HSBC Vietnam Manufacturing PMI: New orders rise at fastest pace since October 2013

HSBC Vietnam Manufacturing PMI: New orders rise at fastest pace since October 2013

- Growth of both output and new orders accelerates

- Rate of cost inflation eases

- Employment falls slightly

Growth in the Vietnamese manufacturing sector regained momentum at the end of the first quarter of 2014. Both output and new orders increased at faster rates than seen in the previous month and new export orders returned to growth. That said, employment decreased for the first time since June 2013. Meanwhile, the rate of cost inflation slowed and firms lowered their selling prices marginally.

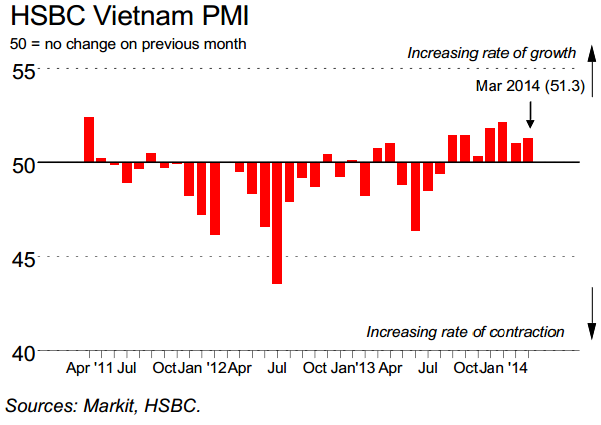

The headline seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – posted 51.3 in March to signal a modest improvement in overall business conditions. The reading was up slightly from 51.0 in February and pointed to a seventh consecutive monthly improvement in operating conditions.

Solid new order growth was recorded in March, with the rate of expansion quickening to the strongest in five months. Panellists reported a general improvement in demand across the sector. New export orders also increased in March, following a marginal reduction in the previous month.

Growth of new orders led manufacturing firms to increase production for the sixth month running. Moreover, the rate of expansion quickened from that seen in the previous month.

The rise in production helped firms to make inroads into backlogs of work during March. Outstanding business in the sector fell for the fifth month running, albeit at the slowest pace in this sequence.

Increased output requirements led firms to raise their purchasing activity. Input buying grew for the seventh successive month and at a solid pace which was only slightly weaker than the series record seen in January. Despite this, stocks of purchases continued to fall marginally as inputs were consumed in the production process. Stocks of finished goods also decreased, although the rate of depletion slowed sharply as a number of panellists reported that finished products had been held in stock rather than delivered to customers.

Employment at Vietnamese manufacturing firms decreased in March, ending a seven-month sequence of job creation. Panellists indicated that the main reason for the fall in staffing levels was that employees had left in order to find jobs elsewhere.

The rate of input cost inflation slowed for the third consecutive month. Although shortages of some raw materials had led suppliers to raise prices, falls in commodity prices in world markets had reportedly been behind slowing inflation. In spite of the continued rise in input costs, manufacturers lowered their output prices marginally amid reports of strong competitive pressures.

Suppliers’ delivery times were broadly unchanged. Where an improvement in vendor performance was recorded, this was linked to requests from firms for faster deliveries. On the other hand, material shortages had led to delays in some cases.

Commenting on the Vietnam Manufacturing PMI™ survey, Trinh Nguyen, Asia Economist at HSBC said: “The rise of output for the manufacturing sector reflects Vietnam's stellar performance in exports, especially to its regional counterparts where the slowing down of China has dampened demand. We expect the manufacturing sector to continue to benefit from rising foreign investment into manufacturing, slowing input costs and improved Western demand. The decline of employment and input cost inflation reflect the bottlenecks of the economy: a mismatch between skilled labour demand and skilled labour supply and sluggish pace of financial sector reform, which has dampened consumer demand, dragging down price pressures.”

HSBC