Dong, dollar exchange rate to hit VND22,900: HSBC forecasts

Dong, dollar exchange rate to hit VND22,900: HSBC forecasts

The exchange rate between the dong and the US dollar will be stable and end at VND22,900 per US dollar by the end of 2018, predicts Ngo Dang Khoa, head of Global Markets, HSBC Bank Viet Nam.

The prediction is based on high capital inflows and the dong’s weakness against other currencies in the region, Khoa said.

In terms of capital inflows, foreign direct investment (FDI) into Viet Nam this year is predicted to be stable, equal to the level achieved in 2017; remittance will be better than 2017; the number of State-owned enterprises to be equitised in 2018 is predicted to be 41 firms higher than 2017 to reach 181 enterprises and is expected to bring in more foreign currency.

At the same time, the rise of the Fed’s (US Federal Reserve) base rate of the dollar has had a dampening effect on financial markets. Few foreign investors are investing in government bonds. For the Vietnamese stock market, although the liquidity has increased in recent years, the of the market is still small compared to the region, so foreign investment in the stock market is often long term. In addition to this, given Viet Nam’s macro-economic outlook, foreign investors are more likely to look at the long term than short term.

However, according to Khoa, Fed’s increasing interest rate will have an impact on businesses that borrow capital in dollars, especially those businesses that borrow dollars with floating rates. At that point, the cost of capital increases and businesses may have problems with liquidity. In such a case, businesses should negotiate changes in the interest rates of the US dollar from floating interest rates to fixed rates.

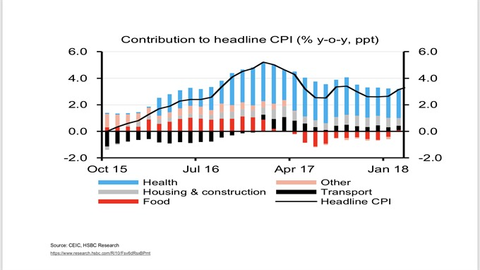

Thus, although the Fed increased interest rates three to four times per year, HSBC is still patient believing that the VND/USD exchange rate is generally stable. What is noticeable in Viet Nam this year is the inflation target of 4 per cent due to pressure from high food and oil prices. By the end of February, the inflation rate in Viet Nam was 3.15 per cent.

The price of petrol is difficult to control as it is decided by global oil prices. In 2017, food prices were low, leading to negative growth compared to 2016. Therefore, this year, inflation is likely to jump when food prices rise even slightly. If food and petrol prices continue to rise, inflation in Viet Nam may exceed the four per cent target in June-July, Khoa said.

Inflation comes from adjusting prices of services, in which more than 50 per cent come from health and education services. HSBC predicts that by the end of the year, Viet Nam’s inflation will return to 3.7 per cent.