Covid-19 to benefit Vietnam’s long-term economic prospects: VinaCapital

Covid-19 to benefit Vietnam’s long-term economic prospects: VinaCapital

VinaCapital estimated Vietnam’s GDP growth would decline by three percentage points this year to 4% from 7.02% in 2019.

VinaCapital, Vietnam’s major asset management firm, is of the view that the Covid-19 pandemic will ultimately benefit Vietnam’s economic prospects.

Illustrative photo.

|

In recent years, multinationals like Samsung, LG Group, and a plethora of Japanese manufacturers have been moving factories from China to Vietnam, or have been establishing new production facilities in Vietnam rather than in China.

The Covid-19 pandemic is expected to accelerate companies’ efforts to re-locate production out of China, partly because the trade war will intensify after the Covid-19 medical emergency abates, said VinaCapital in its latest report.

Firms like Foxconn and other Apple suppliers have indicated that they intend to set up production facilities in Vietnam. However, it is worth mentioning that multinationals will not only continue setting up production facilities in Vietnam, but will also have a much greater incentive to help foster the development of local supply chains going forward, said the firm.

Some companies have been reluctant to move production facilities from China to Vietnam in the past because supply chains in Vietnam lack depth. Given the severity of what the world is experiencing right now, coupled with concerns about China's handling of the Covid-19 pandemic. “FDI companies will be prompted to not only continue establishing new factories in Vietnam, but to also start imbuing local suppliers with much more technical and operational expertise in order to support the production of those multinationals in Vietnam,” suggested VinaCapital.

VinaCapital referred to a research report published by the San Francisco Fed last week titled “Longer-run economic consequences of pandemics”, that included two positive implications for Vietnam.

Firstly, wage inflation tends to increase after a pandemic subsides, which would encourage manufacturing firms to relocate factories from China to Vietnam and Southeast Asia, instead of repatriating production to the US.

Secondly, investment returns tend to plunge in the decade following a pandemic (unlike after a war), which together with the so-called “Japanification” of the US economy will ensure a wave of foreign indirect investment inflows into select frontier and emerging stock markets (including Vietnam’s) for years to come.

Covid-19 impacts on Vietnam’s GDP growth

VinaCapital estimated Vietnam’s GDP growth would decline by three percentage points this year to 4% from 7.02% in 2019, which is attributable to (i) -1.5 percentage points from a 50% drop in tourist arrivals; (ii) -1 percentage point from slower manufacturing output growth; (iii) and -0.5 percentage points from slower domestic consumption growth.

Source: VinaCapital.

|

According to the firm’s prediction about Vietnam’s quarterly growth throughout the year, the country is set for a zero growth rate in this second quarter.

Such assessment is based on the fact that the Covid-19 fully impacted the economy for about one month in the first quarter (Q1) but has resulted in a growth reduction to 3.8% in Q1 from 6.8% growth recorded in the same period last year. Meanwhile, the pandemic could fully impact the economy for a bit longer than two months in Q2 (with normal economic activity resuming throughout the month of June).

Well-positioned to rebound in Covid-19 aftermath

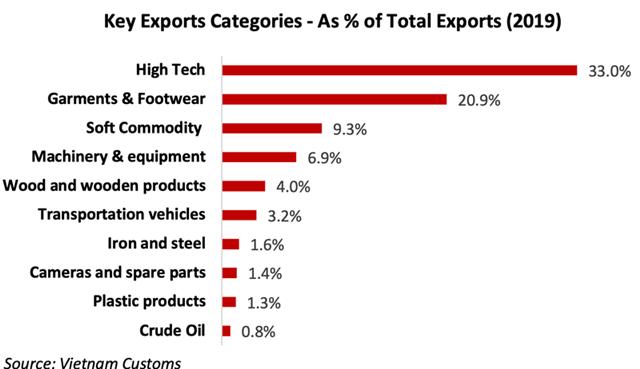

The composition of Vietnam's exports has a unique “Barbell” structure, in which about 60% of the products the country exports are “low value add” products such as garments and cheap furniture that are sold to cost conscious shoppers through outlets like Wal-Mart in the US, and Carrefour in France, while about 40% of the country’s exports are of higher value-added products, including smart phones (nearly 20%/exports), digital cameras, and other consumer electronics.

|

This composition is an artifact of successive waves of FDI into the country, stated the report. This started about 15 years ago, with investments into the production of garments and other low value-added products for companies like HK-based Li & Fung, and followed by investments into the production of high-tech products for companies like Samsung and Panasonic in recent years as those companies moved their factories from China to Vietnam to save costs and to circumvent the US-China trade war.

It is expected exports of the low-end products that Vietnam produces to hold up well over the next two years because of the increased demand for such products by cost-conscious shoppers in developed markets, which is exactly what happened in 2009.

Furthermore, the multinationals that produce these products (or source them from countries like China or Vietnam) will be under tremendous pressure to cut costs over the next two years. This will prompt those firms to shift production to low-cost countries like Vietnam.