Covid pandemic boosts online shopping in Vietnam

Covid pandemic boosts online shopping in Vietnam

The demand on online shopping in Vietnam is increasing, bringing positive results to e-commerce platforms in Vietnam.

Even though the first months of every year is the low season for shopping, e-commerce sites in Vietnam have seen a surge in orders in the January-March 2020 period as the Covid-19 pandemic changes consumers' behavior.

Tiki, the leading e-commerce platform in terms of web traffic, reported 15% growth in shopping demand since the beginning of February compared to the last two months of 2019. According to the Vietnamese e-commerce platform, its orders reached 3,000-4,000 every minute in the fourth quarter of 2019, the time of the e-shopping festival.

“This shows the significant increase in the shopping needs of Tiki consumers since the Covid-19 outbreak,” Vice President of Corporate Development Ngo Hoang Gia Khanh told Hanoitimes.

Owning 593 physical stores, a representative of FPT Digital Retail JSC (FRT) told Hanoitimes that the firm recorded an increase of 8% in its web traffic from the beginning of the year compared to the comparable period of 2019. Its revenue from online trade increased an inter-annual 5% in the first two months.

According to representatives from Tiki and FPT, the hottest items in the first months of the year on digital platforms are face masks, wet towels and air purifiers. For Lazada, the best selling goods are personal care and home appliances.

In February, the demand for room deodorizers and disinfectant sprays jumped by more than 160%, diapers and paper grew by 60%, and packaged products soared by more than 50% inter-monthly.

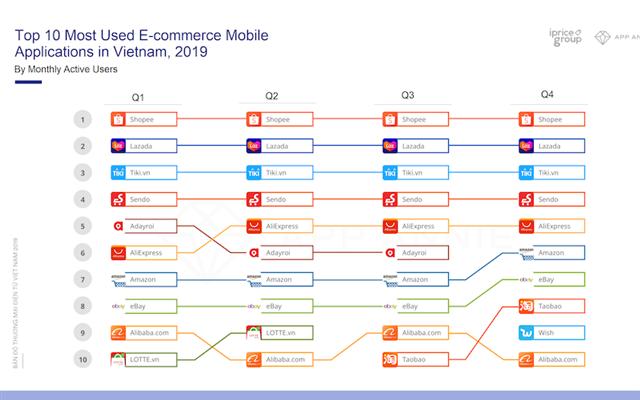

Sources: iPrice Group & App Annie

|

Data analysis of consumer needs through search and traffic activities conducted by iPrice Group and SimilarWeb shows that the demand for fast-moving-consumer goods (FMCG) and health categories grew positively in the first two months. The search for face masks increased by 60 times and 100 times for sanitizers.

“The number of orders for electronics and cosmetics categories remained completely unaffected. Demand for products of some brands such as Samsung is increasing as they have launched new products,” a representative from e-commerce aggregator portal iPrice Group told Hanoitimes.

According to the iPrice Group’s Summary Report of Vietnamese E-commerce 2019 Heading Into 2020, online shopping on e-commerce marketplaces has now become a reflex of Vietnamese consumer trend. Whenever a need arises, consumers will open their favorite shopping app or type an address and visit the website immediately, without having to do much searching or reconsidering. The period of educating Vietnamese consumers about online shopping has been successful, the report said.

Sources: iPrice Group & SimilarWeb

|

Mohit Agrawal, Head of Consumer Insights at Nielsen Vietnam told Hanoitimes that some of these changes are for short term like outdoor activities, content consumption on TV and stocking up at home. Categories like AlcoBev including soft drinks fresh meat should see a recovery in the coming months. However, there are many changes that can be embraced for long term like online shopping, personal and home hygiene.

“The task for the companies is to make sure that they keep their product categories relevant to the consumers and make sure that they are present at the right outlets with the right price,” she said.

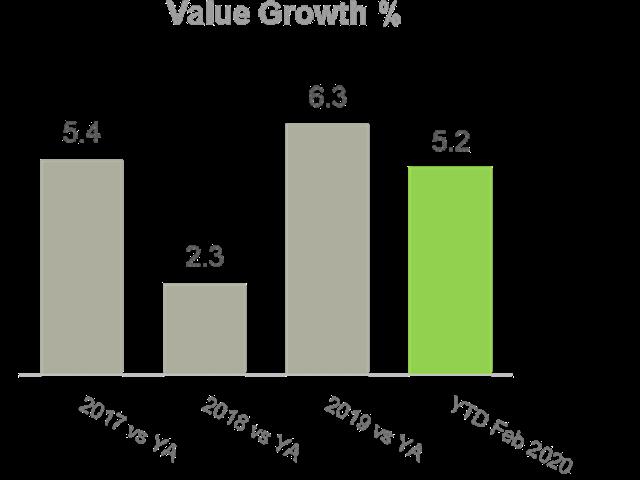

Robust growth in online shopping

The latest report from Kantar Worldpanel Vietnam on March 16 shows that more people shopping online than usual, accelerating the growth of online FMCG spending to a triple digit rate in four weeks right after Tet holidays (from January 27 to February 27, 2020) against the same period of last year (from February 4 to March 3, 2019). “This trend is expected to continue in the coming months especially when there has been advice from local authorities to shop online in order to avoid the crowds and physical contact,” the report wrote.

FMCG yearly trend - 52 weekly year-on-year change Source: Kantar Worldpanel Vietnam

|

Big supermarket operators such as Saigon Co.op, Central Group and VinCommerce quickly grasped this consumer trend to promote sales through e-commerce channels.

In the day Vietnam's 17th Covid-19 case was detected in Hanoi, the number of online orders at Saigon Co.op surged by 10 times. Up to now, the number of online and mobile shopping customers has increased by 4-5 times.

Particularly in Ho Chi Minh City, Big C recorded more than 1,000 orders completed by phone from March 1 to 12. The supermarket chain is expected to reach about 3,000 orders from the beginning of March, an increase of 200% compared to February.

Vietnam’s ride-hailing company Be Group has also launched the campaign “be go to the market” on goods delivery. After nearly one week of implementation, the startup received hundreds of service requests, especially in Hanoi and Ho Chi Minh City.

According to Kantar Worldpanel, the swelling number of Covid-19 infected has resulted in panic buying among Vietnamese in some areas, especially where there have been confirmed cases. It drives up demand for hoarding, leading to the notable growth of major modern retail formats including hypermarket, supermarket and minimarket which offer hygiene, product variety, and lots of epidemic supporting programs such as home-delivery, stable-price masks and hand sanitizer, farm produce sales support, among others.

Among big retail players, Big C achieved the strongest performance, driven by increasing both footfall and spend per trip in its stores. MM Mega market (cash-and-carry retail model) also picks up during this time despite its downturn in recent years.

Meanwhile, physical grocery stores are losing visits as shoppers prefer “less physical contact” and fewer shopping trips but with a bigger trip size. As such, street shops – key shopping channel, and convenience stores are seeing a short-term negative impact caused by the Covid-19 pandemic, the report from Kantar Worldpanel concluded.