Hanoi apartment market Q1/2020: Grade B suffers

Hanoi apartment market Q1/2020: Grade B suffers

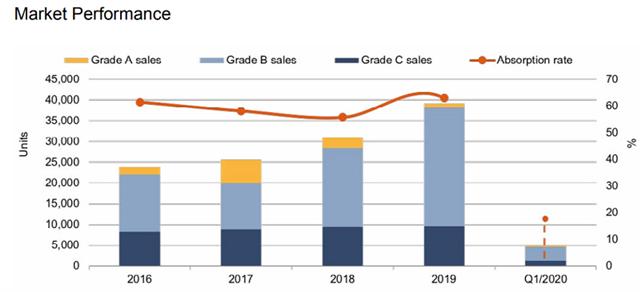

The absorption fell 57% on-quarter and 51% on-year to 17% during the quarter.

Hanoi’s apartment market experienced the lowest absorption of Grade B in the first quarter (Q1) this year as the country focus on fighting coronavirus, according to Savills – a leading global real estate service provider.

Outlook for Hanoi's apartment market remains positive

|

The absorption fell 57% on-quarter and 51% on-year to 17% during the quarter.

Grade B sales eased to 70% from 75% in Q4/2019. With abundant supply, developers face severe competition to maintain performance.

Primary prices decreased 2% on-quarter and increased 5% on-year.

Meanwhile, the absorption of Grade C was at 20%, the highest absorption among segments in Q1, fueled by increasing demand for more affordable units.

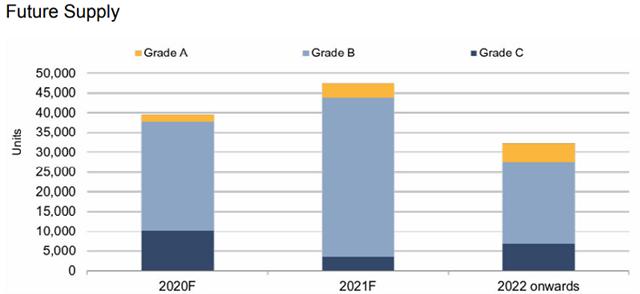

Supply

Supply of Hanoi's apartment market. Source: Savills Research and Consultancy

|

In Q1/2020, five new and the next phases of six existing projects, provided approximate 4,800 units, down 64% on-quarter and 50% on-year.

New launches were at their lowest for five years as developer plans rapidly changed in response to the pandemic.

Primary supply fell 17% on-quarter and 19% on-year to 27,900 units. Grade B remains the largest supplier accounting for 73%.

In terms of sales, approximately 4,900 transactions were reached, down 53% on-quarter and 50% on-year due to low quarterly performance, first affected by national holidays in early Q1 then social distancing.

As the pandemic spread, local buyers avoided crowded sales events while travel bans limited foreign purchases.

In addition, intensified government measures since April 1 have forced developers to shutter site operations and close sales offices.

Stable primary prices

Hanoi's apartment market performance. Source: Savills Research and Consultancy

|

Primary prices remained unchanged on-quarter but went up 10% on-year to US$1,460/square meters (sq.m).

Unless the pandemic continues in Q2 this year, Savills anticipates it is unlikely to result in a sharp primary price correction.

For five years, average primary prices have steadily increased 5% each year. Grade A at 10% on-year has been the highest with improving development standards in new supply.

Positive longer-term demand drivers

The 2019 ‘Population and Housing Census’ reported approximately 2.2 million households in Hanoi. Average household sizes are on a downward trend and currently at 3.5 people/household. People living in apartments were the highest nationwide at 12.9%, with 2.8% planning to buy new dwellings. Net floor area (NFA) per capita was 26.1 m2/person in 2019, up from 23.6m2/person in 2014.

In addition, foreign interest in high-end products has been high with 30% project quotas quickly taken up. This trend is expected to continue in well located, premium projects by reputable developers.

Outlook: reasons to be cheerful

The short-term economic impact of Covid-19 will be significant.

In 2020, approximately 39,600 units from 28 existing and future projects will enter the market and Grade B will continue to lead. Of the 28 announced projects, 43% are under construction and 36% at foundation. Leading future suppliers are Tu Liem district with 37% of stock, Gia Lam with 24%, and Hoang Mai 23%.

When restrictions are lifted, developers will be under pressure to ramp up sales, which is likely to see improved buyer incentives. These may include more flexible payment terms, smaller deposits, and extended payment schedules.

According to Savills, there are reasons to be cheerful namely (1) online sales will accelerate in 2020; property management will implement IR4.0 technologies to remotely connect with residents; (2) the government’s decree on extending tax and land rental payments will help ease the worst pandemic effects; (3) new regulations will reshape supply; (4) wider capital sources will enter the market as 2019 remittances reached a new high of US$16.7 billion, of which over 20% was invested in property. Meanwhile, real estate firms in 2019 issued bonds worth over US$4.6 billion.