Lucrative business deals on South Korean radar

Lucrative business deals on South Korean radar

South Korean investors are continuing to bet on Vietnam’s prospects despite the coronavirus outbreak slowing down business activities both at home and abroad.

South Korean manufacturers are continuing to ramp up activities despite the current challenges. Photo: Le Toan

|

Samsung Electronics said last Friday it will temporarily move some of its smartphone production to Vietnam, after closing a factory in the South Korean city of Gumi following a positive coronavirus test there. Samsung’s premium smartphones, Galaxy S20 and Galaxy Note 10, were being produced entirely in Gumi. Samsung said the decision to shift to Vietnam was made to ensure “stable production” of its high-end smartphones. About 200,000 units of premium smartphone production per month will move to Vietnam.

Production will resume in Gumi once the situation returns to normal, said the company, which also pointed out there are production plants in the Vietnamese northern provinces of Bac Ninh and Thai Nguyen, from where half the worldwide shipments depart.

The world’s largest smartphone maker has so far reported six virus-infected workers at its production sites in Gumi, North Gyeongsang province, only about 50km north of Daegu, the epicenter of South Korea’s virus outbreak.

Samsung Vietnam last week kicked off construction of its largest research and development (R&D) centre in Southeast Asia west of Hanoi. The $220 million facility will cover an area of 11,600 square metres, with nearly 80,000sq.m floor area. The building is designed with 16 storeys above and three storeys below ground and is expected to be completed in late 2022. This is the first time Samsung has created a building specifically for R&D activities overseas. It will also be the largest such centre raised by a foreign-invested enterprise in Vietnam, reflecting the company’s commitment to the country.

Meanwhile, SK Lubricants in February also acquired a 49 per cent stake in Mekong Petrochemical JSC for ₩50 billion ($42 million). The move is a stepping stone for South Korea’s leading lubricants producer to expand its business in Vietnam and the ASEAN market.

Vietnam’s lubricants market, which is projected to reach 6.4 million barrels by 2028 from 3.5 million barrels last year, is dominated by BP, Shell, and Chevron. Meanwhile, Mekong Petrol is the only Vietnamese lubricant company whose market share has been growing, from 4.3 per cent in 2012 to 6.3 per cent in 2018, based on a strategy to expand its high-end products.

Also last month, Korea Investment Management (KIM) was approved to acquire all of the shares issued by local Hung Viet Fund Management JSC (HVCapital). The South Korean fund was greenlit to acquire a 99 per cent stake in HVCapital, while the remaining 1 per cent was split equally between two foreign individual shareholders, Yun Hang Jin and An Jong Hoon.

KIM is a familiar name in Vietnam’s securities market with assets under management in the scale of billions of US dollars. KIM Vietnam Growth Securities Master Investment Trust is the group’s biggest fund in Vietnam, with assets under management of $850 million.

According to data by the Foreign Investment Agency under the Ministry of Planning and Investment, South Korea was the leading foreign investor in Vietnam in 2019, with the total registered capital of $7.92 billion, accounting for 20.8 per cent of total foreign direct investment into Vietnam during the year. However, in the first two months of 2020, South Korea ranked third with $425.4 million or 7 per cent, after Singapore and China.

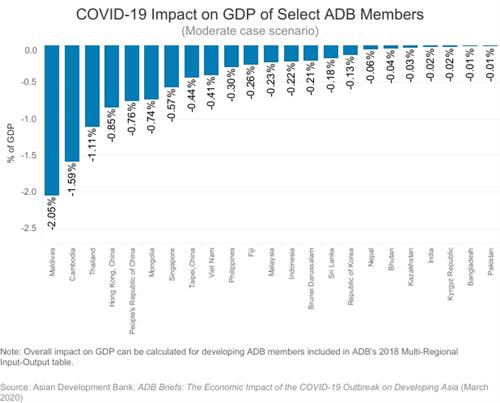

The slowdown of South Korean inflows to Vietnam can be attributed to the ongoing COVID-19 outbreak.

Yo Chul Ho, general director of automobile spare parts manufacturer ABS Vina Co., Ltd. based in the southern province of Binh Duong, said that the company is feeling the bite of supply chain disruptions caused by the outbreak.

Michael Han, head of SK Group’s representative office in Vietnam told VIR, “Unlike most other South Korean conglomerates, we do not have a manufacturing base here in Vietnam. Nonetheless, the epidemic is beginning to take a toll as it is preventing our relevant colleagues based in South Korea from visiting potential companies. Equally important, the deteriorating situation in South Korea certainly is not helping.”

Han added that the outbreak will have some profound impacts in the short term, with SK Group in particular looking at a few deals in Vietnam.

“We are dealing with some uncertainty which is one of the core elements that spooks investors away, regardless of their origin or the circumstances. That said, given some time, I think the market will bounce back once we get to know more about COVID-19,” Han explained. “Previous outbreaks impacted the world and the market far greater than what we have seen so far. If we can recall how the market eventually responded to those threats, hopefully we can find some answers for COVID-19.”

Jacob Won, founding partner at Locus Capital, said that the interest from South Korean companies in Vietnam in 2019 compared to 2018 did not change much and remained at a high level. However, Won explained that it is hard to say that if the quality of mergers and acquisitions (M&A) has increased because it has always been challenging to find the right-sized M&A targets in Vietnam that can match the criteria of their South Korean counterparts.

Won further noted that M&A activities will fall significantly through 2020. With travel restrictions between Vietnam and South Korea, it will be impossible to progress the discussion on M&A without a physical meeting and a visit to the target company.

“For now, all companies have to wait and see how the coronavirus issue will pan out. If it gets contained sooner rather than later, then things will get back to normal. If not, then it will be a gloomy year not only for M&A activities between Vietnam and South Korea but also for the whole economy,” he added.