Buoyant steelmakers still hoping for more

Buoyant steelmakers still hoping for more

Listed steel companies announced breakthrough business results in the fourth quarter of 2020, enticing potential investment in the sector, and ending a successful year that they could hardly have imagined after the first period of the year was negatively affected by the pandemic outbreak.

|

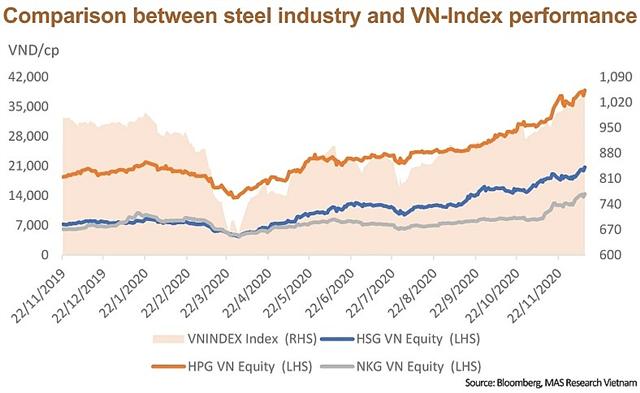

The results were contributed by recovered domestic consumption and steel export benefits. In the stock market, the shares of listed firms witnessed strong growth, such as Hoa Phat Group (HPG) up 114 per cent, Hoa Sen Group (HSG) up 193 per cent, and Nam Kim Steel (NKG) up 122 per cent at the end of the year (see chart).

For the galvanised steel industry, it was difficult for any business 6-8 months ago to imagine the price of hot rolled coil reaching $700 per tonne in 2020, especially when prices plunged just before then. Hoa Sen and Nam Kim reported strong growth in this area too, while Hoa Phat continues to firmly build a leading position in the construction steel segment with market share increasing to 32.5 per cent in 2020. The company achieved net revenues of nearly VND91.3 trillion in 2020 ($4 billion) and a record net profit of VND13.5 trillion ($587 million).

Vietnam-Italy Steel JSC (VIS) returned to profit after two years of heavy losses. Steel trading companies such as SMC Commercial Investment (SMC) and Tien Len Steel (TLH) simultaneously reported big profits in the last quarter of 2020 thanks to favourable changes in steel prices, thereby ending a year of success.

As the only company in the industry that owns a distribution network of hundreds of points across the country, Hoa Sen plans to expand its business product portfolio through the development of a home furniture and building materials retail chain with a strategic partner.

At its January annual general meeting, Hoa Sen chairman Le Phuoc Vu said that the group will no longer be a mere manufacturing enterprise, but move towards becoming a distributor of building materials and interior decoration items.

While it would continue to produce the same items, it would not expand production capacity but instead invest in opening new Hoa Sen home stores and upgrading existing ones. The group is expected to reach VND33 trillion ($1.43 billion) in revenues this year and post-tax profits of VND1.5 trillion ($65.2 million), 20 and 30 per cent higher than in 2020 respectively.

Nam Kim Steel meanwhile said it will focus more on distribution in the south, with plans to build a warehouse and steel pipe factory in the first quarter in the southern province of Binh Duong. Elsewhere, SMC Steel Ltd. wants to go deeper in the field of processing, becoming a supplier for manufacturers operating in Vietnam. Earlier this year, SMC together with Samsung C&T agreed to establish a steel processing joint venture with a planned factory located Ba Ria-Vung Tau province’s Phu My Industrial Park.

Vietnam’s steel industry sales volume is expected to increase by nearly 16 per cent in 2021, three times higher than originally forecast thanks to new demand including infrastructure funding and foreign investment inflows, which are also helping to promote civil engineering along infrastructure and foreign-invested projects.

According to a Mirae Asset Vietnam research report, it is estimated that output of the Dung Quat project will add 2.2 million tonnes of total output to the country’s steel industry, while the Pomina Phu My plant will increase construction steel output by 1.1 million tonnes.

The report noted that in 2021 the real estate industry “will gradually recover alongside the recovery of the global economy, which would benefit Vietnam’s steel industry. Output in 2021 is expected to reach 28.67 million tonnes, an additional 15.7 per cent on-year”.

More stable global supply is likely to lead to more intense competition in the market, and with the risk of COVID- 19 still present, the increases could also affect the overall recovery as well as production capacity and export markets.