Hanoi developments induce delay fluster

Hanoi developments induce delay fluster

Tens of millions of dollars poured into infrastructure together with new planning projects have added vibrancy to Hanoi’s real estate market, but alongside current rising land prices, developments could cause construction delays or sharp rental increases.

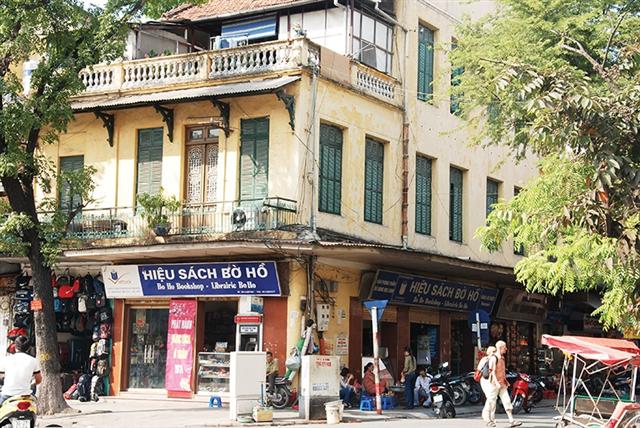

Several inner-city districts in Hanoi are facing major re-zoning activities over the next few years

|

So far this year a raft of initiatives in Hanoi have been revealed which could drastically change the landscape of the capital, from a zoning plan for four inner-city districts, Red River subdivision and bridge-building, and at least one smart city venture in the north of the city.

At the same time, across the country as a whole, land fever has swept cities and some rural areas after long-term plans were announced of possible new airport locations, causing people to frantically seek out deals, both officially and unofficially.

In Hanoi itself, the urban subdivision planning project for Hoan Kiem, Ba Dinh, Dong Da, and Hai Ba Trung districts is considered less disturbing to the real estate market in the city because the purpose of the plan is only to reduce population density, improve infrastructure, and expand roads. Land price inquiries are currently more focused in areas away from the centre of the Red River subdivision planning project, in districts such as Hoang Mai, Thanh Tri, Thuong Tin, Me Linh, Dong Anh, Long Bien, and Gia Lam.

According to experts, the recent information on infrastructure investment and planning has had a great impact on land prices in both the east and west of Hanoi, turning these areas into key markets for the near future.

Initial leverage stems from the general planning of the capital to 2030, with a vision to 2050, in addition to existing bridges such as Long Bien, Chuong Duong, Vinh Tuy (phase 1), Thanh Tri, Nhat Tan, and Thang Long. It is expected that there will eventually be a total of 18 bridges crossing the Red River.

In addition, the leverage from the river’s subdivision planning project with synchronous connection of traffic and many public works, tourism services, sports and entertainment services, and modern ecological urban areas built along both sides of the river is also making investors rush to buy land in these areas, causing prices to be pushed up in recent times.

According to the Vietnam Association of Real Estate Brokers, land prices in suburban areas such as Dong Anh, Long Bien, and Gia Lam are now being pushed up by about 50-60 per cent, and in some places by as much as 100 per cent, at a threshold of $1,300-2,100 per square metre compared to the last quarter of 2020.

Along with planning projects, land prices in the Hoa Lac area are also increasing as this has been a popular choice for investors thanks to the development of high-tech parks and an increasingly-complete infrastructure system.

Plans for Hoai Duc in the west of Hanoi to switch from a suburban district to urban district in 2022 have also caused many stalled projects in the area to suddenly liven up with a sharp increase in prices.

The land fever in Hanoi has caused some concern for infrastructure developers, especially in terms of offices for lease and industrial zones.

Ngo Quang Phuc, CEO of Phu Dong Group, said land fever prolongs compensation times and affects the progress of projects, making the scarcity of industrial land in some hotspots for investment attraction more stressed.

In industrial and service zones, Phuc said, pushed up land prices will damage the production and business model of some initiatives. The life-cycle of a project can be about five years, but an industrial and production project takes 20-30 years, so when the land price increases, it will be greatly affected

Nguyen Van Dinh, deputy general secretary of the Vietnam Real Estate Association, said that the increase in land prices will usually be proportional to the level of investment. If the planning is only in guidelines and drawings, an increase of about 3-5 per cent is reasonable.

Dong Anh in Hanoi’s north, for example, is one of the localities also trying to reach the goal of becoming an urban district but at present, Dong Anh has not invested in much other than two main streets and the extended National Highway No.5. Other projects are still in the stages of construction and planning.

“Therefore, if the land price is too high, it will be a two-edged sword to create hindrance to its development, because it will increase investment costs for infrastructure development, making businesses hesitant in investment,” Dinh affirmed.

Specifically, there are foreign investors that are implementing projects that have compensated the clearance of 90-95 per cent, but when the land price is pushed up, even only a few per cent need clearance. Therefore, Dinh added, if there are no solutions soon, land price fluctuations may directly affect the investment attraction strategy of Hanoi and many investors could suffer losses.

However, according to Savills Vietnam, the land price increase in some areas in Hanoi has mostly stemmed from speculation and does not reflect the true nature of the market. After a certain time the excitement will cool, especially as the government has come forward with measures to help tighten credit and to prevent spiralling land prices.