Shares move up, may break peak

Shares move up, may break peak

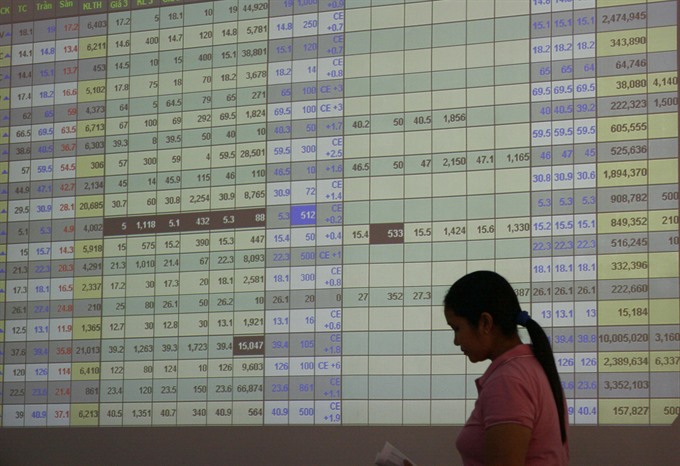

Vietnamese shares rallied on Monday due to strong growth among blue-chips, but then weakened significantly towards the closing minutes.

The benchmark VN-Index on the HCM Stock Exchange inched up 0.26 per cent to close at 1.126,29 points, recovering from a fall of 0.07 per cent on Friday.

On March 12 eleven years ago, the benchmark VN-Index recorded an all-time peak of 1,170 points. Analysts believe the rising momentum will continue and allow the index to surpass this record on rising investor confidence in the market outlook.

According to Bao Viet Securities Company (BVSC), the index is still expected to surpass the peak set before the Tét holiday of 1,130 soon to move towards 1,150 or even the record high at 1,170- 1,180 in the short term.

The minor HNX Index advanced 1.16 per cent to end at 129.06 points. The northern market index ended down 0.07 per cent on Friday.

More than 310.9 million shares were traded on the two local bourses, worth VND8.5 trillion (US$375 million).

On the two stock markets, the market breadth was negative with 268 declining stocks against 214 gaining ones, while 249 other shares ended flat.

The UPCOM Index on the Unlisted Public Company Market (UPCoM) fell 0.1 per cent to 61.31 points. The index added 0.88 per cent on Friday.

On Monday, foreign investors were net buyers of VND668.64 billion on HOSE, focusing on PDR (VND374.3 billion), VIC (VND144.3 billion) and VRE (VND127 billion). In addition, they net sold VND1.72 billion on the HNX.

Bank stocks led the market up with prominent stocks such as Viet Nam Joint Stock Commercial Bank for Industry and Trade (CTG) (3.24 per cent), Bank for Foreign Trade of Viet Nam (VCB) (1.41 per cent), Sai Gon Thuong Tin Commercial Joint Stock Bank (STB) (3.57 per cent) and JSC Bank For Investment And Development Of Viet Nam (BID) (3.6 per cent).

Particularly, the decline of large cap stocks dragged the index down, including Viet Nam Dairy Products Joint Stock Company (VNM), Binh Minh Plastics Joint Stock Company (BMP) and Vingroup Joint Stock Company (VIC).

Lately, MV Index Solutions announced the results of the quarterly MVIS Viet Nam index review – the selected index of the VanEck Vectors Viet Nam ETF (V.N.M ETF). VRE is the only stock to be added to the VFM ETF portfolio in this review.

BVSC said VRE shares will account for 5 per cent stake in the V.N.M ETF portfolio, or the fund will purchase US$21.17 million worth of VRE shares (about 8.7 million shares).

Though VRE has been listed on the stock market for only 4 months, the ticker was “specially” added to the portfolio by V.N.M ETF (minimum requirement is a six-month listing).

With this benefit, VRE has gained over the past 3 consecutive sessions. After this portfolio review, the number of Viet Nam shares in the V.N.M ETF portfolio will increase to 19 and account for 75.32 per cent of the portfolio, BVSC said.

It also added that market sentiment is forecast to stay cautious in the next sessions as investors are waiting for the review of the two ETFs this weekend. The market should not see dramatic movement in the short term.