Fintech potential still untapped

Fintech potential still untapped

Digital financial services have the potential to significantly expand economic activity in Cambodia by bridging the gap between existing financial products and growing credit needs, according to a new study.

Adopting digital financial services, or fintech, could increase the Kingdom’s GDP by about 6 percent, the authors of Accelerating Financial Inclusion in Southeast Asia with Digital Finance, a report commissioned by the Asian Development Bank (ADB), concluded. Fintech has the potential to generate more than $1.7 billion in additional electronic payment flows, fuel more than $2.5 billion in additional credit uptake and mobilise more than $500 million in savings, they said.

According to the report, which surveyed digital finance potential in the four ASEAN countries – Myanmar, Cambodia, Indonesia and the Philippines – the Kingdom’s formal financial institutions only met 16 percent of the population’s needs for savings activities, the lowest of the countries ranked. At the same time, it scored the highest in terms of having the most-developed network of microfinance institutions (MFIs).

The report concluded that financial inclusion in Cambodia was “highly skewed”, but the Kingdom’s rapid adoption of mobile payments for money transfer services, along with the extensive reach of its MFI network, had laid the groundwork for rapid uptake of digital financial services.

“We believe digital enablement can be a powerful lever to address the unmet needs of [the population],” the report said, adding that digital services would help reduce the reliance “on high-cost agent networks and on branch and ATM infrastructure that has discouraged MFIs from mobilising deposits from their rural borrowers”.

“A savings product based on a mobile wallet and serviced with a cash-in, cash-out agent infrastructure can help address this problem,” it added.

While the report laid out the overall economic advantages to the Kingdom, it noted, however, that both demand-side constraints and a lack of a government-regulated electronic know-your-customer (e-KYC) platform limited potential.

Chris McCarthy, CEO of Mango Tango and co-chair of the Cambodia eBusiness Working Group, said that while digital finance including cashless payment systems “are in their infancy in Cambodia, the potential for growth is high”.

He cited recent research Mango Tango completed for the Mekong Business Initiative (MBI), an ADB-backed program, which found that the majority of banks and financial institutions were investing heavily into new digital financial products.

“We also found that there is plenty of infrastructure to support digital finance in Cambodia already,” he said. “So, all the pieces are there. The one piece that is missing is convincing the majority of people to use the banking system.”

Only 16 percent of Cambodia’s 15-million-strong population has access to financial services, while only 5 percent of the population has a formal savings account, according to the ADB report.

McCarthy said most banking customers in Cambodia fail to see the need to move beyond operating in cash, and that the majority only hold accounts to receive paychecks and typically make full withdrawals on payday.

Despite a bevy of new fintech initiatives, coupled with Cambodia’s high mobile internet penetration, he said “people have to have a reason to use these services and so some education about the value of banking has got to take place”.

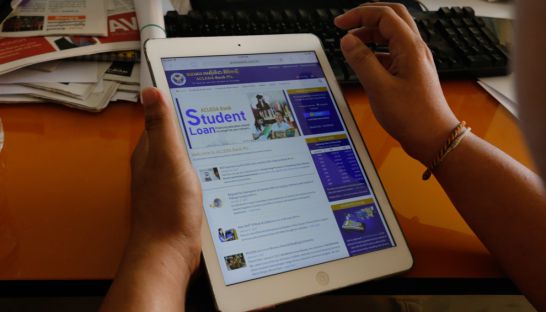

This sentiment was echoed by So Phonnary, vice president of Acleda Bank, Cambodia’s largest bank by assets.

“Most customers still rely on traditional cash-based services and the key to financial inclusion is dependent on educating customers about the benefit of online services, which they don’t know about,” she said.

Phonnary said that although fintech products were making inroads, products need to be developed with the existing financial literacy of clients in mind.

“It is really about getting clients to trust the financial institution and their products, while making sure that the products also have enough protections in place,” she said.

“We have seen many products that are trying to create a demand, and maybe having more choices will bring about more digital financial inclusion.”