Marine shipping stocks benefit from higher freight rates

Marine shipping stocks benefit from higher freight rates

Stocks of marine shipping companies have seen a breakthrough, buoyed by supportive policies and rising sea freight prices after hitting bottoms.

Nam Đình Vũ Port, a part of Gemadept's port system in Hải Phòng City. — Photo gemadept.com.vn |

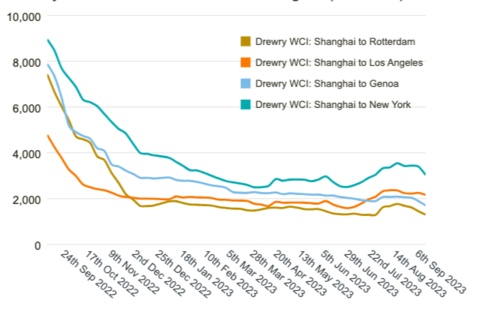

The global sea freight prices have started rebounding from the end of July, showing that the marine shipping industry is gradually escaping the 16-month correction.

Domestically, the Việt Nam Maritime Administration announced a draft to replace current regulations on the price framework for pilotage, wharf, dock and mooring buoy utilisation, container handling and towage services at Vietnamese seaports.

The draft proposes a 10 per cent increase in fees for the container handling service starting from the beginning of 2024 in some areas, including Hải Phòng Province, HCM City, and the Cái Mép - Thị Vải port cluster.

It also put forward to raise the price framework for loading and unloading import and export containers by 10 per cent for region I, as prices in this area are currently the lowest in the country.

Moreover, terminals capable of receiving ships over 160,000 DWT can impose a 10 per cent increase in loading and unloading service fees, meaning that terminals have the opportunity to add up loading and unloading fees by 20 per cent compared to now, according to the draft.

"Recently, seaport stocks have recovered significantly thanks to positive news such as the US good inventories hitting bottom, showing positive signs for Việt Nam's export activities, and the 10 per cent price increase proposal in container loading and unloading services," Lê Xuân, a HCM-based independent trader, told Việt Nam News.

Drewry world container index: Trade Routes from Shanghai. Source: drewry.co.uk |

In the near term, stocks of this group will continue to perform positively on the Vietnamese economic foundation, which is supported by macroeconomic policies, with export activities improving compared to the first six months, Xuân said, adding that investors should select ticker symbols that really benefit from the positive factors and own deep-water ports.

On the stock market, marine shipping stocks, such as Hải An Transport & Stevedoring JSC (HAH), Gemadept Corporation (GMD), Viconship (VSC), and Vosco (VOS) are actively traded and have jumped in recent trading sessions. GMD shares even peaked at VNĐ63,900 a share (US$2.63) on September 6, a rise of 46.2 per cent over the beginning of 2023.

Business results in 2023 - 2024

The shipping industry sees an opportunity to grow again as global inflationary pressures gradually cool down, while Việt Nam's import-export activities show signs of improvement and demand for goods transportation in major markets such as America and Europe increases.

VNDirect Securities Corporation expects business activities of Hải An Transport & Stevedoring to gradually improve in the coming months, especially into 2024.

In the first half of 2022, the company's consolidated revenue reached nearly VNĐ1.3 trillion, a decline of 19 per cent on-year, and its profit after tax dropped 50 per cent to VNĐ216 billion.

The securities firm said that Hải An's ship exploitation capacities will decrease by 25 per cent this year, but will increase by 25 per cent next year, with profit after tax reaching VNĐ449 billion in 2023 and VNĐ516 billion in 2024.

The company's growth driver comes from positive market prospects and fleet expansion. Hải An currently has 11 container ships, with a total carrying capacity of nearly 16,000 TEU, accounting for nearly 40 per cent of the container shipping industry in Việt Nam.

It plans to receive four new container ships with a capacity of about 1,800 TEU in 2023 - 2024, bringing the total fleet capacity to more than 23,000 TEU.

Meanwhile, Gemadept's consolidated revenue decreased by over 2 per cent year-on-year to VNĐ1.8 trillion in the first six months of 2023, while its consolidated profit after tax reached more than VNĐ1.97 trillion, three times higher than that of last year.

Gemadept's profit increased sharply thanks to a gain of VNĐ1.86 trillion in financial revenue from the capital transfer deal at Nam Hải Đình Vũ Port.

SSI Securities Corporation expects that the total output of the company's port operations will reach 1.4 million TEU in the last six months of 2023, an increase of 9.5 per cent compared to the first half of the year.

The result for the year is estimated at 2.9 million TEU, down only 6 per cent over last year. But by 2024, the output is expected to reach 3.5 million TEU, an increase of 22 per cent.

For Vosco, its leaders said that the company regularly monitors the market, and evaluates and takes advantage of the growth of the product tanker market to sign contracts with high fees.

In the first six months of 2023, Vosco recorded a gain of more than VNĐ392 billion over last year in revenue to VNĐ1.59 trillion. However, profit after tax reported a fall of VNĐ241 billion to 74.1 billion during the period, due to the decline in the market for dry cargo ships and container ships.

The company will strive to take advantage of market opportunities and continue to carry out measures to control and manage costs, especially fuel and spare parts, to improve business results, and ensure safety during ship operation.

An Binh Securities Company believes that demand in major export markets such as the US, Europe, and China hit bottom in the second half of 2023 and gradually recover, helping the country's production and import-export output increase, leading to higher demand for marine shipping.