SmartPay e-wallet launches cardless virtual loyalty programme

SmartPay e-wallet launches cardless virtual loyalty programme

SmartPay e-wallet has recently strengthened their stature in the financial industry by becoming the first e-wallet in Vietnam that has an in-app loyalty programme that works without the need for the usual paper/plastic punch loyalty cards.

With this virtual loyalty programme of SmartPay, merchants will no longer have to worry about printing out cards or keeping track of members progress with every purchase

|

Understanding the time and cost merchants have to invest to issue and manage loyalty cards, SmartPay has recently launched an in-app loyalty programme to help merchants accept payments via SmartPay to and easily set up their own loyalty programmes with a few swipes and taps.

Regarding this new development, Lu Duy Nguyen, head of product, and Zhangozina Aigerim, marketing director, had shared: “We believe that the virtual loyalty programme will help merchants reduce the average service time per customer while boosting the number of customers returning and revenue figures. For individual users, this virtual loyalty programme will free them from the struggle of having to keep all of their loyalty cards in their physical wallets as, through SmartPay, all of their digital loyalty cards are stored in their e-wallet. This development can be recognised as our first step towards implementing convenient features to facilitate cashless payments in Vietnam.”

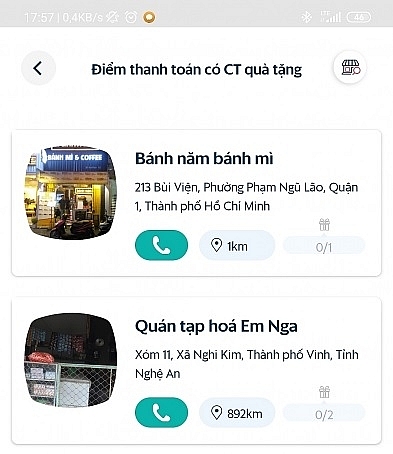

Individual users can easily find all available loyalty programmes set up by merchants in the “Tích điểm đổi thưởng” section

|

To set up a loyalty programme, merchants only need to follow the simple steps below:

Step 1: Tap on the Merchants' section, choose the number of transactions that a customer would need to make in order to be qualified for a reward.

Step 2: Set up a confirmation code that will be given to customers completing the required number of transactions to receive their reward.

Step 3: Upload branded loyalty card designs or choose from the free templates stored in the SmartPay mobile app.

After the loyalty programme is activated, a virtual loyalty card per customer will be automatically activated after they make the first Scan2Pay transaction with the merchant. Once a customer has completed the number of required transactions to be qualified for a reward, merchants will automatically receive a notification in their SmartPay mobile app.

The app development team at SmartPay

|

Upon being asked about their future plans, Lu Duy Nguyen and Zhangozina Aigerim said: “In the upcoming update, merchants with activated loyalty programmes will be promoted to individual users for free through the 'Merchants around us' map. We are also planning to develop another in-app feature that allows merchants to set up their own digital discount vouchers.”

Click here for more information about SmartPay's virtual loyalty programme.

The SmartPay mobile wallet is available for both Android and iOS operating systems on AppStore and GooglePlay. Click here to download.

Since its launch in May 2019, SmartPay e-wallet has acquired more than 700,000 individual users and a network of 60,000 merchants across Vietnam accepting payments via SmartPay. In addition to the virtual loyalty programme, SmartPay has also recently launched several features to enhance user experiences, such as bus ticket booking and loan applications.

There is also a wide range of special offers for newly-registered merchants as well as an exciting referral programme for both individual users and merchants accepting payments via SmartPay.