Many securities companies swim against the crisis stream

Many securities companies swim against the crisis stream

Despite the economic recession, securities companies still could earn big money in the first six months of 2012, thanks to the upward trend of the market and the stable income from brokerage fees.

|

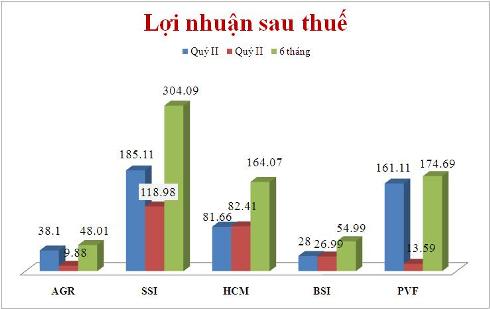

| The post tax profit of the listed securities companies on HOSE |

The audited finance report of VNDirect Securities Company shows that 80 percent of the 26 companies operational in the finance field listing their shares on the two Hanoi and HCM City bourses, have reported profit for the second quarter and the first six months of the year.

The Saigon Securities Incorporated SSI has reported the highest post tax profit on the HCM City bourse (HOSE), at 304.09 billion dong. On the Hanoi bourse HNX, the leading position belonged to the Bao Viet Securities Company which made a profit of 65.56 billion dong.

Especially, all the five securities companies that trade listed stocks on HOSE have reported profits. Agriseco AGR had the highest revenue of 482.88 billion dong in the first half of 2012, which was mostly brought by the stock trading activities. Meanwhile, BIDV’s Securities Company only got 157.8 billion dong.

SSI is leading the securities companies in terms of the post tax profit, earning over 300 billion dong in the first half of the year. By June 30, 2012, the stockholder equity of the company had reached 3526 billion dong, a slight increase over the same period of the last year.

AGR and PVF are the two companies which have the post tax profits in the second quarter by far lower than that of the first quarter. However, if considering the business performance of the two companies in general, the two still could earn big money with the profits of 50-100 billion dong.

However, good business performance is not the thing occurred in all securities companies. Seven companies on the Hanoi bourse have reportedly incurred losses. The Trang An Securities Company (TAS) and Phu Hung Securities Company are the two biggest losers with the heavy losses reported for both the first and second quarters of the year.

Other securities companies, including Kim Long (KLS), Phuong Dong (ORS) and Saigon Hanoi (SHS) still reportedly made profit in the first six months of the year, even though they incurred losses in one of the two quarters.

The information about the big profits of securities companies has surprised the public. No one could imagine that the companies would make profits in the current economic recession, with the modest growth rate of 4.38 percent and the CPI decreases in the last consecutive months June and July.

While the enterprises in other business fields complain about the high production costs and high bank loan interest rates, finance companies still have pockets clinking with plenty of money. Especially, in January 2012, the VN Index dropped to the deepest low at 331 points.

To date, eight listed securities companies have reported the revenue of over 100 billion dong so far. AGR got the highest revenue of 482.88 billion dong, followed by SSI with 409.64 billion dong.

Pham Ngoc Bach, a senior executive of VnDirect Securities Company, said the stock market has recovered considerably since the beginning of the year which has brought profits to securities companies. The stock liquidity has been improved with the trading volume reaching 2 trillion dong at some trading sessions.

Bach said securities companies have a stable income source from brokerage fees. The number of companies providing brokerage service has decreased to 20, while prestigious companies still can make profits from brokerage service.

vietnamnet