Livestock industry on the TPP chopping block

Livestock industry on the TPP chopping block

Vietnam’s livestock industry on which the livelihoods of nearly 10 million people depend will most likely be put on the chopping block by the 11 other signatory nations to the Trans-Pacific Partnership (TPP) trade accord.

Deputy Director Tong Xuan Chinh of the Department of Livestock Production also pointedly asserted that the nation’s farmers and ranchers would simply lack the capacity to compete in a post TPP world.

“Other TPP members such as the US, Canada, New Zealand, Japan and Australia will undoubtedly swallow the livestock industry in one big gulp,” said Nguyen DucThanh, director of the Vietnam Institute for Economic and Policy Research (VEPR).

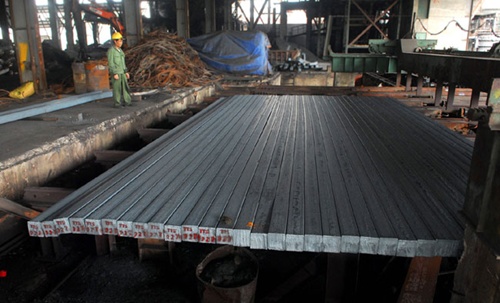

The industry is largely characterized by smallholders most of whom are family farmers with limited production and little to no resources to invest in the advanced technologies required to effectively compete in the global marketplaces.

Thanh said VEPR research is consistent with Deputy Director Chinh’s conclusions and shows that many if not substantially all of the smallholders will be forced to close their doors and go out of business.

In the transitional period, Thanh stressed it would be necessary for the government to provide financial and retraining assistance for the displaced farmers and some restructuring of the industry necessary.

The livestock industry may just be the sacrificial lamb that the nation will have to cough up in exchange for advantages the nation could gain as a whole in other industries such as the textiles industry.

Thanh postulates that the textiles industry, for example, would obtain the upper competitive hand after the proposed TPP come into effect provided it can resolve the thorny problems associated with the rules of origin.

Hypothetically, as it now stands, if the TPP were to come into effect tomorrow, textile businesses and those in the related apparel and footwear industries would accrue little to no benefit from tariff reductions.

This is because the rule of origin for textiles – or what is more commonly referred to as the ‘yarn forward rule’ – require Vietnam (or any TPP member) to use a TPP member-produced yarn in order to receive duty-free access.

The yarn forward rule means that all products in a garment or footwear from the yarn stage forward must be made in Vietnam, or one of the countries that is a party to the agreement, to receive TPP tariff reduction benefits.

A recent report showed Vietnam textile manufacturers need to import 50% of their raw materials (mostly from China) and therefore in the absence of resolving this dilemma by fully developing the supply chain in Vietnam, the TPP benefits are virtually limited to non-existent.

The VEPR Director noted that traceability and preparing the certificate of origin would also be an issue hampering farmers and ranchers in the livestock industry just as it has been a major stumbling block in textiles, automobiles and other industries, which has contributed to the overall delay in the TPP’s passage.

The certificate of origin rules are intended to ensure that the benefits from TPP tariff reductions and other non-tariff related barrier relief provided by the trade pact don’t inure to non TPP member nations such as China.

More specifically, if a Vietnam livestock or textile (or other) business purchased raw materials from China and incorporated those materials into a product that was shipped to the US with reduced tariffs— China would become a non-signatory benefactor to the TPP.

The TPP rules of origin are intended to prevent this from happening but do so in an exquisitely complex manner.