Vinacomin sells 17 per cent of domestic bond issuance

Vinacomin sells 17 per cent of domestic bond issuance

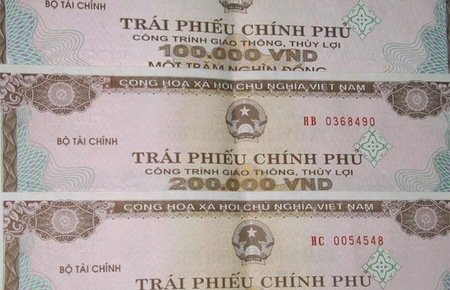

Vinacomin last week sold just 17 per cent of its $145 million domestic bond issuance, as bidders turned the other cheek.

The national coal and mineral group sold VND500 billion ($21.4 million) out of VND3 trillion ($144.9 million) offering volume at a yield of 14.5 per cent, Vinacomin’s deputy director Nguyen Van Bien said.

There were “several investors” interested in the auction, but just four bidders won, he added.

“There are big uncertainties in the market. Investors are cautious in investing,” said Bien.

The country's largest mining firm planned to issue 3,000 domestic bonds at VND1 billion ($48,300) each with terms of 5-7 years within 2012.

The poor result follows analysts’ predictions, who forecasted that investors would demand a higher yield than the group would accept.

BIDV Securities' Finance Department deputy chief Nguyen Thi Thuy estimated that investors were largely demanding a rate of about 18 per cent, while they preferred shore-term bonds at around 1-1.5 year terms with periodic payments about once every six months.

"The market has just passed through the crisis. Interest rates have decreased after the State Bank policy, but investors' cash flows are just short-term, while bonds require long-term investment," said Vu Hoang Chuong, head of EVN Finance Joint Stock Company's Investment and Consultancy Department.

Vinacomin’s big need for funds forced the group to issue bonds amidst difficult market conditions.

Vinacomin's 2012 bonds would enjoy floating interest to be paid annually. The proceeds were planned to finance Vinacomin’s projects during 2011-2015 to ensure the economy's need for coal and natural minerals. The issuance advisors include Vietinbank and ANZ

vir