Vietnam building bridges for greater economic growth and development

Vietnam building bridges for greater economic growth and development

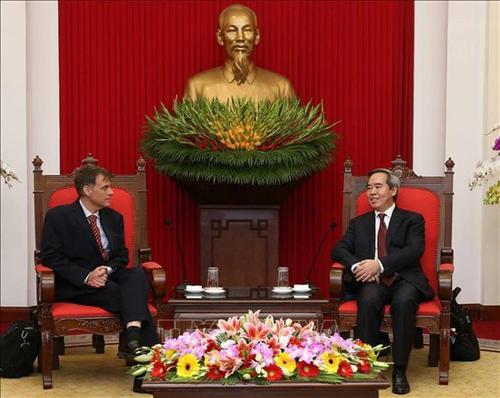

Donald Lambert, principal private sector development specialist, Southeast Asia Department at the ADB, provides three key strategies that can help Vietnam achieve its ambitious development targets in the coming years.

Donald Lambert, principal private sector development specialist, Southeast Asia Department at the ADB

|

Vietnam is preparing a new socio-economic development plan that will cover 2021 through 2025 and a new socio-economic development strategy covering 2021 through 2030. They are expected to establish ambitious development targets – as is appropriate for a country that has achieved much over recent years.

Ambition, however, has a price tag, and Vietnam will need to adopt new approaches to fund its development.

Let us put in context how much has changed since the last five-year plan. In 2015, Vietnam was the fifth-largest recipient of net official development assistance and qualified for some of the most concessional assistance from the ADB and other donors.

It is a different story now. Vietnam’s per capita income has been increasing at a compound annual growth rate of over 6 per cent, making it one of the fastest-growing economies in the world. It is now firmly established as a middle-income country and is one of the most attractive destinations for foreign direct investment.

This success means, however, that donors will begin to allocate grants and other forms of deeply concessional assistance to countries with more pressing needs. This is already happening. In 2017, Vietnam “graduated” from the World Bank’s concessional country classification and 18 months later from the ADB’s equivalent grouping.

The ADB and others have been trying to cushion this transition by blending grants with its lending to Vietnam to reduce net borrowing costs. Additionally, the ADB approved in 2019 a new pricing policy that provides a temporary benefit to countries, like Vietnam, that are recent graduates from the most concessional assistance. Although helpful, these measures are temporary and inherently limited and will not provide the funding paradigm for Vietnam’s next socio-economic development plan.

These funding needs, moreover, are considerable. The ADB has estimated that Southeast Asia will need to invest on average $210 billion per year in infrastructure through 2030. Vietnam will require a large portion of this with the Global Infrastructure Hub estimating that Vietnam needs to invest $110 billion between 2021 and 2025 for infrastructure and to meet the Sustainable Development Goals. Based on historical trends, this leaves a projected $22 billion funding shortfall.

$22 billion over five years is a big number, but it is not insurmountable. In fact, Vietnam is in a better position than many. While the Philippines, India, and other Asian countries have privately funded a large portion of their infrastructure, the private sector has historically only funded 10 per cent of Vietnam. That means there is a lot of scope for Vietnam – particularly given its compelling growth story – to attract more infrastructure investment.

Vietnam has graduated from the World Bank and the ADB's recipients of concessional loans and will need to adjust its strategies to fit its new circumstances

|

To make this happen, Vietnam should pursue three complementary strategies.

The first strategy is more catalytic use of development assistance. This requires a different mindset. Vietnam is no longer a low-income country, but it is also not ready to fund itself exclusively through private investment and domestic capital markets. A transition period is needed where Vietnam uses donors’ assistance to catalyse private investment that would not come otherwise.

This transition period will, however, require new tools. This includes issuing counter-guarantees to the ADB and other development partners so they can use their strong international credit ratings to de-risk projects. Vietnam should also prioritise development assistance to strengthen the financial sector, providing stand-by facilities or other enhancements to make it easier for state-owned enterprises tasked with key projects to access affordable financing, and allowing development partners to issue dong-linked bonds to lower the cost of capital for Vietnamese borrowers. These are all measures that the ADB and others have introduced in other middle-income countries. However, either because of statute or policy, they are currently not possible in Vietnam.

Using development assistance catalytically to attract private investment closely ties to the second priority: passing a strong law on public-private partnerships (PPP). Time is short. The National Assembly has already considered a first draft of the bill and hopes to pass a second version in May. Consultations should focus on the key missing ingredients needed to attract international investment.

For example, the law needs to better mitigate the risk that the demand for an infrastructure project falls short of projections. Vietnam already does this with feed-in-tariffs for power generation projects. The PPP law should afford similar protection to other sectors, particularly transport. This can be achieved through minimum revenue guarantees or ensuring that availability payments extend automatically beyond the current ceiling of five years.

Another PPP concern is governing law. The current decree governing PPPs provides more scope for using foreign laws to govern PPP contracts than the draft PPP bill. This is important. PPPs entail complicated legal contracts, and investors rely on legal systems with deep case histories to interpret them. Finally, the termination risk must be addressed. Once a project is built, investors need assurance that they will be repaid even if the government terminates the contract. Without these changes, the new PPP law’s success is uncertain, and projects tendered in the road and other sectors are likely to receive only limited interest from foreign investors.

The final strategic priority is better mobilisation of domestic capital markets. The passage of the new Securities Law in November 2019 was a good step as are recent regulatory changes that encourage companies to turn to the bond market instead of banks to fund long-term obligations.

More is needed, however. Private pension funds, investment funds, and insurance companies all need to mature so there is a strong base of demand for corporate bonds. Meanwhile, the main public pension, the Social Insurance Agency, must first be able to prudently manage and second start to invest in corporate debt. Vietnam needs to establish a domestic credit rating agency, and the government should actively market this investment opportunity to leading international rating agencies. These steps will help the corporate bond market to evolve, eventually creating opportunities for project bonds, particularly if credit enhancement mechanisms are available for these instruments.

Vietnam’s graduation from concessional funding sources is unequivocally positive. It is a direct result of the dynamism and potential of this thriving economy. The trick now is to manage that success by evolving its strategy to fund the next five-year plan. On the one hand, it cannot be business as usual. Vietnam will hopefully never again be one of the world’s largest recipients of aid.

On the other hand, Vietnam cannot increase the share of private investment in infrastructure instantaneously. A measured strategy that deploys development assistance catalytically, strengthens PPPs, and makes better use of domestic capital would establish the resource base for Vietnam’s next socio-economic development plan and beyond.