Local gold price rockets to near $2,173

Local gold price rockets to near $2,173

The COVID-19 outbreak pushed the local price of gold to an eight-year peak – nearly VND50 million ($2,173.91) per ounce.

More than VND4 million ($173) added to one ounce of gold price within one day

|

The Vietnamese gold market on February 24 taken by surprise by a tremendous rise of VND4 million ($173.91) rise to the ounce in a single day.

At 4.40 PM on the same day, the price of SJC gold reached VND47.8-49 million ($2,078.26-2,130.43) per ounce (buy-sell), DOJI also listed the price at VND47.7-49.15 million ($2,073.91-2,136.96). Bao Tin Minh Chau offered VND47.8-49.2 million ($2,078.26-2,139.13).

Previously, at 3 PM, the price at DOJI set a new record, VND49.95 million ($2,171.74), exceeding the VND49 million ($2,130.43) peak in 2011. Experts said that this is the greatest daily fluctuation experienced in local gold trading history.

On the other hand, the gold also leapt to $1,680 in the international markets, up 2.3 per cent or $37.7 against last Friday. Calculated by Vietcombank’s exchange rate, the price is equivalent to VND47.5 million ($2,065.22), VND2 million ($87) less than the local price.

Explaining the reason behind the soar, banking economist Bui Quang Tin said that the fast spread of the coronavirus at big economies like South Korea and Japan has negatively impacted the global market, securities, and the performance of companies. This has elevated demand for safe investments like gold.

Tin also said that if the epidemic is not brought under control, the whole of 2020 will be a tough year for the global economy and the impacts may last weel into 2021.

DOJI also forecast the price of gold to reach $1,700 per ounce and will exceed $1,800 per ounce if the health crisis is prolonged.

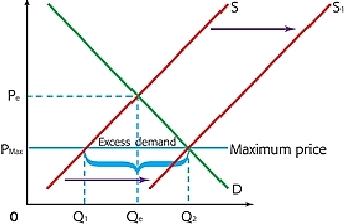

Regarding the VND4 million ($173.91) increase in local prices, Tin said that demand exceeding supply is the main reason behind this. Currently, only the State Bank of Vietnam (SBV) and a select few commercial banks are authorised to officially import gold.

“Once the global price of gold rises, big investors with enormous capital like investment funds or commercial banks join the market and bid prices up. Thus, with the great demand but limited supply it is understandable that local prices went so high up,” said Tin.