Vietnam's March 2020 PMI drops to record low due to COVID-19

Vietnam's March 2020 PMI drops to record low due to COVID-19

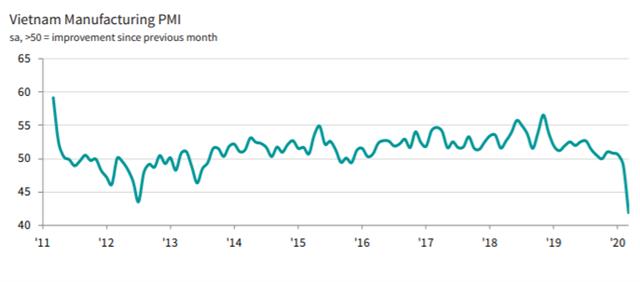

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) fell sharply to 41.9 in March from 49.0 in February. The latest data signalled a steep decline in the health of the manufacturing sector, and one that was the most marked in more than nine years of data collection so far. The deterioration surpassed the previous record seen in July 2012.

Vietnam experienced the sharpest falls in output, new orders, and employment in the Vietnam PMI survey’s history

|

The coronavirus disease 2019 (COVID-19) had a strong negative effect on the Vietnamese manufacturing sector during March. Business conditions deteriorated to the greatest extent since the survey began in March 2011 amid record falls in output, new orders, and employment. Firms also scaled back purchasing activity and inventory holdings, while severe a disruption to supply chains was reported. Meanwhile, business confidence also hit a new low.

The COVID-19 pandemic led to substantial declines in both new orders and production during March. Both fell at the sharpest rates in the survey’s history, with total new business decreasing at a broadly similar pace to new export orders. Around 42 per cent of respondents saw manufacturing production fall at the end of the first quarter. Steep reductions were registered across each of the consumer, intermediate, and investment goods sectors.

A severe drop in new orders as a result of COVID-19 led firms to lower their staffing levels. Employment fell markedly, and for the second month running. Despite job cuts, firms were still able to reduce their backlogs of work given the extent of the decline in new business.

|

Stocks of finished goods also decreased markedly, and to the greatest extent in a little over six years. Despite a lack of demand for inputs, suppliers’ delivery times continued to lengthen. In fact, vendor performance worsened to the greatest extent in the survey’s history as COVID-19 disrupted supply chains. Delays from Chinese vendors were mentioned in particular.

Input costs rose marginally in March, and at the slowest pace in four months. Where input prices increased, panellists linked this to a scarcity of raw materials. On the other hand, a lack of demand for inputs and lower oil prices led some respondents to record a drop in input costs. Meanwhile, output prices decreased sharply, and to the greatest extent since July 2012.

Business sentiment dropped to the lowest since this series was added to the survey in April 2012 amid concerns around the effects of COVID-19. More than one-quarter of firms predict output to fall over the coming year. That said, just under 39 per cent of respondents expect production to be higher than current levels, with a recovery expected once the outbreak is brought under control.

Cimigo market research has collected the Vietnam PMI since 2013. The Vietnam PMI is compiled by IHS Markit from responses to monthly questionnaires sent to purchasing managers in a panel of around 400 manufacturers.