Online food purchases predicted to rule the roost post-pandemic

Online food purchases predicted to rule the roost post-pandemic

The online food and grocery delivery segment has gained remarkable momentum after multiple platforms launched services for those stuck at home during social distancing.

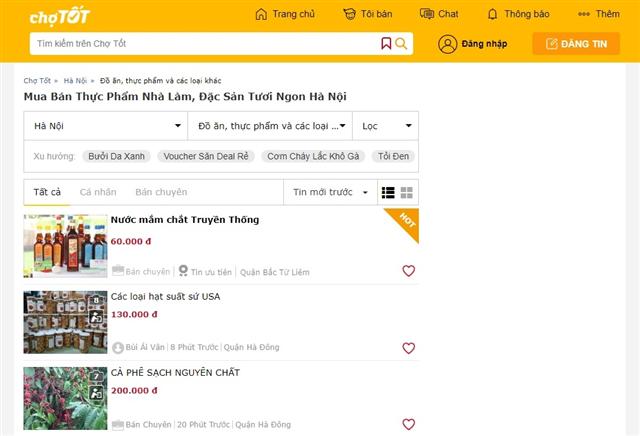

Online food purchases predicted to rule the roost post-pandemic, illustration photo

|

During the unprecedented public health crisis, many restaurants are struggling just to stay afloat. To aid food businesses, Cho Tot has teamed up with Unilever Food Solutions to add a food category to its online marketplace. The new feature allows restaurant owners to sell food without paying premium or commission to external vendors.

Since the trial, Cho Tot Food has witnessed the average traffic growth of 40 per cent with the number of orders up 26 per cent. CEO Nguyen Ngoc Hai Duong told VIR that online food and grocery delivery in Vietnam has been growing even faster since the COVID-19 outbreak and more vendors are joining big food delivery platforms.

“However, small restaurants and food sellers cannot afford the high commission fees and need alternative options. Cho Tot Food was launched to support local stores in increasing their online visibility among Cho Tot’s more than 1.6 million visitors a day,” she said.

Similarly, customers can now order food online on Shopee, which has integrated Foody’s Now.vn into its platform. Other e-commerce operators like Tiki and Lazada also jumped on the bandwagon by introducing grocery delivery services during the coronavirus outbreak. Customers can easily buy fruit, fresh meat, and vegetables from both platforms with delivery in two or three hours.

Vu Anh Tuyet, chief of staff at Lazada Vietnam, told VIR that selling fresh food was already part of its long-term strategy in Vietnam, and the pandemic has only accelerated their plans. The firm is very specific about its approach to ensure that the collection of fresh assortments on its platform are not only high-quality and trustworthy but also quickly delivered, especially in Vietnam where consumers have such convenient access to markets.

“We must offer operational excellence to win in the fresh produce category. Lazada’s unique advantage in serving fresh foodstuff to customers lies in our logistics capabilities, with two-hour delivery for urban customers which covers the majority of e-commerce customers in Vietnam,” Tuyet added.

Major players like Now.vn, GrabFood, GoFood, and retail giants like VinMart, Big C, and Saigon Co.op have launched similar services to expand their online shopping models. Customers can now install the GO! & Big C app to shop for groceries and fresh food at Big C and Saigon Co.op also saw a 10-fold increase in online orders in March.

Another retailer, BRGMart, also introduced the BRG Shopping app, while in April, during the peak of epidemic control in the country, 19 HaproFood stores under the BRGMart supermarket chain were launched in Hanoi to capitalise on the growing demand for food and essentials.

Online food and grocery delivery is growing at an exponential rate. The latest survey by market research service provider Q&Me showed that some 75 per cent of respondents have used food delivery services and 24 per cent of them were new users who started to use food delivery services due to COVID-19.

Last week, Grab also released its official growth figures during the pandemic. Just one week after the launch of GrabMart, the number of grocery orders soared by 91 per cent. The figure hit a record high on March 31 prior to the nationwide social distancing order. Meanwhile, GrabFood saw the average value of its orders rise by 26 per cent as many families were having meals together.

According to Q&Me, delivery apps offer easy ordering while dedicated apps are better at speed and quality, generally at a higher cost. GrabFood is the most popular app with 79 per cent of users, followed by Now and GoFood with 56 and 41 per cent.

A recent study by market research firm Kantar Worldpanel also pointed out that COVID-19 has been pushing Vietnamese people to try new experiences. A significant number of new consumers are picking up online shopping and minimarkets for fast-moving consumer goods. Consequently, both online shopping and the minimart format reached a peak in shopper base versus any historical four-week period.

However, there are several barriers for the continued development of these emerging channels after the crisis. According to Q&Me, 25 per cent of users do not use delivery because they cook themselves and are concerned about food quality and shipping costs.

Nguyen Duc Tai, chairman of Mobile World Investment Corporation, operator of the Bach Hoa Xanh chain which saw online sales increase 1.5 times during the pandemic, pointed out that long shipping distances are an acute problem as distribution centres are far from recipients. If the chain can shorten the average shipping distance from more than 5km to 2-3km, it could slash its shipping expenses significantly.

Despite the challenges, experts agree that embracing digitalisation seems the most relevant and common way to deal with COVID-19, at least to minimise their losses.

While some changes and gains may be short-term, many players will be looking to keep these trends alive in the long term, and need to re-think strategies and partnerships with key retailers in order to rule the new norm.