BSR to earn $88m via IPO

BSR to earn $88m via IPO

Binh Son Refining and Petrochemical Company Limited (BSR) plans to sell some five to six per cent stake to domestic and foreign investors, collecting estimated revenue of nearly VND2 trillion (US$88 million) through its initial public offering (IPO) in November 2017.

The information was revealed by Tran Ngoc Nguyen, the BSR’s general director, on stockbiz.vn.

He expected all the shares would be sold during the upcoming IPO because the production situation, revenue and profit of the company were positive from the investors’ view.

The starting price will be based on the market situation, with the participation of reputable domestic and international companies. "We will announce the starting price close to the IPO date and update the latest business results," Nguyen added.

In the next 12 months, the company targets to sell 49 per cent stake to strategic investors, estimated at $1 billion and bring the State’s ownership to less than 50 per cent.

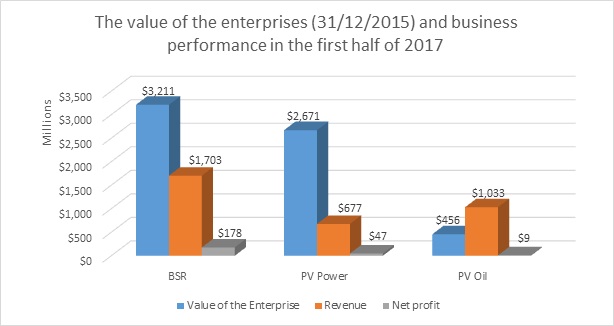

BSR is a wholly-owned subsidiary of Viet Nam National Oil and Gas Group (PetroVietnam) and operator of the $3 billion Dung Quat Oil Refinery, the first oil refinery in the country.

Tran Dinh Thien, director of the Viet Nam Institute Economics, said the strength of Dung Quat Oil Refinery is to create petrol, an essential product for domestic and business purposes. With processing capacity of over 6.5 million tonnes of crude oil per year and meeting over 30 per cent of the domestic demand, BSR has stable cash flow. It is the significant factor for large investors to consider investing capital.

However, BSR should build a strict, transparent and effective corporate governance system to develop sustainably and create trust for investors, Thien suggested.

According to BSR’s business result for the first nine months of 2017, the company earned revenue of more than VND55 trillion, exceeding 125 per cent of the target plan, and after-tax profit of nearly VND5.5 trillion, contributing over VND6.5 trillion to the State budget.

Besides this, the firm’s return on equity was 16.09 per cent, a year-on-year increase of 12.43 per cent.