Vietnam automobile companies face gloomy outlook in 2020

Vietnam automobile companies face gloomy outlook in 2020

Under the growing impacts of the pandemic, market demand is forecast to plunge, while oversupply and the burden of liquidating inventories would lead to lower selling prices.

Automobiles in Vietnam are bracing for a tough year with combination effects of the Covid-19 pandemic and fierce competition within the industry, according to Viet Dragon Securities Company (VDSC).

Under the growing impacts of the pandemic, market demand is forecast to plunge, while oversupply and the burden of liquidating inventories would force car companies to lower selling prices, said the brokerage firm in its latest report.

|

Revenues, therefore, will be strongly affected in the first half of the year but are expected to recover in the second half. Furthermore, companies have to spend more money on advertisements and discounts, in turn shrinking their respective gross profit margins (GPM) compared to the GPMs last year.

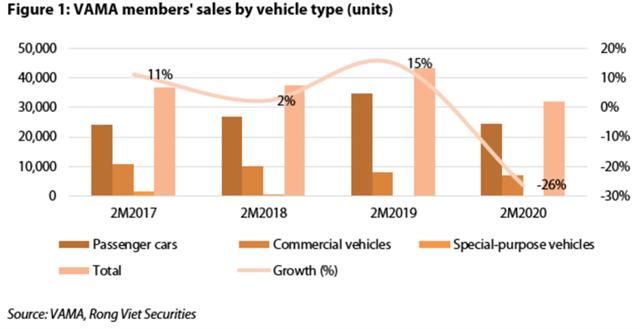

As of the end of February, sales of members under the Vietnam Automobile Manufacturers Association (VAMA) decreased by 26% to 31,908 units. In particular, sales of passenger cars and commercial vehicles recorded a decline of 30% and 12% respectively, reaching 24,458 units and 7,073 units.

|

Passenger car consumption fell largely due to the negative impacts of the Covid-19 pandemic on the income and consuming behavior of buyers. In terms of commercial vehicles, the decline in sales volume may have come from some factors such as (1) the production and mining sectors were stagnant because of the pandemic, and (2) the downward trend since 2017 until now. In contrast, special-purpose vehicles increased by 24% to 377 units.

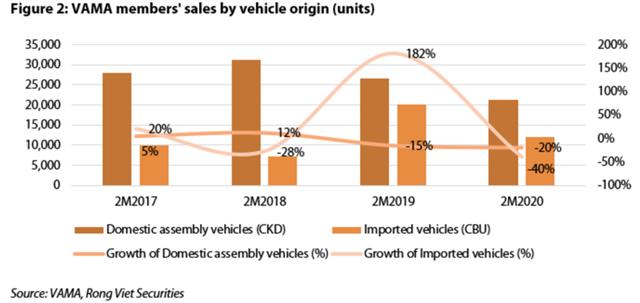

So far in 2020, the number of domestically-assembled cars sold fell by 20% year-on-year to 21,296 units, while the sales of imported cars fell sharply by 38% to 12,107 units.

|

Supply surges

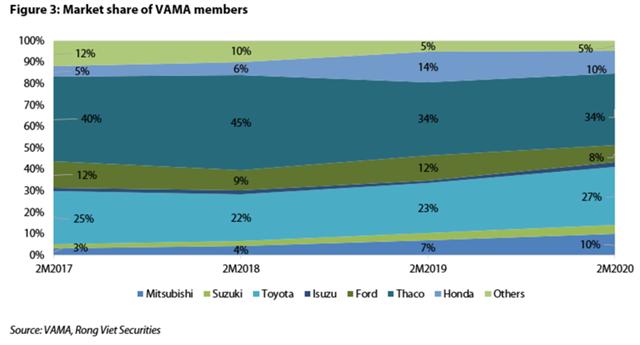

Meanwhile, the domestic supply is expected to increase rapidly. Specifically, VinFast, an auto unit of conglomerate Vingroup, with a capacity of 38 units/hour has been in operation for half of a year; Truong Hai Auto Corporation has completed a project to increase the capacity of its Kia factory from 20,000 units/year to 50,000 units/year. TC Motor plans to build a new car assembly factory in 2020, with a capacity of 100,000 vehicles per year. Ford Vietnam wants to improve its production in order to expand their market share.

Besides, the supply of imported vehicles is also expected to increase from the third quarter of 2020 when the EU – Vietnam Free Trade Agreement (EVFTA) is predicted to come into effect on July 1, 2020. This agreement would help reduce import tariffs from the current rate of 65 – 75% and eventually selling prices.

In addition, with 0% import tax for Southeast Asian countries under the ASEAN Trade Agreement (ATIGA), it is expected that the imported cars from Thailand and Indonesia will continue to flow into Vietnam.

Prices continue to fall

According to VDSC, selling prices are expected to drop in short term as companies look to liquidate inventories and boost demand. In the long term, the report suggested that prices are likely to decline as more favorable policies are kicking in.

|

Specifically, the import procedures will be simplified in 2020 when some regulations are expected to be removed such as batch inspection or type quality certificates. As a result, the reduced costs will make car prices to fall further.

In case of the domestic automobile industry, the current production cost of domestic models is about 20% higher than imported cars of the same type. Normally, imported components for domestic production are subject to additional costs such as transportation, packaging and import duties.

Meanwhile, higher prices of components produced domestically are due to huge initial investment and small scale production, given the modest size of the market.

Therefore, in order to support the domestic automobile industry, by the end of 2019, the Ministry of Finance issued a Decree waiving import tax applied to car components under the preferential tax program for manufacturing and assembling cars.

Moreover, when the EVFTA takes effect, import tax on components and auto parts imported from the EU will be reduced to zero percent after seven years. By lowering the import tax for automobile components, costs of domestically-assembled vehicles are expected to decrease in the near future.