Long-term potential ahead for local tech startup scene

Long-term potential ahead for local tech startup scene

Vietnam’s startup ecosystem continues to be a darling for foreign ventures funds and angel investors. However, the flow of fresh funds into the market might be dampened by the rapidly escalating global health emergency. Eddie Thai, partner at US-headquartered venture capital firm and incubator 500 Startups, outlined to VIR’s Thanh Van his insight into Vietnam’s startup ecosystem amidst the crisis and his fund’s plan in 2020.

Eddie Thai, partner at US-headquartered venture capital firm and incubator 500 Startups

|

For the first time, investment in Vietnamese tech startups last year exceeded that experienced in Singapore to rank second in Southeast Asia. What were the key factors for the surge in investment in Vietnam-based startups last year?

I think the surge was the natural result of Vietnam’s maturing ecosystem. For any digital economy the first wave of successful companies would be in media, e-commerce, and payments. So it’s only natural that such companies would have reached sufficient scale to receive tens or hundreds of millions of dollars of investment. Indeed, a substantial portion of the money invested last year went to e-commerce players Tiki and Sendo and payments players Momo and VNPay.

How do you see the attractiveness of Vietnam as a tech investment destination in 2020 and upcoming years?

There continues to be immense long-term potential for Vietnam tech, both for companies serving the domestic market as well as for companies serving markets beyond Vietnam. However, there are at least a couple of short-term risks to consider.

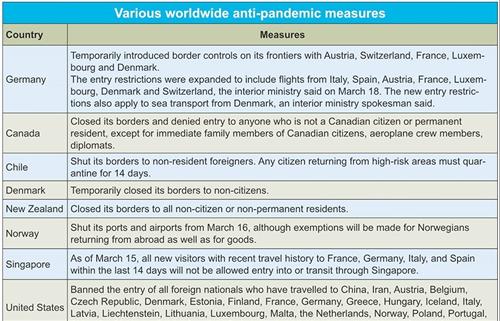

First, obviously, there is economic risk due to COVID-19. China’s economy is suffering right now and, although Vietnam is doing a pretty good job of keeping people safe up so far, it will still suffer major economic effects (less trade, less tourism, less domestic consumption, etc). Many tech startups will be affected by this as well. In addition, there is also a more direct impact of the virus: international VCs have been cancelling or delaying their trips to Vietnam. This means financing will be lower in the near term.

Second, at least before this outbreak, valuations were getting quite high as international investors continue to turn their attention to Vietnam. We were even seeing some companies raise at higher valuations than similar counterparts in San Francisco. The same thing happened in Indonesia over the past few years, and now it’s Vietnam’s turn. It seems great for founders and early-stage investors, but actually can be dangerous for future fundraise efforts.

Why are higher valuations dangerous for future fundraising efforts?

Valuations that are too high often anchor the founders to high expectations in future rounds. Knowing this, some investors then neglect to even explore the opportunity. Then other investors, sensing weakness in the opportunity, may also decline to pursue.

By the time the founders adjust their expectations, it may be too late to raise any money at all. Or when the founders finally adjust, they have to take a valuation that's lower than the last round's valuation, which can be seen as a negative signal to future potential investors (e.g. a lack of progress or momentum). It's better to get steadily increasing valuations over time than to raise a very high one followed by a lower one.

Does it mean startups are not getting the right valuation?

Startup valuation is more art than science, so it's hard to say for a particular startup whether a specific valuation is the "right" one. However, there are ranges of valuation that are appropriate for specific startups, and yes, I think many startups' valuations fall outside of that range. Some are too high (compared with the company's progress), and some are too low (resulting in the founders giving up too much of their company too early).

In Vietnam I would guess there is a large portion of startups being valued inappropriately. I think part of the reason is the increase in investor interest in recent years. But also part of the reason is the inefficient venture market: there are not too many investors that really understand Vietnam yet, and there are not too many founders who are familiar with fundraising. The two-way information asymmetry increases the likelihood of mispricing.

500 Startups Vietnam has been active in the country’s startup market. Could you share some highlights of the fund’s activities in Vietnam so far and the plan in the upcoming time?

500 Startups Vietnam invested in 19 new companies in 2019. We aim to invest in a similar number in 2020. We are also continuing to run our Saola Accelerator. Our first batch (last year) had six companies, and our second batch has seven companies. We’ve just kicked that off, and Sean Percival, former vice president of MySpace, is programme director. Overall, we aim to reach our target of 80 companies invested cumulatively by early 2021.