Nam Long (NLG) eyes profit-taking in 2019 - 21

Nam Long (NLG) eyes profit-taking in 2019 - 21

Nam Long Investment Corporation (NLG) achieved net revenues of VND1.221 trillion (US$52.5 million) in the fourth quarter of last year, a 50 per cent increase year-on-year, its financial report for the quarter shows.

The sharp increase was attributed to the company’s projects such as Flora Novia, Dao Nho villas and Valora Island projects, which it completed and handed over to customers.

Its after-tax profit was nearly VND560 billion ($24.1 million), more than four times the figure for the same period last year.

Of this, VND114 billion ($4.9 million) came from joint venture activities, with the major contribution coming from nearly 1,200 apartments at the Mizuki Park project (joint venture with Japanese partners).

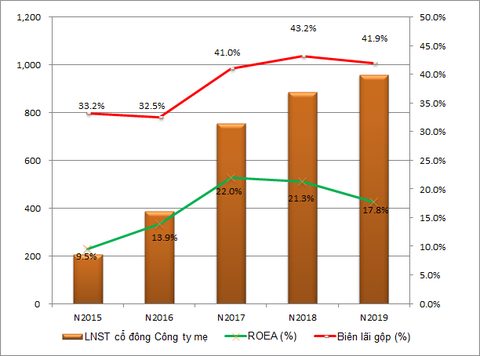

The quarter numbers pushed Nam Long's net income after tax for the full year to VND1.007 trillion ($43.3 million), up 13.4 per cent from the previous year and 5 per cent higher than its target.

This was its highest profit ever while VND1 trillion was a nice, round figure.

By the end of last year Nam Long had accumulated VND1.839 trillion ($79.1 million) worth of undistributed profits and VND988 billion worth of equity surplus. The company also has more than 19.5 million treasury shares with a carrying value of nearly VND383 billion.

Nam Long currently has VND2 trillion in cash reserves while its loans decreased by 8 per last year to VND924 billion, with corporate bonds it issued in 2018 and maturing in 2025 accounting for VND626 billion.

Its debt-to-equity ratio is only 0.16. Nam Long has more than VND1.8 trillion worth of receivables, including nearly VND1.2 trillion in short-term advanced payment from buyers and VND694 billion in long-term unrealised revenues.

A company spokesperson said the period from the end of 2019 to 2021 would be a profitable period because the number of apartments to be delivered to customers would be three times the number in 2015 – 18.

So the company has set itself an annual profit growth target of 25-30 per cent in the period.

This year Nam Long will launch some 3,000 units worth around VND8 trillion at projects such as Mizuki Park, Akari City, a 165ha portion in phase 1 of the 355ha Waterpoint, and other some others in Can Tho City and Hai Phong.

Its collaboration with Japanese partners Nishi Nippon Railroad (Nishitetsu) and Hankyu Realty (Hankyu) has helped it raise relatively cheap funds and spread business risks.

By raising cheap capital, the company has been able to develop affordable projects, exactly what its main customer base demands.

The co-operation with the Japanese companies has also helped Nam Long hedge risks at a time when the real estate market has been volatile, especially recently.

It hopes to acquire 10-20ha of land a year in places in the southern region such as HCM City, Dong Nai, Long An, and satellite cities that have industrial parks and are densely populated.

It has also started to move into the north to places like Ha Noi and Hai Phong to expand its network and meet more customers’ demands.