Hanoi’s retail property market suffers from Covid-19

Hanoi’s retail property market suffers from Covid-19

The city’s real estate market took a hit in the first quarter and it will take time to recover.

Retail is one of the industries hit the hardest by the Covid-19 pandemic, and is contagious to the real estate industry. Hanoi’s real estate market has witnessed the closure of many tenants when they struggled with impacts from the preventive measures of the coronavirus pandemic in late March.

Shops shut down in an Old Quarter street. Photo: Vietnambiz

|

Both small and large retailers suffer

Pham Thanh Tung, a food & beverage (F&B) business owner in Ba Trieu street, Hoan Kiem district, told Kinh te & Do thi newspaper that his business results have heavily suffered from the pandemic.

Due to a sharp decline in number of customers, his restaurants have been closed since mid-March before the city government requested all non-essential catering establishments to cease their operations until April 15. The landlord agreed with Tung to reduce the monthly rent by VND40 million (US$1,703) and exempted 100% of the rent for the period of the temporary closure. “With a monthly rent of VND200 million (US$8,518), without the reduction, it would be hard for me to overcome the pandemic period,” Tung was quoted as saying.

Mai Truong Giang, the owner of two bakery shops – Chewy Chewy and Otoke Chicken, told Lao Dong newspaper that his company will cut costs, including a 20% reduction in rent for the three next months as they suffer a decline of 40-50% in revenue each month.

As rent accounts for 30-50% of total operation costs, many large retailers are suffering from the pandemic. Mobile World Investment JSC, which owns more than 3,000 phone and electronics and grocery outlets, has proposed a reduction of 50% in rent for the next 12 months and exemption of rent during the temporary closure meant to prevent the Covid-19 outbreak. About 10% of Mobile World's outlets stopping operations are located in Hanoi. If the proposal is refused, the retailer will change the store locations.

Together with the largest phone and electronics retailer, a series of big distributors in commodities such as jewelry, mattress, F&B, furniture and apparels are also hurt by the pandemic.

Vua Nem, the mattress supply chain, has requested its landlords to reduce 25% of three-month rent since mid-March and exempt 100% of April rent. A representative from the retailer told local media that 40% of the landlords agreed with the request. Though boosting sales via online channels, the largest mattress retailer has still faced with the loss of revenue.

Another big retailer, PNJ which owns 69 jewelry stores in the North of Vietnam, have also received the agreement from landlords about the reduction of 40% of rent. The retailer continues negotiating with other landlords to reduce their rent cost and other business expenses.

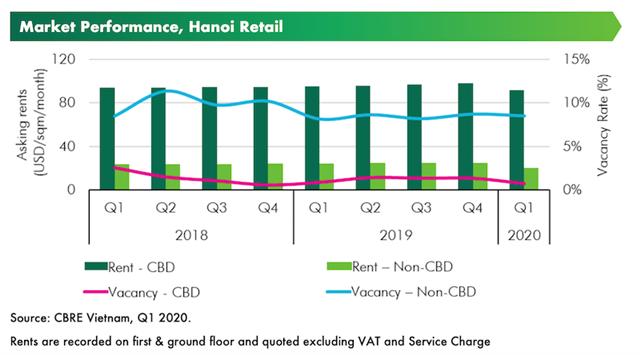

According to the first quarter report by CBRE Vietnam, key retail streets witnessed widespread closure, along with large number of lease terminations as tenants struggle with business suspension.

Chart: CBRE Vietnam

|

Retail sales of catering & accommodation services decreased by 9.6% and 27.8% quarter-to-quarter, respectively, according to CBRE. Revenue drops varied across different sectors, with education being the most affected due to forced closure, hence recorded almost no revenue. Meanwhile, F&B, fashion & accessories or entertainment saw a 50 – 80% decrease in revenue. Some F&B chains are forced to shut operations in many of their branches, the report wrote.

Focusing on the Hanoi’s retail real estate industry, the latest report for the first quarter conducted by JLL Vietnam on April 7 showed the market recorded a slight decrease of 48 percentage points (ppts) quarter-on-quarter to 90.4% in the occupancy rate of the first quarter of 2020. The ban on public gatherings leads to a sharp reduction in the number of visitors at shopping malls and caused many stores to resort to online shopping.

“The decline has affected retail activities and caused the moderate operation or temporary closure of stores at shopping malls in accordance with the government order,” the report wrote. “However, the market recorded some bright spots, most notably the launch of many upgraded stores in the Vincom Pham Ngoc Thach shopping mall.” Only supermarkets and convenience stores witnessed less impact from the pandemic thanks to providing essential goods.

Performance forecasts

While the Covid-19 pandemic has had a clear impact on brick-and-mortar sales, e-commerce remains resilient. The outbreak has led to a surge in online shopping in Vietnam, with online FMCG spending rising by a triple-digit percentage since January this year, according to CBRE. “The trend of digital grocery channels is expected to accelerate in the coming months as shoppers avoid malls and other crowded locations,” the report wrote.

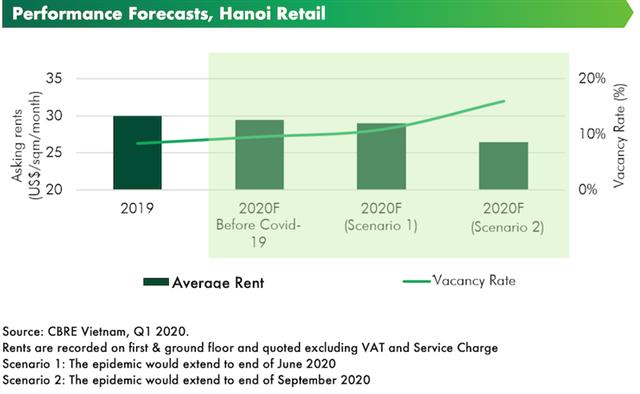

Given minor delays to several projects, new supply in 2020 is expected to total approximately 103,000 square meters of net leasable area (NLA). Most developers are in wait-and-see mode amid the outbreak of the Covid-19 pandemic, which is likely to affect new mall openings and expansions in 2020, according to CBRE.

Chart: CBRE Vietnam

|

Meanwhile, JLL Vietnam forecast the city retail market would be seriously affected by the Covid-19 pandemic. With a large supply expected for the market in 2020, the competitive pressure will continue increasing, leading to the adjustment of rents. In addition, flexible rental policies and incentive programs between landlords and tenants could help improve the operational situation.

The market needs the next couple of quarters to recover because the prolonged disease has affected purchasing power and rental demand, according to Phan Cong Chanh, CEO of Phu Vinh Group.

“With landlords taking proactive approach and providing support for struggling businesses, we are on reasonable ground to expect quick recovery when the pandemic is controlled,” the report from CBRE wrote.