Vietnam banking sector to suffer in 2020 before rebounding in 2021

Vietnam banking sector to suffer in 2020 before rebounding in 2021

Fitch Solutions expected credit growth to weaken to 7% in 2020 from 13.7% in 2019, but the growth is predicted to pick up to 12% one year later.

Vietnam’s banking sector earnings are predicted to weaken in 2020, due to weaker credit growth, rising loss provisioning alongside a worsening of asset quality in a weak economic environment, as well as debt restructuring schemes, according to Fitch Solutions, a subsidiary of Fitch Group.

However, an acceleration in credit growth and an improvement in asset quality in 2021 should support a recovery in earnings in the banking sector, stated Fitch Solutions in its latest report.

Source: Bloomberg, Fitch Solutions.

|

In 2020, Fitch Solutions expected credit growth to weaken to 7% in 2020 from 13.7% in 2019. Credit growth as of September 22 was only 5.1% above end-2019 levels. According to Fitch Solutions, this is due to a combination of supply and demand factors over the coming months.

On the demand side, continued uncertainty around the economic outlook will continue to spur businesses to delay capital expenditure, and this will discourage borrowing. On the supply side, tighter lending standards by financial institutions to guard against a build-up of bad loans will also weigh on issuance.

Meanwhile, Fitch Solutions expected banks to increase their loan loss provisioning in anticipation of a worsening of asset quality due to weak economic growth in 2020.

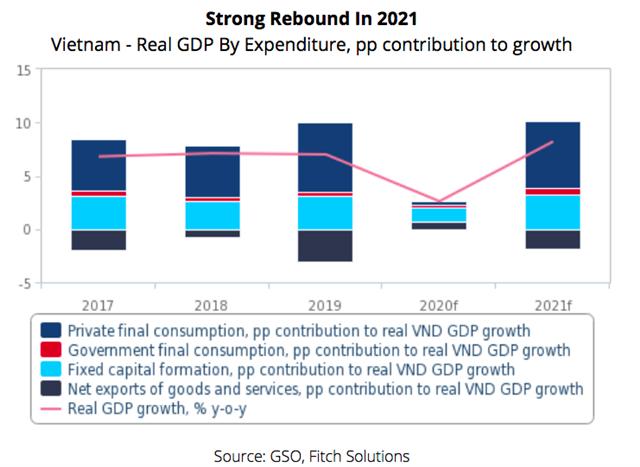

It forecast real GDP growth to weaken to 2.6% in 2020, from 7.0% in 2019, while there is the risk of the weak economic environment seeing the sector-wide non-performing loan ratio rise higher in 2020, from 1.9% at the end of 2019.

Between January and September 2020, more than 38,600 enterprises have temporarily suspended operations, up 81.8% year-on-year. Of this number, retail trade saw the largest absolute increase to 14,400, from 8,211, up 75.3% year-on-year, while real estate businesses saw the largest proportionate increase among all sectors at 161.4% to 1,103 enterprises over the period.

The number of business bankruptcies remained fairly flat on aggregate across the sectors over the first nine months of 2020. Although many sectors saw a fall in bankruptcies in 2020 versus 2019, the real estate sector bucked the trend and bore the brunt of the increase in business bankruptcies, with real estate bankruptcies rising to 696, up 50.3% year-on-year.

|

Debt restructuring schemes to reschedule debt repayments for companies unable to fulfil their obligations due to the Covid-19 outbreak, as well as possible exemption and reduction of interest and fees for delinquencies due to the pandemic, will also have a negative impact on bank earnings, Fitch Solutions suggested.

Nevertheless, as Fitch Solutions expected Vietnam’s GDP growth to reaccelerate to 8.2% in 2021, it predicted credit growth to pick up to 12%. An improvement in business revenues and debt repayment will also be positive for asset quality and reduce the need for loss provisioning, which will support earnings.