A fruitful US-Vietnam partnership

A fruitful US-Vietnam partnership

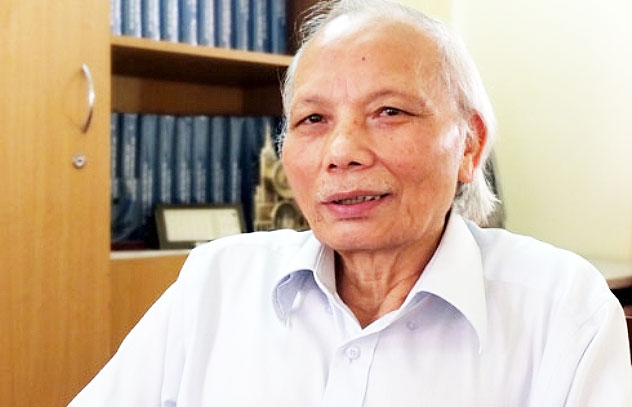

As Vietnam and the US celebrate the 20th anniversary of normalised relations this month, prominent economist Nguyen Mai looks into the vicissitudes of the two countries’ trade relations, and examines why the US has become Vietnam’s leading export market and investment partner.

The largest export market

After the normalisation of diplomatic relations between the US and Vietnam in 1995, particularly the ratification of the bilateral trade agreement (BTA) in 2000, the two countries’ trade value has seen spectacular growth, with the US becoming Vietnam’s biggest export market.

Around one year after the normalisation of relations, in May 1996, the US administration sent its draft BTA to Vietnam. Following more than four years of negotiations and legal setup, the BTA was officially signed in Washington on July 13, 2000 and came into force on December 10, 2001.

The scope of the US-Vietnam BTA is much wider than any other trade agreement Vietnam has signed with other countries, consisting of detailed regulations on the two countries’ open-door commitments to the trade of products and services, as well as investment activities and the protection of intellectual property rights for products belonging to legal entities from either of the two nations.

After the BTA took effect, the US began conducting normal trade relations and granted Vietnam its Most Favoured Nation (MFN) status, cutting down the average tariff level imposed on imports from 40 per cent to a mere 4 per cent, thus opening the door for Vietnamese exporters.

In December 2006, US President G.W. Bush gave Vietnam the Permanent Normal Trade Relations (PNTR) status.

Based on the BTA, Vietnam and the US have signed a slew of agreements and conventions on banking, insurance, aviation, and the Trade and Investment Framework Agreement (TIFA), and are negotiating with several member states of the Asia Pacific Economic Cooperation Forum (APEC) regarding the Trans-Pacific Partnership Agreement (TPP).

Ratification of the US-Vietnam BTA helped ramp up trade value between the two countries. Two-way trade value jumped from a mere $2.89 billion in 2002 to $35 billion in 2014, up 12.1 times, while Vietnam’s exports to the US market multiplied 12 times during the period, from $2.45 billion to $29.4 billion.

Last year, the US continued to be the leading export market for Vietnam, performing a 19.6 per cent jump against 2013.

Among ASEAN countries, Vietnam’s export value to the US climbed from the sixth position in 2000 to the lead position last year, accounting for 22 per cent, followed by Malaysia (21.5 per cent), Thailand (19.8 per cent), Indonesia (14.7 per cent), Singapore (12.5 per cent) and other member states (9.5 per cent).

Vietnam has maintained a high export growth in this demanding market thanks to diversified export items, indicating the enhanced competitiveness of Made-in-Vietnam products.

Vietnam’s trade surplus with the US has been constantly rising, hitting $23.8 billion last year, making a substantial contribution to the $2 billion trade surplus in 2014.

The structure of Vietnam’s exports to the US market have also seen remarkable improvements as processed goods have become core items, while the proportion of semi-processed goods and natural resources dropped consistently.

In 2001, before the ratification of the BTA, 78 per cent of Vietnamese exports to the US were semi-processed items and petroleum products. Two years after the BTA came into force, processed items accounted for 72 per cent of the total export value to the US market, and currently stand at 74-75 per cent.

Last year, US export value to Vietnam amounted to 9.2 times that in 2002. Major US export items to Vietnam are transport vehicles, machinery, processed and semi-processed items, and food.

US export growth to Vietnam, however, was unstable. Specifically, in the first two years of implementing the BTA, US exports nearly tripled in value, rising from $460 million in 2001 to $1.32 billion in 2003, mainly due to the realisation of Boeing purchase contracts. During 2004-2006, it approximated $1.11 billion per year and reached $1.68 billion in 2007. In the following years, it came to $2.85 billion in 2008, slightly falling to $2.71 billion in 2009, before reaching $3.77 billion in 2010. The figure jumped to $5.6 billion last year.

Since the two countries signed the BTA, thousands of Vietnamese firms, either with state support or through self-funding, have conducted market surveys in the US to find potential partners. However, knowledge of local firms about the US market’s distinctive characteristics remains limited, from the US legal system to business practices and marketing activities.

To reap greater returns in promoting bilateral co-operation, Vietnam needs to be smart while promoting the country’s image in the US, using marketing methods suitable to cultural particularities, and taking measures to effectively tackle anti-dumping lawsuits.

Economist Le Dang Doanh, in a study about TPP implications, has presented rosy forecasts that Vietnam’s export value to the US market might hit $38 billion in 2017, climbing to $45 billion in 2018, and $53 billion by 2021.

The Vietnam Textile and Apparel Association (Vitas) expects that the TPP would help push up Vietnam’s textile and clothing export value to $30 billion in 2020 and $55 billion by 2030.

A leading investor

With a favourable diplomatic atmosphere and huge co-operative potential between the two countries, the US is expected to become Vietnam’s number one investor.

The US-Vietnam BTA has a chapter regulating investment relations with a view to increasing market access, simplifying licensing procedures and investment registration, strengthening investor protection, and providing for international arbitration mechanisms to settle disputes between investors and government bodies.

Before US President Bill Clinton announced the lifting of the trade embargo on Vietnam in February 1994, American companies’ investment in Vietnam had been conducted through third parties.

From 1995 to the end of 2014, the total committed investment capital of the US into Vietnam amounted to $11 billion, ranking seventh among countries and territories doing business in Vietnam.

American investors’ disbursed capital in Vietnam averaged $248 million per year in the pre-BTA period (1996-2001) and $479 million per year in the post-BTA period (2002-2006). It has risen significantly from 2007 until now.

As many US investment projects in Vietnam have been conducted through third countries, the above figures may not reflect the whole picture.

In recent years, US direct investment into Vietnam has shown positive tendencies. In the Saigon Hi-Tech Park in Ho Chi Minh City, global chip giant Intel is deploying its over $1 billion project using about 3,000 engineers and skilled labourers, striving to satisfy 80 per cent of global chip demands.

In February 2015, the Seattle Times cited a Microsoft Corporation spokesperson, who stated that in March 2015, Microsoft will close two handset manufacturing plants in China (one in Beijing and another in Guang Tong). After acquiring Nokia, Microsoft has chosen Vietnam as its smartphone manufacturing base to serve the global market, intending to raise investment from $150 million to $1.5 billion.

Many other famous US brands, like Citigroup, Chevron, Ford, Starwood Hotel, Coca Cola, AIA and Coffee Bean have built firm footholds in Vietnam.

In fact, 75 per cent of US investment in Vietnam is wholly foreign owned, while joint venture forms represent 24 per cent. US investors are present in 42 out of 63 provinces and municipalities nationwide, but are mainly focused in Ho Chi Minh City, Haiphong, Ba Ria-Vung Tau, Binh Duong, and Ca Mau.

Over the past two decades, Vietnam-US relations have moved away from hostility towards co-operation for mutual benefit. Although some divergences persist, the two countries’ leaders are committed to establishing comprehensive partnership relations. This commitment was emphasised during Vietnamese President Truong Tan Sang’s visit to the US in July 2013, an occasion that signified the two countries’ budding friendship.

Vietnam’s deeper integration into the world community through the signing of many free trade agreements (FTAs), including the TPP, and the formation of the ASEAN Economic Community (AEC) later this year would further cultivate investment and trade relations between the US and Vietnam.