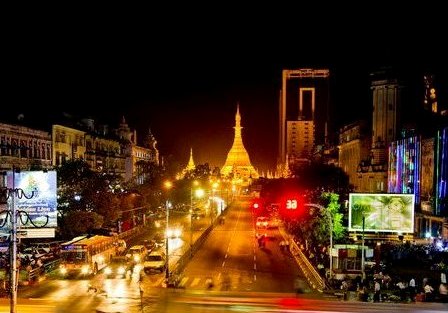

Myanmar: Investment conference draws mixed reaction from crowd

Myanmar: Investment conference draws mixed reaction from crowd

HUNDREDS of delegates attended an investment conference at Yangon’s Parkroyal Hotel last week but many said they left with key questions unanswered.

Around 300 delegates from more than 250 companies from the United States, Canada, the United Kingdom, Japan, India, China, Vietnam, Singapore, Thailand, Cambodia, Malaysia, Sri Lanka, Indonesia, and Bangladesh attended the 2012 New Myanmar Investment Summit on June 20 and 21.

Singaporean businessman and managing director of Inle Investment Partners, a firm focusing on investments in infrastructure and energy, U Moe Moe Oo, said there were still many grey areas concerning foreign investment in Myanmar.

“As an investor, my main concerns are around ownership issues, disputes with joint venture partners, arbitration and enforcement issues,” U Moe Oo said.

“A lot of this focuses on big issues such as the rule of law that Daw Aung San Suu Kyi has raised. However, at this point in time, none of that seems to be clear.”

U Moe Moe Oo said the government was keen to secure foreign investment to gain credibility for its reform process.

“But the problem is that although they know they want foreign investors to engage in Myanmar, they don’t really seem to know how to do it beyond telling us we are welcome to invest,” he said.

Dr Kan Zaw, the deputy minister for National Planning and Economic Development, said the government’s new investment law would put Myanmar in line with international standards and make it more competitive regionally.

Parami Energy Group chief executive officer U Ken Tun encouraged foreign investors to test Myanmar’s market during his presentation.

“Businessmen, if you wait until 2015, I don’t know what opportunities will be left for you,” he said.

The managing director of a Yangon-based market research company said Myanmar was open for business and their investments would be protected by the existing Foreign Investment Law.

“You can start doing business in Myanmar – you do not have to wait for the new foreign investment law,” said U Moe Kyaw of Myanmar Marketing Research Development.

Previously, a web of overlapping US sanctions on Myanmar were the biggest deterrent to Western investors, U Moe Kyaw said. He added that the US government’s recent suspension of sanctions would encourage new investment from that country.

German businessman Joerg Gulden, managing partner of German-based integrated advisory firm Roedl & Partners, said the current investment framework was encouraging but a more comprehensive legal framework would be required before the country attracted sustainable foreign investment.

“The conference drew a good picture of today’s investment climate in Myanmar: a typical frontier market with big opportunities, big risks and even bigger uncertainties,” Mr Gulden said.

“It showed an investment framework that might be acceptable for foreign investments in the primary sector, but is far from being ready for capital intensive and sustainable foreign direct investment,” he said.

Dr Kan Zaw said Western investors could surpass China and Thailand as the biggest contributors to Myanmar’s economy.

“Western countries will be the top investors in Myanmar in the coming years,” Dr Kan Zaw said.

However, American lawyer Steven Dickinson said Myanmar still had a long way to go before becoming an attractive investment option for Western firms.

“Other than for oil and gas, Western companies won’t come to Myanmar for some time,” said Mr Dickinson, a lawyer for Hong Kong-based law firm Harris & Moure.

He said a lack of infrastructure and high operating costs, coupled with political instability and a crippled banking system, would deter many Western investors, particularly those in the manufacturing industry.

“That’s a bad thing for Myanmar because there are people who are going to come here, particularly for the areas of oil and gas, minerals and timber,” Mr Dickinson said.

“And those investors are going to strip the country bare, leave the money in the hands of a few top people and give little back to the general population,” he said.

Alessio Polastri, managing partner of Yangon-based law firm P&A Asia and a speaker at the conference, said he had received a positive response from most participants.

However, he said the high price of land was a major deterrent to potential investors.

“Land prices are a deal-breaker,” Mr Polastri said.

“Seventy-five percent people who contacted me were already planning to invest – they are cash-ready – but they couldn’t complete the negotiation because the price of the land was too high,” Mr Polastri told The Myanmar Times.

Delegates paid up to US$1495 each for the event, which was organised by Centre for Management Technology, a Singapore-based firm.

Myanmar Times