Hotel landscape opens up

Hotel landscape opens up

As Cambodia aims to become a regional tourism destination, slowly trying to shift away from the well-trodden budget back-packer circuit to a more upscale clientele, Phnom Penh, regardless, has seen a lack of investment in large luxury hospitality developments as the capital is still viewed as a mere stopover. However, competition is about to intensify on the back of a booming construction and tourism industry.

Currently there are only three internationally renowned five-star hotels operating in the capital – namely InterContinental Phnom Penh, Hotel Sofitel Phnom Penh Phokeethra, and Raffles Hotel De Royal – while the prolific rise of guesthouses and boutique hotels take up the lion’s share of room occupancy at marketable prices.

And historically, according to international property consultancy Knight Frank’s latest property report, five-star hotels here have struggled to achieve desired occupancy.

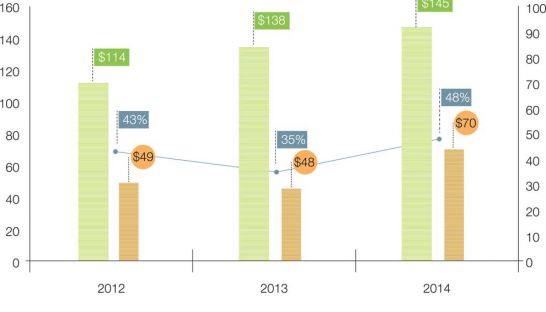

These occupancy rates have typically remained below 50 per cent in Phnom Penh of which, from that figure, 95 per cent are foreigners, the report explained, adding that without domestic demand to pick up the slack, competition will become strong as new internationally branded hotels enter the market.

By 2020, Phnom Penh will see the Shangri-La hotel at ‘The Peak’, and the Okura Prestige at ‘The Bay’, open their doors.

But just within 2016, the number of five-star rooms will have already doubled, most notably with the opening of 175-room Rosewood Hotel in Vattanac Capital Tower, and an additional 1,000 rooms added to the Nagaworld facilities.

Ross Wheble, Knight Frank’s country manager, believes that Nagaworld’s 1,000 room expansion – the bulk of 2016’s hotel rooms – will likely fare well due to the fact that it has carved out the niche gambling market.“The fact that it is an extension of their existing hotel suggests that they have sufficient demand to support this number of hotel rooms,” he said.

In terms of local demand picking up to close the gap, Wheble cited the 2014 socio-economic survey conducted by the National Institute of Statistics, which showed that disposable income of the top 20 per cent of Phnom Penh’s population increased by 74 per cent between 2011 and 2014.

“[This] indicates that Cambodia’s continuing economic growth is increasing the standard of living and should support growing demand from the domestic market,” he said.

Nevertheless, 2015 saw the first signs of the overall hotel market finally opening up after a lack of development that had persisted since the global financial crisis. With an existing supply for the second half of last year registered at 6,484 rooms distributed across 48 hotels, which for Knight Frank’s research only included those labeled three-star or above, Sokha Hotel and Toyoko Inn added 2,267 rooms to that figure.

While short term competition may prove a challenge, Knight Frank views the overall hotel sector in Phnom Penh positively, with “significant medium to long term potential” especially as the aviation industry includes more direct flights with a higher frequency, and infrastructure improves between the primary destinations of Siem Reap, Phnom Penh, and Sihanoukville.

“With continued improvements in infrastructure and an increase in international flights, we foresee tourism as a rapidly growing sector in Cambodia driven largely by leisure travelers,” said Wheble. And this, he added means “[that] there will be a growing demand for upscale hotels as tourist arrivals from high value markets increase.”

The report also noted that the viable gap within the hotel industry could be bridged by internationally branded four-star hotels that cater to “a growing need for business class hotels to cater to middle management and executives, and we see this as a growth potential over the medium term.”