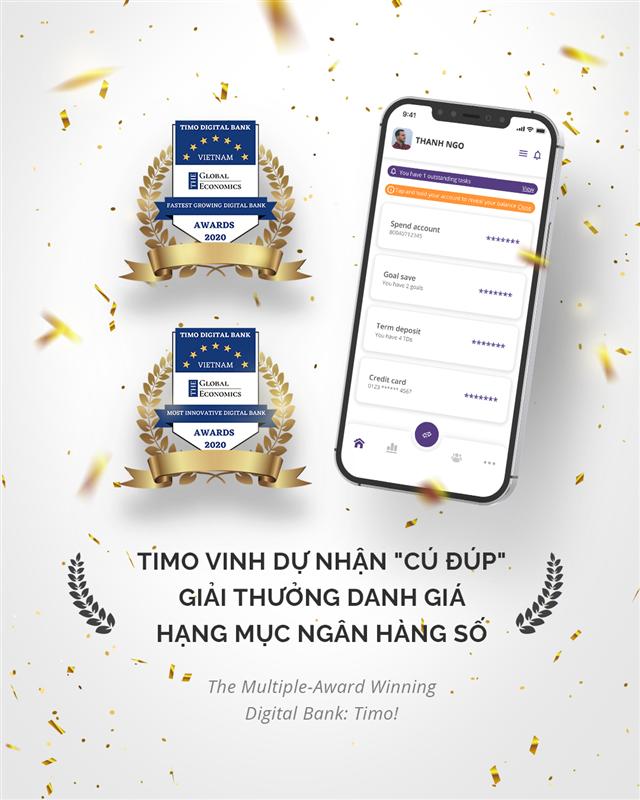

Timo wins Fastest Growing and Most Innovative Digital Banking awards

Timo wins Fastest Growing and Most Innovative Digital Banking awards

Timo – a leading non-conventional bank in Vietnam and beyond with a digital-first mindset and over 300,000 customers – has achieved a remarkable double first at The Global Economics Awards categories, becoming the Fastest Growing Digital Bank and Most Innovative Digital Bank in its ongoing digital banking transformation.

The Global Economics Awards is a UK-based premium financial magazine and is happy to commend Timo Bank in its unique approach of integrating banking with a lifestyle sought after by many private banking customers.

Timo won the Fastest Growing and Most Innovative Digital Banking titles at The Global Economics Awards in the UK

|

Timo’s strategy is product-led, innovation-led, and customer-centric – the best of integrated functionality and value. Timo has modernised its e-payment ecosystem with EasyPay for their increasing digital-native customer base.

What made Timo stand out from traditional banks was a strategic decision to bypass formal branches and instead invite customers to “Hangouts”, which are hybrid coffee shop-banking centres. This was the first innovation that prioritised customers at the forefront of business.

Unlike typical banks in Vietnam, Timo also streamlined the sign-up process via digital channels that could be completed in under five minutes, followed by a 15-minute physical visit to any of the Hangouts nationwide where a “wet signature” and Debit Card is collected (as required by State Bank of Vietnam regulations).

New Timo members can enjoy a complimentary beverage at the Hangout while the verification is completed and walk away with a Debit Card.

Most importantly, this customer experience and customer-first approach allowed Timo to demystify the complex banking environment and deliver a simple, user-friendly, and transparent banking platform accessible on the iOS, Android, and through a web app.

Safety measures like authentication, are also streamlined with multi-level security protocols like Fingerprint Login, Face Recognition, Card lock/Unlock in-app iOTP in the App and OTP via SMS to ensure customers’ funds are safe.

After five years of operating in the market, Timo opened five hybrid coffee shop branches called “Hangouts” across four key provinces nationwide – where customers can experience a digitised financial product in a unique environment that’s not a typical bank. In 2019, Timo was recognised for its innovative efforts and was awarded The Best Digital Bank in Vietnam by Asia Money – further cementing its maturity and success in improving the landscape of the banking sector in Vietnam.

Extending the digitalisation trend in Vietnam, Timo decided to move to its next development stage by partnering with Viet Capital Bank in September 2020, with a shared vision of bolstering innovation and better customer experience.

Within two months after the transition from the previous partner, Timo recorded impressive numbers with over 100,000 new and migrated accounts.

The company has been quick to expand its capacity by continuously deploying new "Hangouts" branches and pop-up event locations to meet the overwhelming demands of customers eager to join the newest digital bank. In the true spirit of collaboration, Viet Capital Bank branches in select cities, also onboarded Timo customers. This number will continue to grow as Timo and Viet Capital Bank strengthen their partnership and aims to reach as many customers as possible across the country.