Wake-up call for pharma firms with poor practices

Wake-up call for pharma firms with poor practices

The new sanctions for drug quality violations drafted by the Ministry of Health are expected to come out soon, threatening manufacturers and traders to have their operations suspended and business certificates revoked should they fail to comply with set standards.

Wake-up call for pharma firms with poor practices. Photo: Le Toan

|

The Ministry of Health’s (MoH) Drug Administration of Vietnam (DAV) has submitted to the government a draft decree, including sanctions of suspending whole factories and revoking business licenses if companies fail to satisfy the good manufacturing practices (GMP) and others in the country.

“These sanctions are among the strictest in the draft decree which is expected to come out soon, aiming to ensure drug quality. In addition, fines for wrongdoings in manufacturing and trading will also be doubled to tripled,” an official of the DAV told VIR.

|

The new decree, which will replace Decree No.176/2013/ND-CP dated 2013 on sanctioning of administrative violations in the health sector, is among the bold solutions that the MoH will carry out this year in order to deter any possible infringements and protect people’s health.

As planned, the MoH will intensify unexpected inspections at domestic and foreign-invested pharmaceutical factories, ensure that they follow production standards, and tighten assessments of GMP and Good Pharmacy Practice standards like the conditions of transportation, storage, and others.

The DAV on February 18 also issued Document No.1705/QLD-KD on supervising and inspecting trading activities at retail pharmaceutical trading units, urging health departments to act decisively.

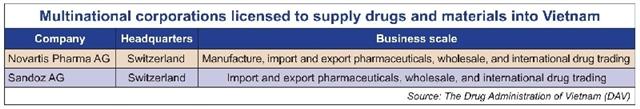

Four days previously, the DAV also announced its list of multinational corporations that are licensed to supply medicines and materials for drug production into Vietnam, as well as another list of manufacturing facilities that meet PIC/S-GMP and EU-GMP standards.

The MoH responds with the draft decree to a number of recent violations of domestic and foreign-invested enterprises (FIEs) in the health sector. According to its official statements, the DAV received 133 reports in 2019 about unqualified pharmaceutical samples, some of which came from FIEs.

Last year, many violations related to drug quality were detected and fined. One particularly scandalous example was VN-Pharma’s fake cancer medication, which created many resentful Vietnamese people. The incident was a valuable lesson for state managing agencies and the MoH, which carried responsibility for granting drug import licences for VN-Pharma as well as a business licence for foreign drug producer Helix, whose actions led to the import of thousands of fake cancer medications.

Industry insiders attributed these venturesome endeavours to the growing demand and high-growth potential in the country, where drug spendings per capita rose by 10.6 per cent on-year to about $53.5 in 2018.

According to statistics by IBM Market Research, Vietnam’s pharmaceutical market size is expected to reach $7.7 billion by 2021 and $16.1 billion by 2026, with a growth rate of up to 11 per cent. Moreover, the newly-ratified EU-Vietnam Free Trade Agreement will add to the sector’s growth and attraction.

As there are high profit margins in this business, wrongdoings in manufacturing and trading seem to be never-ending in the country. After the VN-Pharma case, many more drug quality violations have been reported, with the majority involving South Korean and Indian businesses. The DAV’s January report on drug quality violators included drugs of many well-known FIEs such as Robinson Pharma Inc., Young IL Pharm. Co., Ltd., and Euro Healthcare.

Briefly after publishing the report the DAV also announced that there were 55 more cases of international pharmaceutical businesses violating drug quality rules in Vietnam, including 38 from India, six from South Korea, one from Thailand, and one from Poland.

Robinson Pharma’s Aloe Vera (VN-5901-08) is also included on the list. The US company is a large contract manufacturer of softgels, tablets, capsules, powders, and liquids for dietary supplements and personal healthcare. Currently, Robinson Pharma has the largest softgel capacity in the United States and is a leading vitamin manufacturer with multiple third-party certifications for GMP compliance. In Vietnam, VimatCorp is said to be the sole distributor of Robinson Pharma’s products.

Currently, FIEs are not allowed to distribute drugs and their ingredients in Vietnam but instead have to co-operate with local wholesalers.