock published in 2019 showed that 50 per cent of customers of finance companies and 60 per cent of customers of banks can access loans, making up two-thirds of the demand. Commercial banks are always concerned about the risks because almost all customers applying for consumer loans have low and medium income, without no collateral to back up the loan or meet strict lending criteria.

Along with clarifying the existing difficulties and opportunities for consumer finance companies, experts proposed numerous solutions to encourage the demand of people as well as knowledge about this sector.

Vietnam is currently home to 18 financial companies, including six foreign players. The government’s strong commitment to crackdown on shadow banking is expected to propel the market’s further development.